Digital asset funds are ending the year on a stronger note. In the first week of December 2025, CoinShares reported weekly crypto inflows of about $716 million into exchange-traded products (ETPs), while Bitcoin treasury firm Strategy added another 10,624 BTC to its balance sheet.

Crypto Inflows Signal Sentiment Is Turning

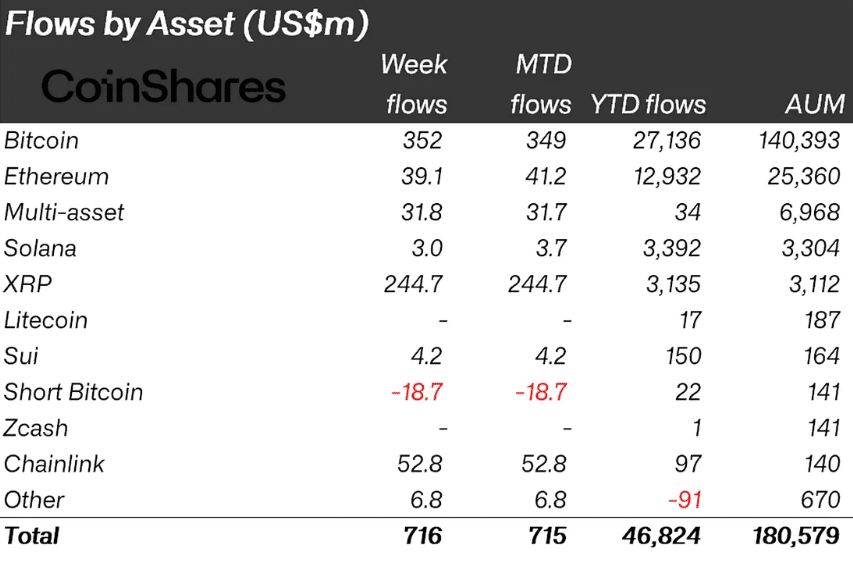

CoinShares’ latest fund flows report shows two key points. First, money is coming back into crypto ETPs across regions. The US led with around $483 million in inflows, followed by Germany with almost $97 million and Canada with roughly $81 million.

Total assets under management in these products are now about $180 billion, up nearly 8% from November lows, although still below the $264 billion peak.

Bitcoin products took in about $352 million last week, lifting year-to-date inflows to $27.1 billion. Short-Bitcoin ETPs, on the other hand, saw their largest weekly outflows since March, at roughly $18.7 million.

That shift suggests that traders who had been betting against BTC are starting to close those positions, hinting that bearish sentiment may be close to exhaustion.

Altcoins also saw strong interest. XRP products attracted around $245 million, far above their 2024 totals, while Chainlink recorded a weekly inflow of $52.8 million, equal to more than half of its total assets in ETPs.

These numbers highlight where institutional and wealth-management money is moving. Watching weekly flow data can help you spot early signs of rotation between Bitcoin and large-cap altcoins and manage exposure before price action fully reflects that shift.

Strategy’s Growing Bitcoin Stack Keeps Spotlight on BTC

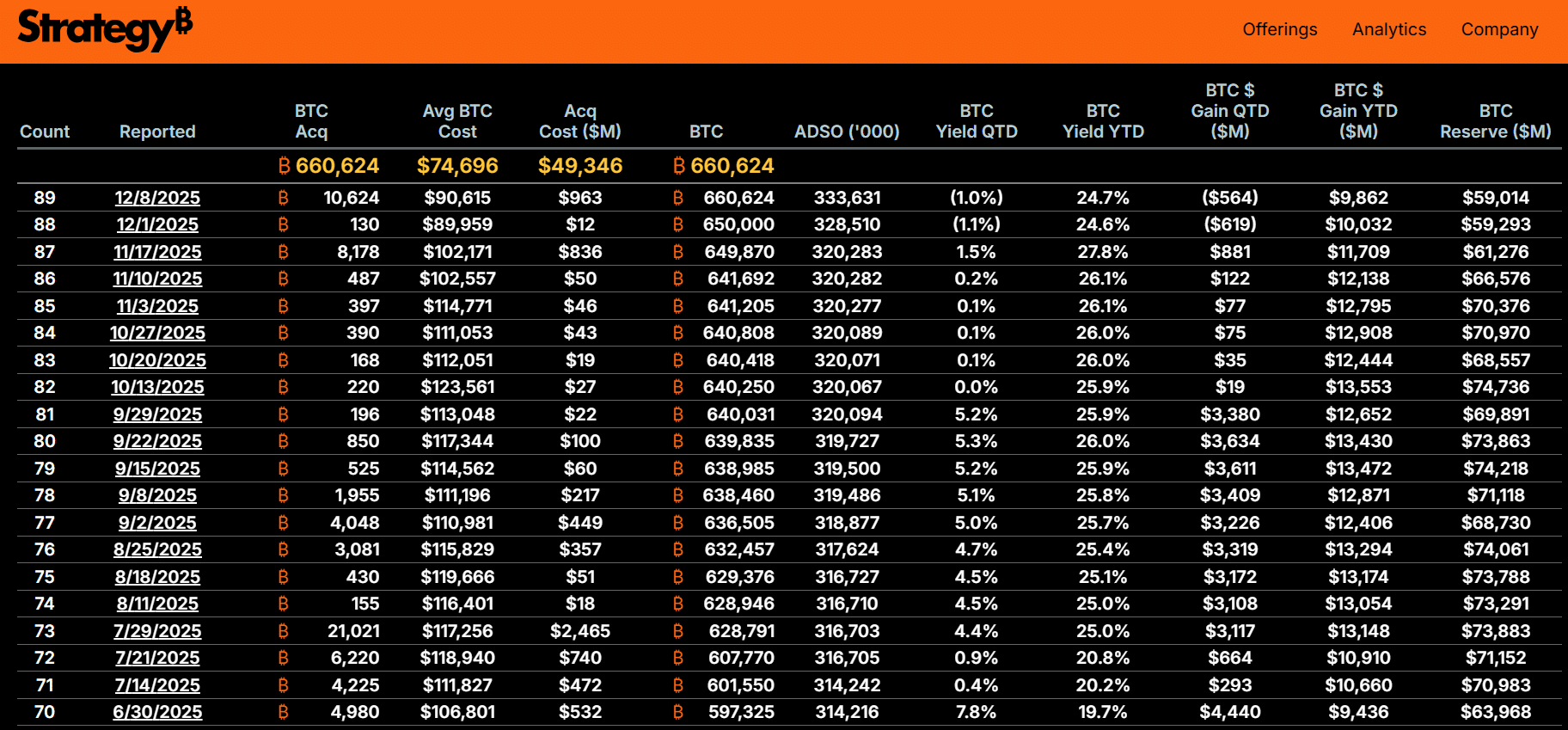

Against this backdrop, Strategy (formerly MicroStrategy) disclosed a new purchase of 10,624 BTC for about $962.7 million, at an average price near $90,615 per coin.

The company now holds roughly 660,624 BTC—about 3% of Bitcoin’s fixed 21 million supply—worth around $60 billion at current prices and sitting on more than $10 billion in unrealized gains.

The firm is funding these buys through ongoing stock and preferred-share issuance, along with a $1.44 billion cash reserve set aside to cover dividends and interest for roughly 18 months.

That setup suggests Strategy is under little pressure to sell BTC before its next major debt maturity in 2027, even if price volatility picks up.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.