Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

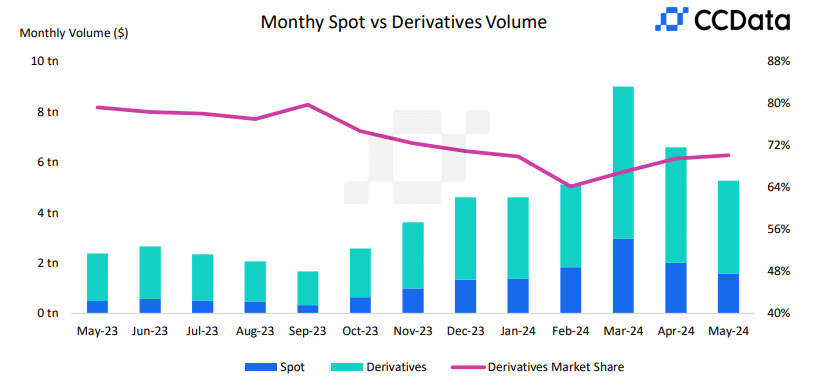

In May, the world of crypto exchanges experienced significant changes as trading volumes continued to trend downward. According to a recent report by CCData, the combined spot and derivatives trading volume on centralized exchanges fell by over 20% to $5.27 trillion. This marks the second month in a row of declining activity.

According to CCData, spot trading volumes on these exchanges dropped by 21.6% to $1.57 trillion. At the same time, derivatives volumes also saw a decrease of 19.4% to $3.69 trillion. Despite this overall decline, the derivatives market actually gained dominance, reaching its highest level since December 2023.

This shift was largely driven by traders looking to take advantage of the SEC’s surprise approval of spot Ethereum ETFs in the US.

Binance Remains King Among Crypto Exchanges

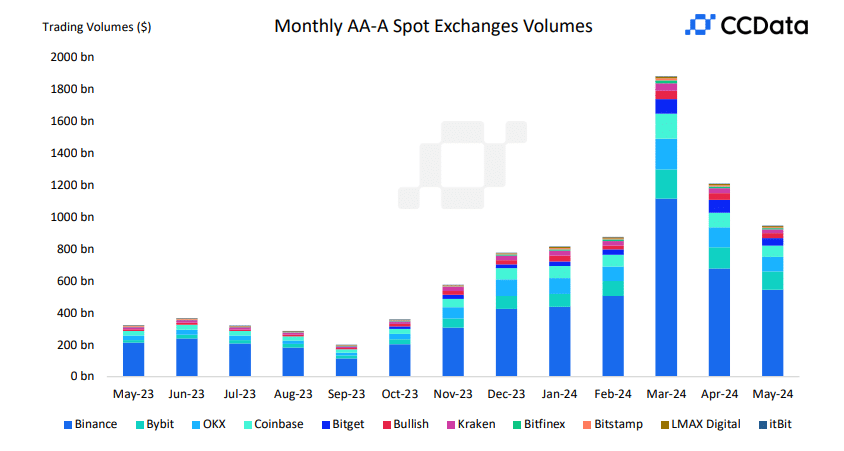

Among the major players, Binance remains the largest spot exchange, with a market share of 34.6%. However, even Binance saw its volumes fall by nearly 20% to $545 billion in May. Bybit, on the other hand, reached an all-time high market share of 7.36%, solidifying its position as the second-largest spot exchange in the industry.

In the derivatives market, Binance continues to lead with a 45.4% market share. OKX, Bitget, and Bybit follow with shares of 21.3%, 13.5%, and 12.1%, respectively. These top exchanges traded volumes in the hundreds of billions.

Interestingly, the CME exchange saw a notable rise in activity related to Ethereum. ETH futures on CME rose by 37.5% to $20.5 billion, the highest monthly volume since November 2021.

Even more impressively, ETH options trading volume on the exchange jumped by 115% to $931 million, setting an all-time high. This surge highlights the growing institutional interest in Ethereum following the SEC’s ETF decision.

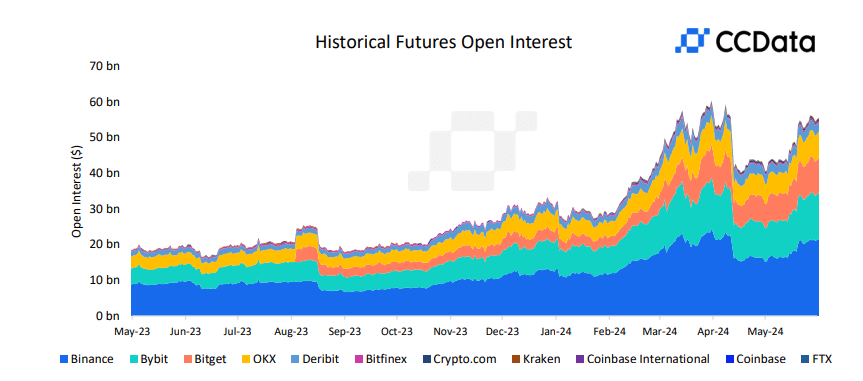

Overall, while trading volumes have declined, the crypto exchange landscape remains dynamic. The unexpected regulatory shifts have introduced volatility and speculation into the markets. As a result, open interest in derivatives exchanges has risen significantly to $55.2 billion as traders seek to capitalize on these developments.

As the crypto market continues to evolve, it will be important to monitor how these exchanges adapt and compete. The changing regulatory environment and shifting investor sentiments will undoubtedly shape the future of this fast-paced industry.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.