USDWTI Price Analysis – March 2

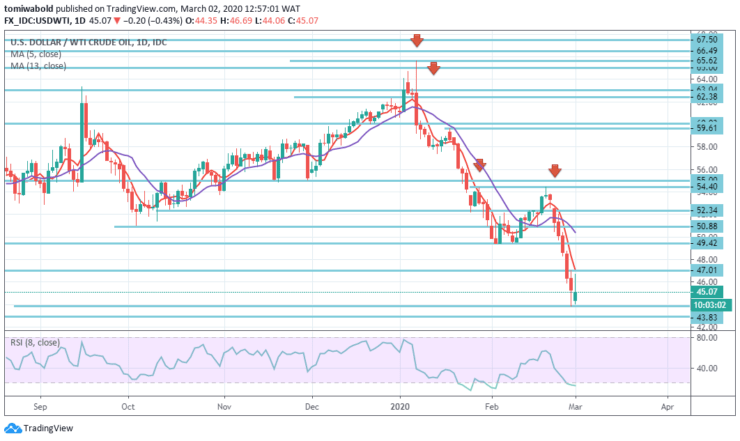

WTI (oil futures) is slowing its pace of recovery from a new 15-month low level of $ 43.83 after the sell-off opening gap caused by China’s horrible manufacturing PMI data released on Sunday. On the contrary, further selling stays on the cards, and any accidental attempt to buying can only be considered corrective.

Key Levels

Resistance Levels: $ 54.40, $ 52.34, $ 49.42

Support Levels: $ 43.83 $ 42.93, $41.80

USDWTI Long term Trend: Bearish

WTI crude oil prices plummeted more than 2% on Friday and reached multi-year support at $ 43.83 level. Given that this zone was held in the past, we anticipate seeing some ranging.

RSI indicates a low momentum at the moment and indicates oversold. Thus, oil prices should set a rebound past the $ 47.01 level for any signs of a rebound.

USDWTI Short term Trend: Bearish

During the day, the pair is trading on the level at $ 45.27, with oil trading up 2.64% against the US dollar after Friday’s close amid hopes that the Organization of Petroleum Exporting Countries (OPEC) and its allies may deepen reduction in oil supplies.

The pair is anticipated to maintain support at $ 43.83 level, and a fall could lead to the next support level at $ 42.93. The pair is anticipated to find its first resistance at $ 47.01 level, while an increase could lead to the next resistance level at $ 49.42.

Instrument: USDWTI

Order: Buy

Entry price: $ 43.83

Stop: $ 42.93

Target: $ 47.01

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.