The crypto industry experienced a significant downturn in the first quarter of 2025, with the total market capitalization falling 18.6% to close at $2.8 trillion, according to CoinGecko’s latest Q1 report.

This decline follows a period of euphoria in late 2024, when the market briefly touched $3.8 trillion on January 18, just before Donald Trump’s presidential inauguration.

The Q1 slump affected investor activity substantially, with average daily trading volumes dropping 27.3% quarter-on-quarter to $146 billion. This represents a sharp contrast to the $200.7 billion daily average recorded in Q4 2024.

Crypto Industry Turmoil: Winners and Losers

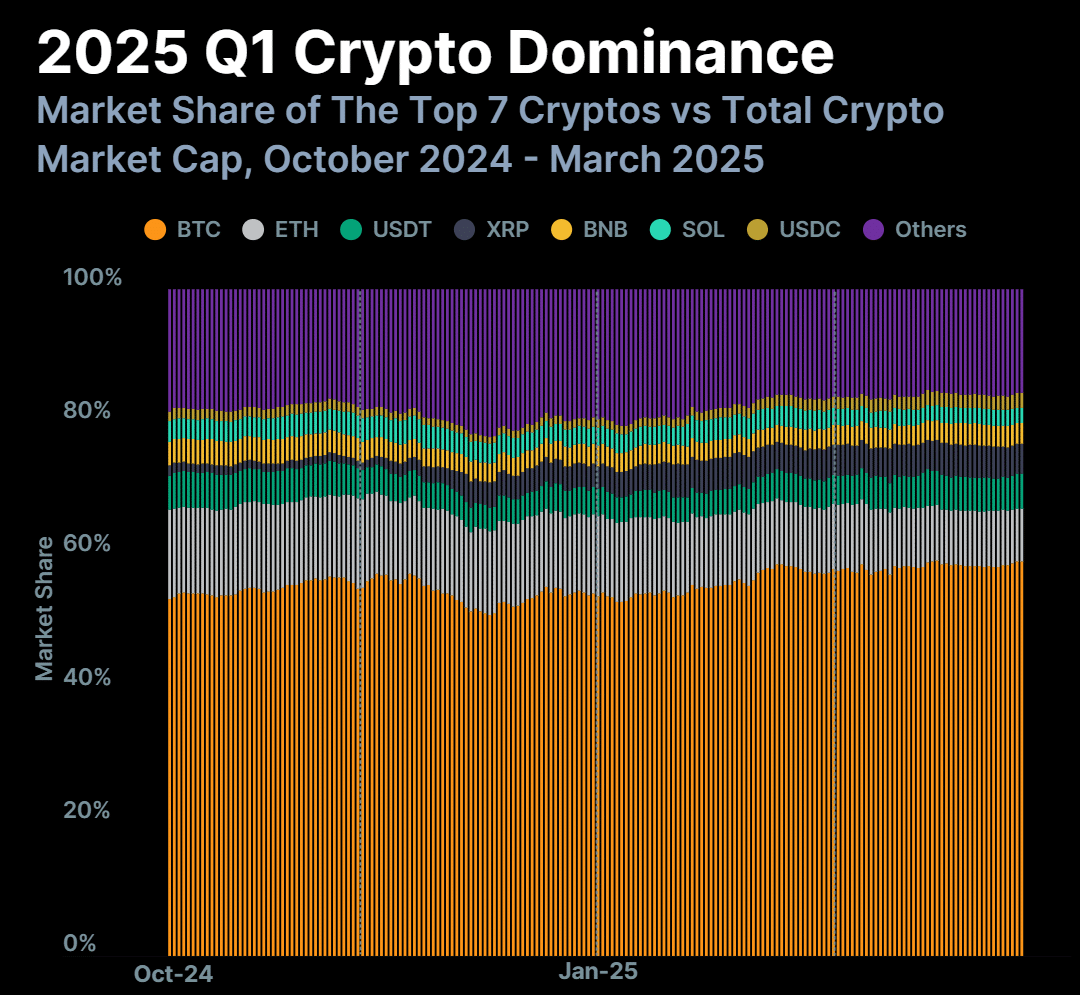

While the entire market took a hit, Bitcoin reinforced its position as the dominant cryptocurrency. BTC’s market share rose by 4.6 percentage points to reach 59.1% by the end of Q1—levels not seen since early 2021.

Though Bitcoin hit a fresh all-time high of $106,182 in January, it retreated to $82,514 by quarter-end, registering an 11.8% decline.

Ethereum was hit particularly hard, with its price plummeting from $3,336 to $1,805, representing a 45.3% decrease within the quarter. This steep drop effectively erased all of ETH’s gains from 2024. Ethereum’s market dominance fell by 3.9 percentage points to 7.9%, its lowest level since late 2019.

Stablecoins benefited from the market turbulence as investors sought stability. Tether (USDT) increased its market share slightly to 5.2%, while USDC regained its #7 spot, replacing Dogecoin.

Centralized and Decentralized Exchange Performance

Spot trading volume on centralized exchanges (CEXs) hit $5.4 trillion in Q1 2025, down 16.3% from the previous quarter. Binance maintained its position as the dominant spot CEX with a 40.7% market share, despite seeing its monthly trading volume drop below $600 billion in March, compared to over $1 trillion in December.

In the decentralized exchange (DEX) landscape, Solana continued its dominance from late 2024, accounting for 39.6% of all DEX trades in Q1. Solana’s share peaked at an impressive 52% in January, driven by the “political memecoin” trend led by tokens like $TRUMP.

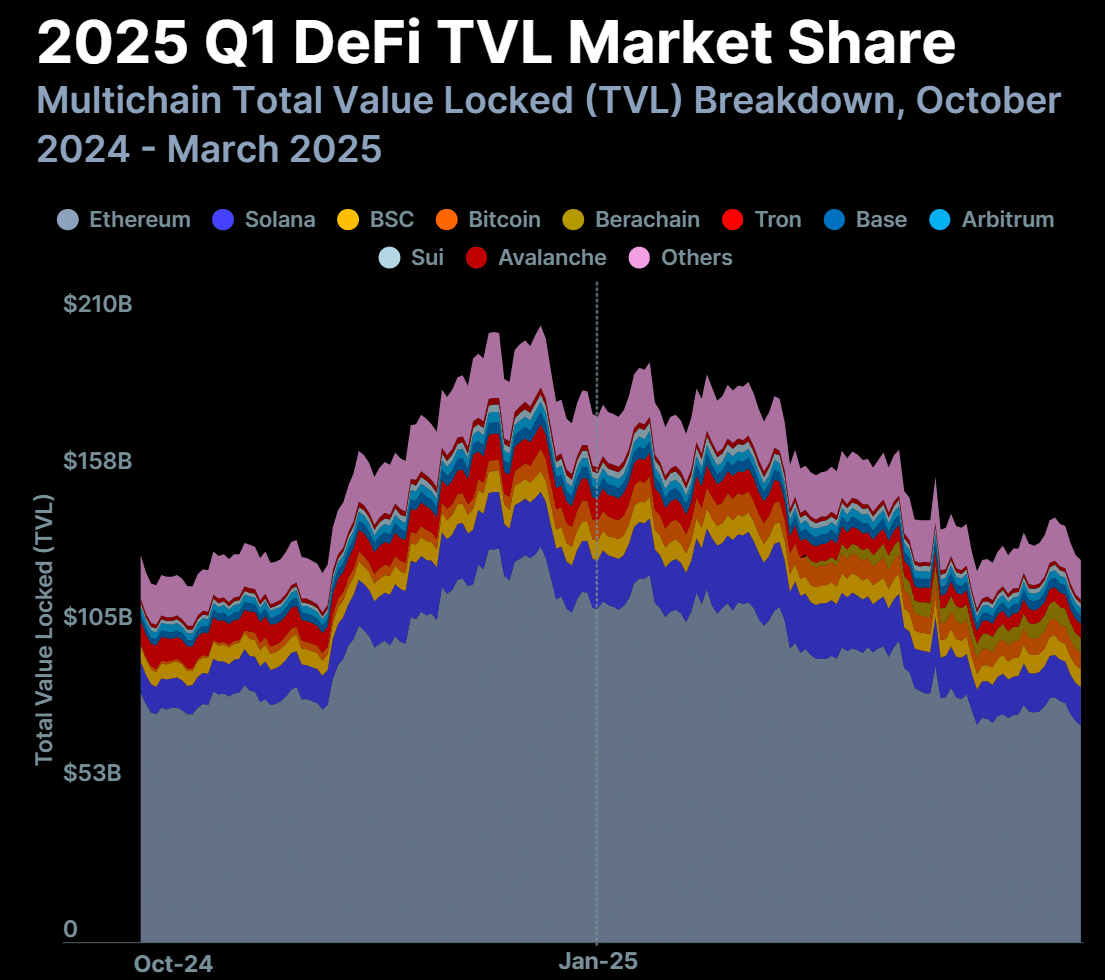

The total value locked (TVL) in multichain DeFi projects fell by 27.5% in Q1, from $177.4 billion to $128.6 billion. Ethereum lost 35.4% of its TVL, dropping from $112.6 billion to $72.7 billion.

A notable newcomer, Berachain, launched on February 6, quickly grew to $5.2 billion in DeFi TVL by the end of Q1, securing the sixth-largest TVL share in the market.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.