USDWTI Price Analysis – May 18

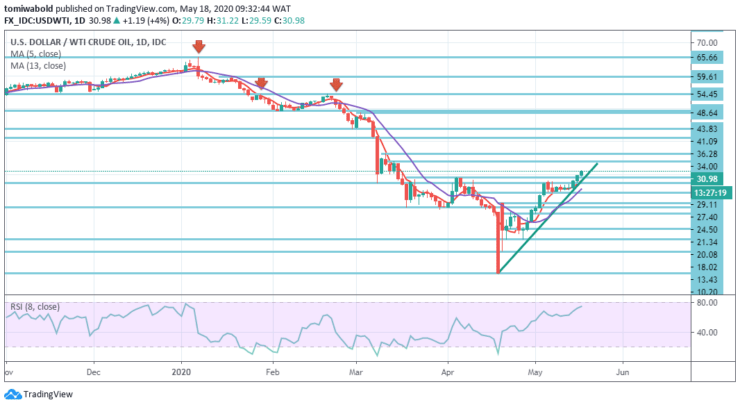

WTI is trading at $30.98 level at the time of writing, having moved from a $29.59bbls low to a $31.22bbls high. This week’s price of a barrel of oil is higher at the open. West Texas Intermediate (WTI) has recorded its highest price since March as analysts notice an increasing demand for fuel and trade optimism with travel restrictions easing.

Key Levels

Resistance Levels: $41.09, $36.28, $34.00

Support Levels: $27.40, $24.50, $21.34

USDWTI Long term Trend: Ranging

Crude Oil has risen nearly 5.00 percent against the USD for the 24 hours to this moment and is growing in price at $30.98 per barrel on Monday, showing claims of oil demand growth. The pair is priced in the Asian session to the European session, from a low level of $29.59 to a high level of $31.22.

The pair is required to find support at a level of $27.40, and a decline along may well turn it to the next level of support of $24.50. The pair is required to find its key resistance at a level of $34.84, and an upsurge through could push it to the next $36.28 resistance level.

USDWTI Short term Trend: Bullish

WTI oil prices rose beyond $29.11 level early on Monday, but now nearing main barriers at $34.00 level, improving optimism about the steady easing of shutdown measures, restarting China’s economy, and indications of more supply cuts, significantly increasing oil prices.

On the 4-hour chart, bulls may collapse on an early attempt at $34.00-level critical barriers as heavy declining daily cluster puts a strain and short-term RSI is overbought whereas traders may capture few earnings during the session.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.