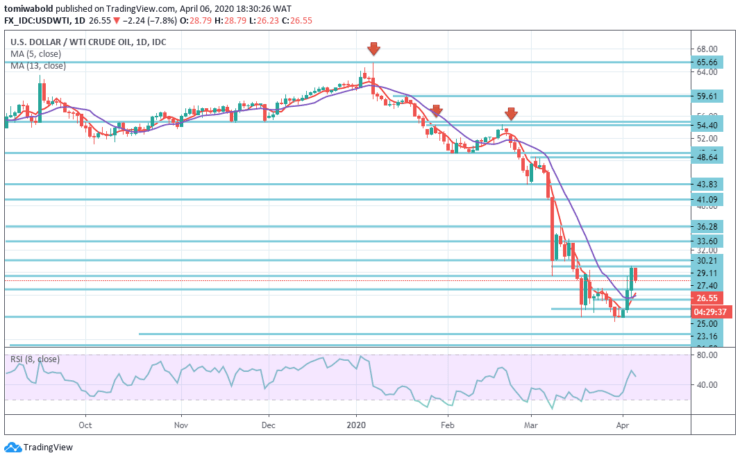

USDWTI Price Analysis – April 6

West Texas Intermediate (WTI) oil is priced in red on Monday after hitting a $29.11 level as the emergency session of OPEC+ has been delayed. The drop may also be related to Saudi Arabia and Russia’s decision to delay the scheduled emergency session until Thursday to negotiate production cuts.

Key Levels

Resistance Levels: $36.28, $33.60, $30.21

Support Levels: $25.00, $23.16, $21.50

USDWTI Long term Trend: Bearish

USDWTI eliminated more than 10 percent from the closing price on Friday and hit a daily low of $26.46 level in the American session’s early trading hours, but has since regained its losses. A downtrend may start if the level of $25 is breached and a drop to support level of $23.16 follows.

On the contrary, if the pair retreats past the level of $27.40, which will be followed by a $29.11 resistance level, the uptrend can be anticipated to proceed.

USDWTI Short term Trend: Bearish

WTI oil recovered momentum above $27.40 level on the 4-hour time frame and climbed above $28 mark in European trading on Monday, following a gap-lower opening in Asia. New progress is required to fill today’s gap to generate a bullish signal for psychological $29.11 level resistance assault.

A breach of which would reveal critical threshold at $30.21 (down 38.2 percent of $48.64) levels and strong support at $25.00 level is anticipated to re-align with bulls while holding this support.

Instrument: USDWTI

Order: Sell

Entry price: $29.11

Stop: $30.21

Target: $25.00

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.