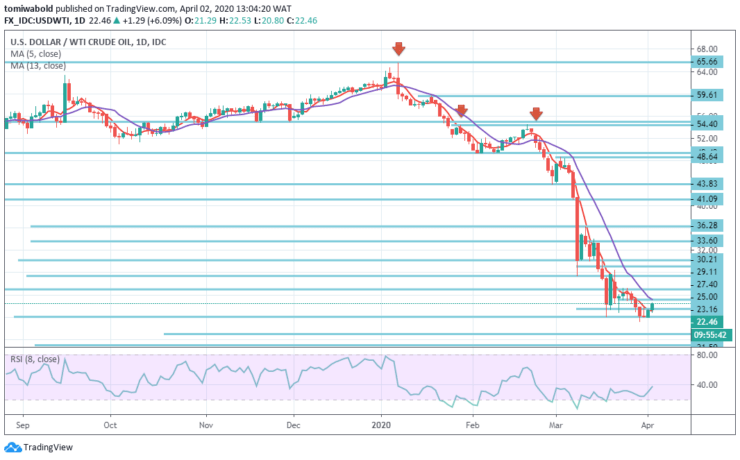

USDWTI Price Analysis – April 2

WTI oil price recovers nearly 10 percent on Thursday amid improved global optimism with widespread gains and bullish bias beyond the $22.00 level. Fresh optimism amongst traders stems from attempts by President Trump to encourage Russia and Saudi Arabia to strike a bargain and close the price dispute.

Key Levels

Resistance Levels: $30.21, $25.00, $23.16

Support Levels: $21.50, $20.08, $17.00

USDWTI Long term Trend: Bearish

Initial signs of recovery on the daily chart involve a break and close beyond declining moving average 5 at ($22.47) level currently under resistance to suggest advancement of rebound to next horizontal barriers at $25.00 (declining moving average 13) level and $30.21 (psychological) level.

The overall look remains firmly bearish and demands patience, particularly if recovery measures fail to clear the pivot zone at 13 moving average.

USDWTI Short term Trend: Bearish

Oil prices are marginally higher trading with prices increasing minimally, with about 1.50 percent intraday. Price remains strongly below the mark of $23.16 although, indicating there is still a probability of downside. Price activity is presently trapped in the $22.53 and $20.08 level area.

One might anticipate a breakout from these levels. The relative strength index refers to a potential early overbought situation that could imply buyers are made with bids opening doors for bearish activity.

Instrument: USDWTI

Order: Buy

Entry price: $21.50

Stop: $20.08

Target: $23.16

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.