As summer wraps up, crypto exchanges are feeling the chill. A new report from CCData shows that trading on these digital money marketplaces took a big dip in September 2024. Let’s break down what’s happening in the world of crypto exchanges and what it might mean for investors.

Key Takeaways:

- Overall trading on crypto exchanges dropped 17% in September

- Binance’s market share hit its lowest point in years

- Crypto.com is growing fast, now the fourth-largest exchange

- Interest rate cuts and the U.S. election could boost trading

- The last quarter of the year is often the busiest for crypto exchanges

Trading on Crypto Exchanges Slows Down

The latest numbers reveal that both spot and derivatives trading on crypto exchanges fell by about 17% last month. In total, $4.34 trillion worth of trades happened, which is the lowest we’ve seen since June. This drop marks the end of what experts call the “seasonality period,” a time when trading is usually slower.

Spot trading, where people buy and sell crypto right away, dropped to $1.27 trillion. Derivatives trading, which involves more complex bets on crypto prices, fell to $3.07 trillion. These numbers suggest that fewer people were buying, selling, or trading crypto in September.

Binance Loses Ground as New Players Rise

Binance, the biggest name in crypto exchanges, had a rough month. Its share of the spot trading market fell to 27%, the lowest since January 2021.

In derivatives trading, Binance’s slice of the pie shrank to 40.7%, a level not seen since September 2020. Overall, Binance now handles 36.6% of all crypto exchange activity, down from previous months.

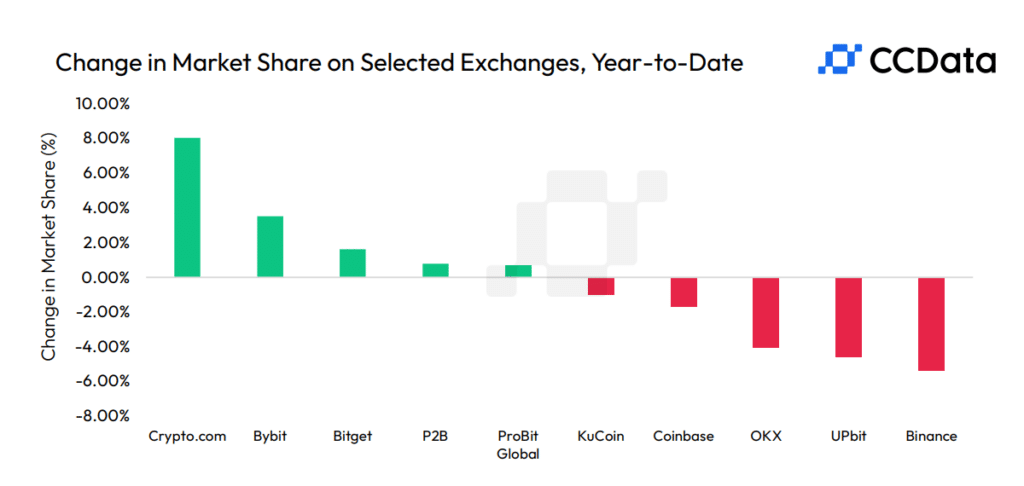

While Binance stumbled, other exchanges gained ground. Crypto.com saw a big jump, with its trading volumes going up by over 40%. This surge pushed Crypto.com to become the fourth largest crypto exchange by volume, now handling 11% of all trades.

What’s Next for Crypto Exchanges?

Despite the September slowdown, there’s hope for busier times ahead. The U.S. Federal Reserve’s decision to cut interest rates could bring more money into the crypto market. Also, the upcoming U.S. election might stir up more trading activity.

Historically, the last three months of the year (October to December) have been the busiest for crypto exchanges in six out of the last ten years. This pattern suggests we might see a bounce back in trading volumes soon.

For investors and crypto enthusiasts, these changes in the crypto exchange landscape are worth watching. As the market evolves, new opportunities and challenges are likely to emerge in the world of digital currency trading.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.