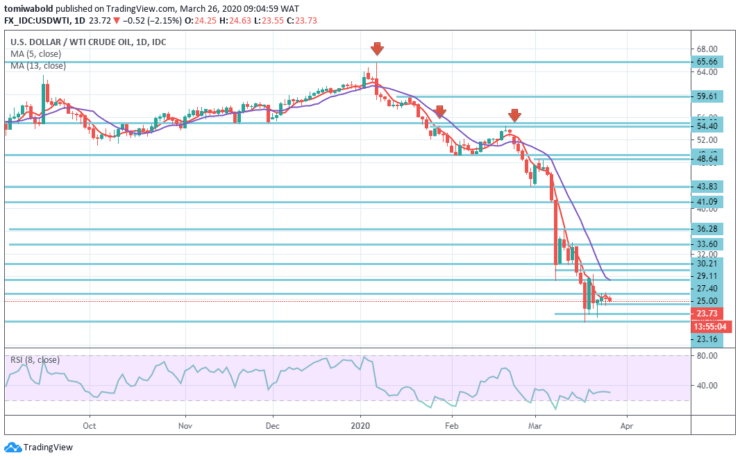

USDWTI Price Analysis – March 26

After reaching 4 days high at $25.83, WTI oil drops below $25 mark, unable to retain progress, amid generally positive market sentiment after US Congress passed the stimulus package. Oil markets appear vulnerable to fresh declines, as perceptions of growing oversupply effects outweigh the direct impact of US measures.

Key Levels

Resistance Levels: $33.60, $30.21, $27.40

Support Levels: $21.50, $20.08, $15.00

USDWTI Long term Trend: Bearish

U.S. oil prices simmered down as government statistics indicated that last week the coronavirus pandemic was starting to undermine U.S. capacity for gasoline. Technical readings on the daily chart are not encouraging as the traction is flat deeper in the negative area, as well as RSI in horizontal mode on the boundary of the oversold region and MA’s 5 and 13 in bearish formation.

The pair is supposed to find support at $23.16 levels, and a drop through might take it to the next $21.50 support level. The pair is set to meet its initial resistance at $25.00 levels, and a surge by could carry it to the next $27.40 resistance level.

USDWTI Short term Trend: Bearish

The price of oil continues underneath downward pressure below its key MAs 5 and 13 as sellers are aiming for a continuation of the short squeeze underneath the $21/20 support zone level that could inject exposure to the $15 level on the downward trajectory.

On the other hand, buyers will be attempting to gather momentum beyond the $25 level of resistance with potential goals on the way north to the $27.40 and $30.21 price levels.

Instrument: USDWTI

Order: Sell

Entry price: $23.50

Stop: $25.00

Target: $20.08

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.