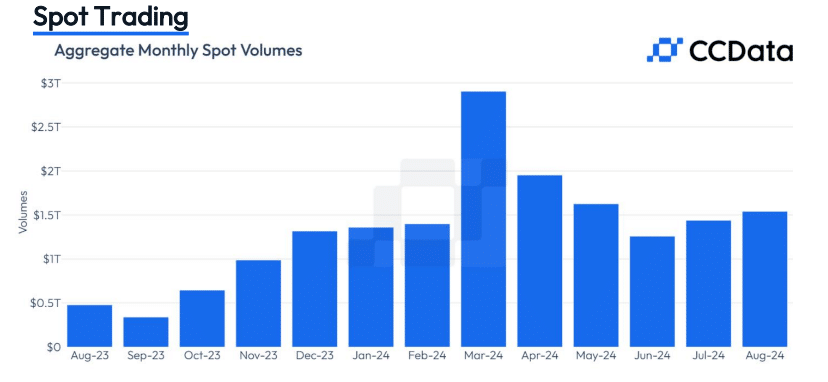

The crypto world is buzzing with activity as crypto exchanges saw a significant uptick in trading volumes during August 2024. According to the latest CCData report, August witnessed a remarkable surge in crypto trading, with combined spot and derivatives volumes hitting $5.22 trillion.

This 5.38% increase marks the highest level since May, driven by market volatility stemming from global economic factors.

The report revealed that spot trading volumes on centralized exchanges jumped 7.06% to $1.54 trillion, while derivatives trading climbed 4.70% to $3.68 trillion. These figures underscore the growing appetite for crypto assets among both retail and institutional investors.

Crypto.com Makes Waves

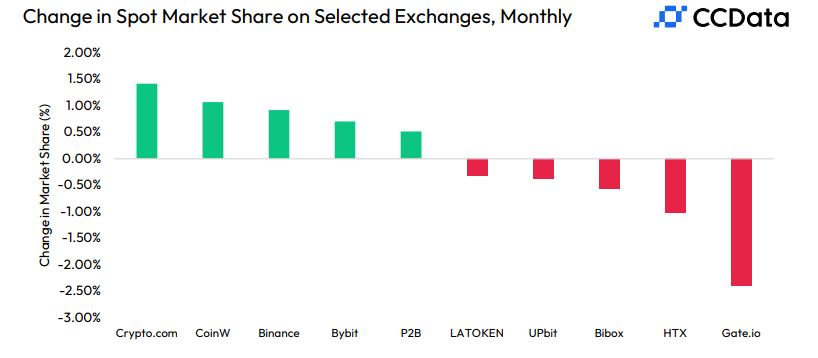

One of the standout performers in August was Crypto.com. The exchange saw its spot trading volume skyrocket by 38.7% to $95.6 billion, the highest since 2022. Its derivatives volume also hit an all-time high, surging 38.2% to $104 billion.

This impressive growth boosted Crypto.com’s market share significantly. Its spot market share rose to 6.21%, while its derivatives market share reached a record 2.83%. The exchange attributes this success to its expanding base of institutional clients and advanced retail traders.

Binance and Bybit Hold Strong

Industry giant Binance maintained its dominance, with its spot market share increasing to 29.0% after five months of decline. However, its derivatives market share dipped slightly to 42.7%.

Bybit also continued its upward trajectory, with both spot and derivatives market shares hitting new all-time highs of 9.89% and 15.9%, respectively.

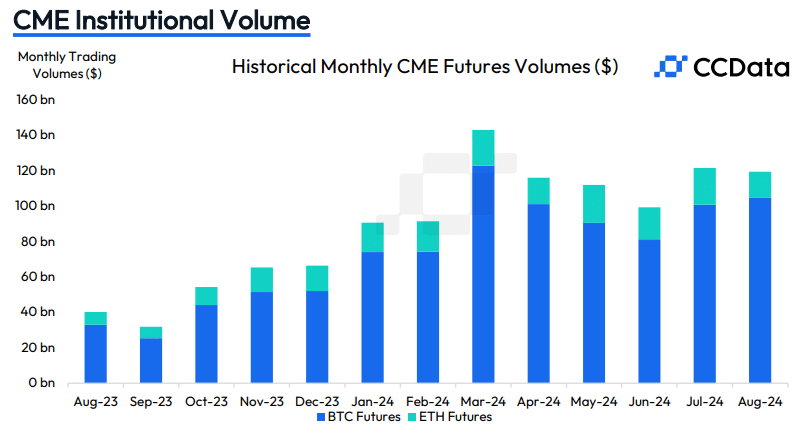

Interestingly, Ethereum trading on the Chicago Mercantile Exchange (CME) saw a notable decline. Ether futures volume dropped 28.7% to $14.8 billion, the lowest since December 2023. Ether options volume also fell by 37.0% to $567 million.

This downturn suggests waning institutional interest in Ethereum, particularly following the launch of spot ETH ETFs in late May. The trend might continue into September, potentially influenced by seasonal factors.

Market Dynamics and Future Outlook for Crypto Exchanges

The surge in trading activity came amid sharp spikes in volatility, partly due to the unwinding of the Japanese Yen carry trade. This led to weaknesses in both traditional financial markets and digital assets.

As a result, the aggregate open interest on derivatives exchanges fell by 15.7% to $45.8 billion in August, indicating a period of market adjustment.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.