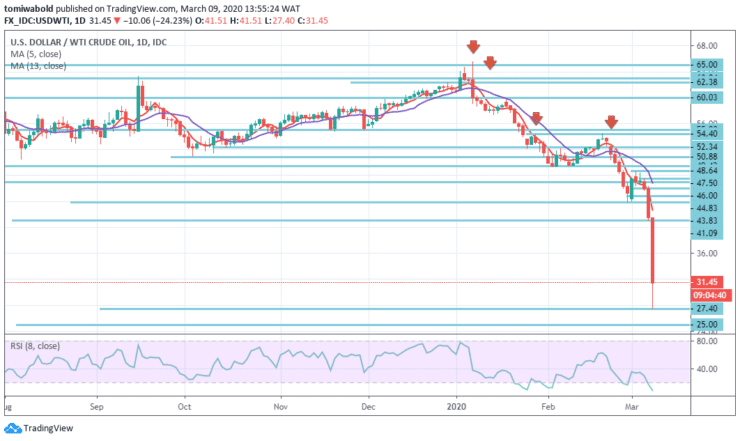

USDWTI Price Analysis – March 9

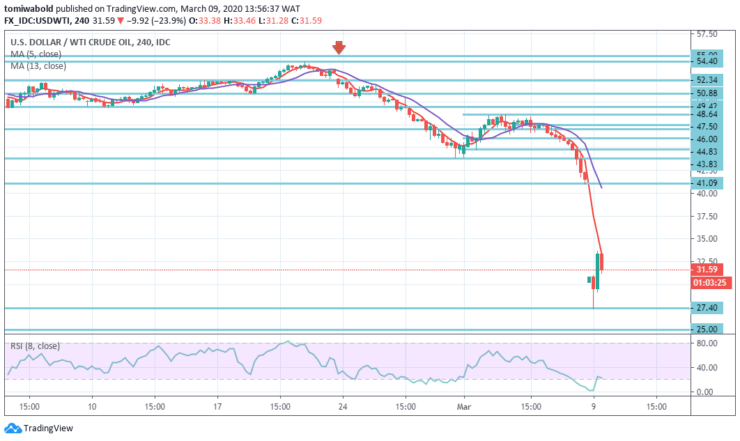

WTI oil futures for April delivery is in free fall mode on Monday after a price war between Saudi Arabia and Russia caused by last week’s OPEC+ meeting. On Monday, the oil price opened 11 percent lower and trading at a $27.40 level multi-year low, though not far from the 2016 troughs.

Key Levels

Resistance Levels: $54.40, $50.88, $46.00

Support Levels: $27.40, $25.00, $20.00

USDWTI Long term Trend: Bearish

In the larger structure, the market mood turned to bearish after the drop beneath the $43.83 level of 2018 low and only a bounce back past that level could restore the optimistic outlook.

If recovery occurs, with the price closing past today’s high of $41.51 level, resistance could arise within the former support area of $41.09-$43.83 levels, a break from which could see the $46.00 level re-test.

USDWTI Short term Trend: Bearish

WTI crude oil prices dropped more than 10 percent today as prices reached a $27.40-level multi-year low, although this coincides with multi-year support turned resistance point at $41.09 level. If the price returns past this level, we might see some consolidation happen.

The restructuring would most likely stay between ranges of $41.09 and $46.00 levels. We’d be on the lookout for any initial signs of higher low formation that could indicate a rebound.

Instrument: USDWTI

Order: Buy

Entry price: $27.40

Stop: $25.00

Target: $41.09

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.