Crypto ETFs continue to make headway, with Canada poised to introduce the world’s first spot Solana exchange-traded funds on Wednesday, April 16. According to a bank circular from TD Bank cited by Bloomberg Senior ETF Analyst Eric Balchunas, the Ontario Securities Commission has approved these groundbreaking investment products.

Four major asset managers—Purpose, Evolve, CI, and 3iQ—will launch these spot Solana ETFs, which notably will include staking features. These staking capabilities may deliver higher yields compared to Ethereum staking while potentially reducing overall ETF holding costs.

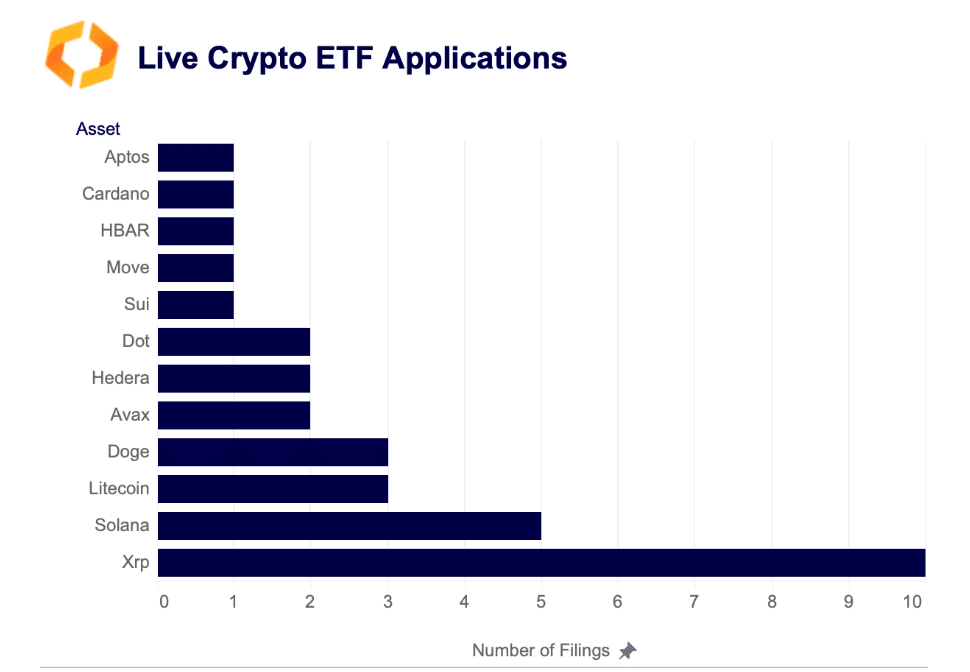

XRP Positioned as Next Likely Candidate for Spot ETF Approval

While Solana ETFs prepare for their Canadian debut, analysts at crypto research platform Kaiko suggest XRP might be the next cryptocurrency to receive spot ETF approval in the United States, following Bitcoin and Ethereum.

Two key factors put XRP ahead of other contenders:

- Superior market liquidity: XRP demonstrates the highest average 1% market depth among altcoins on major centralized exchanges. This indicates substantial buy and sell orders near current market prices, creating a stable environment with lower slippage.

- Teucrium’s leveraged XRP product: The recent launch of Teucrium’s 2x leveraged XRP ETF (XXRP) marks a significant milestone as the first XRP ETF in the U.S., though it’s based on derivatives rather than spot holdings.

FWIW, the 2 solana ETFs in US (which track futures so not a perfect ginnea pig) hhaven’t done much. Very little in aum. The 2x XRP already has more aum than both the solana ETFs and it came out after. Wouldn’t read a ton into it, but it’s our first look at the alt coin race

— Eric Balchunas (@EricBalchunas) April 14, 2025

May 22 represents a critical date for XRP enthusiasts, as the SEC must respond to Grayscale’s spot XRP ETF filing by then. Kaiko analysts argue that since the leveraged ETF relies on European ETPs and swap agreements, “it’s hard to see how a spot product is more risky,” potentially weakening arguments against approval.

Crypto ETFs Hopes Spike Following New SEC Chair’s Confirmation

Meanwhile, the U.S. crypto ETF landscape continues evolving rapidly. Several prominent asset managers, including Grayscale, Bitwise, 21Shares, Canary, and VanEck, have filed applications for spot Solana ETFs. Industry interest has expanded following Paul Atkins’ Senate confirmation as SEC Chair, replacing the crypto-skeptic Gary Gensler.

Despite the growing number of crypto ETF offerings, early performance indicators show mixed results. Bloomberg’s Balchunas noted that existing Solana futures ETFs in the U.S. “haven’t done much” in terms of assets under management, with Volatility Shares’ Solana ETF and 2X Solana ETF holding approximately $5.1 million and $8.7 million, respectively.

The ongoing developments in the crypto ETF space reflect the financial industry’s growing acceptance of digital assets as legitimate investment vehicles, despite persistent regulatory uncertainties and market challenges.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.