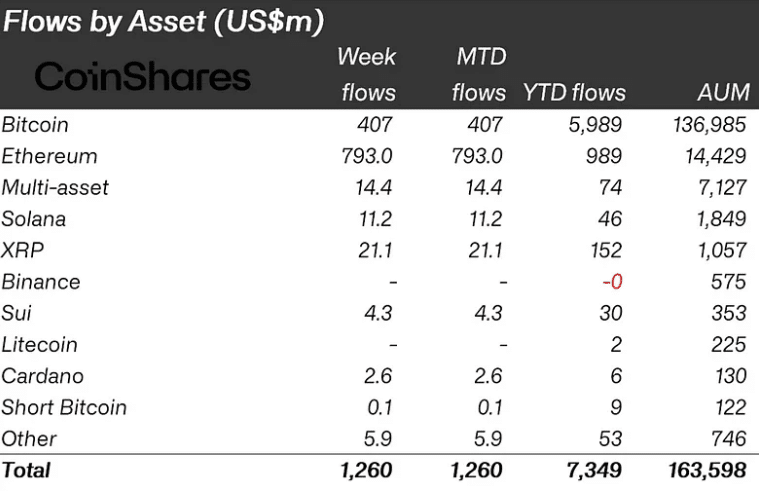

The crypto market witnessed substantial crypto inflows totaling $1.3 billion in the past week, marking the fifth consecutive week of positive investment flows. This surge in crypto inflows comes as investors capitalize on recent price declines across major digital assets.

Breaking Down the Latest Crypto Inflows

Ethereum emerged as the standout performer, attracting $793 million in new investments as its price previously fell towards $2,100. This significant buying activity shows strong investor confidence in Ethereum despite its recent price weakness.

Bitcoin also maintained its appeal, drawing $407 million in inflows, with exchange-traded products (ETPs) now representing 7.1% of Bitcoin’s total market value.

The U.S. market led the investment charge with $1 billion in inflows, while European nations showed notable participation. Germany contributed $61 million, Switzerland added $54 million, and Canada brought in $37 million, demonstrating widespread institutional interest across major financial markets.

ETF Prospects Drive Alternative Cryptocurrencies Higher

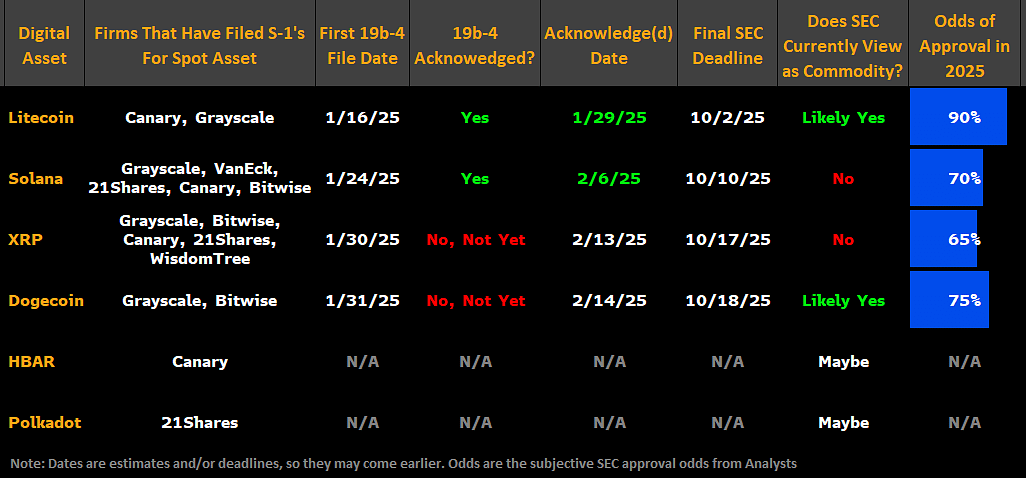

Market sentiment received an additional boost from positive developments in the ETF space. Bloomberg analysts James Seyffart and Eric Balchunas have assigned high approval probabilities to several crypto ETF applications.

Litecoin ETF proposals from Canary Capital and Grayscale received a 90% chance of approval, while Dogecoin products were given a 75% likelihood. Solana and XRP products followed with 70% and 65% approval probabilities, respectively.

This optimistic outlook has already impacted prices, with Litecoin and Cardano posting double-digit gains. Litecoin surged 13% to trade above $132, while Cardano jumped about 17% to exceed $0.82. These movements significantly outpaced Bitcoin and Ethereum’s modest gains of 0.5% and 1%.

The overall investment landscape shows strong institutional appetite for crypto assets, with total assets under management in ETPs reaching $163 billion. While this represents a decline from January’s peak of $181 billion, steady trading volumes of $20 billion per week indicate sustained market activity.

Other cryptocurrencies also attracted notable investments, with XRP and Solana securing $21 million and $11 million in inflows, respectively. Additionally, blockchain equities continued their positive trend with $33 million in new investments, bringing their year-to-date inflows to $194 million.

These developments suggest growing institutional confidence in the crypto sector, particularly as regulatory clarity improves and investment products become more accessible to traditional investors.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.