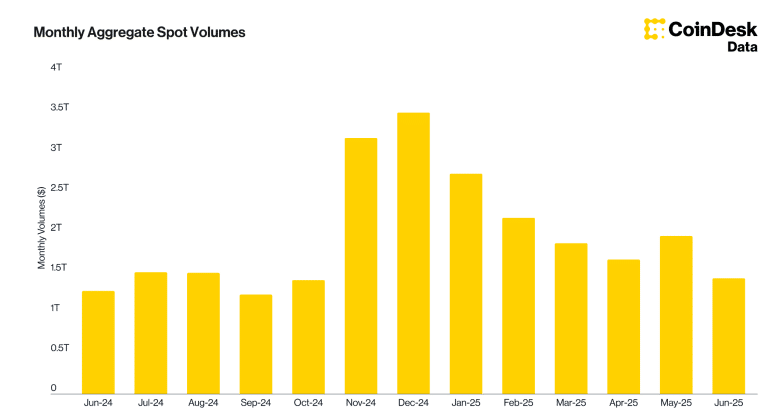

Crypto exchanges experienced a significant downturn in June 2025, with combined spot and derivatives trading volumes plummeting 22.8% to $6.48 trillion.

This marked the lowest trading activity since October 2024, signaling a notable shift in market dynamics across centralized platforms.

The decline affected both major trading categories, with spot volumes dropping 26.7% to $1.44 trillion and derivatives trading falling 21.6% to $5.04 trillion.

Despite the overall reduction, derivatives maintained their dominance, capturing 77.8% of total market share compared to 76.6% in the previous month—the highest proportion since September 2023.

Market Leadership Changes Among Major Crypto Exchanges

Binance strengthened its position during the downturn, increasing its derivatives market share by 1.46% to reach 37.6%. The platform processed $1.89 trillion in derivatives volume despite an 18.4% monthly decline.

Gate emerged as another winner, posting the second-largest market share gain of 1.01% to reach 5.14%, while maintaining relatively stable performance with only a 2.57% volume decrease.

The competitive landscape saw significant shifts as Gate surpassed established players like Hyperliquid, CME, and Coinbase International to become the fifth-largest derivatives exchange by volume.

Gate now commands 10.6% of aggregate open interest across all trading pairs and platforms.

On-Chain Trading Platforms Show Resilience

Hyperliquid, the leading on-chain derivatives platform, demonstrated remarkable growth despite market headwinds.

While its trading volume declined 12.1% to $215 billion—the first decrease in three months—its market share among derivatives exchanges reached a new all-time high of 4.26%.

The platform’s open interest surged 24.8% to $7.43 billion, reflecting growing adoption of decentralized trading infrastructure.

Institutional Activity Remains Subdued

CME’s institutional trading segment reflected broader market sentiment, with total derivatives volume falling 5.92% to $198 billion. Bitcoin futures led the decline with a 5.38% drop to $138 billion, while options trading experienced a more severe 32.6% contraction to $2.70 billion.

The widespread volume decline coincided with Bitcoin’s consolidation below previous highs and broader digital asset price corrections amid escalating geopolitical tensions, particularly in the Middle East region.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.