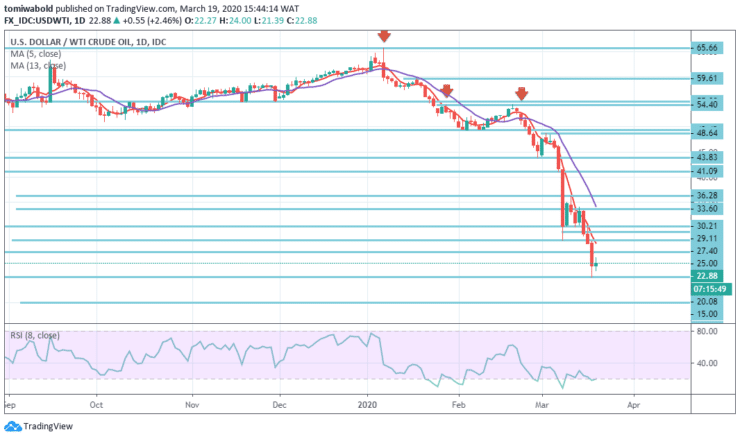

USDWTI Price Analysis – March 19

Amid many attempts so far this Thursday to expand the recovery momentum beyond the $24 price level, WTI (oil futures on NYMEX) has entered a consolidated mode over the last few hours as investors evaluate the efficacy of the new global stimulus steps to counter the economic impact of the coronavirus outbreak.

Key Levels

Resistance Levels: $33.60, $30.21, $27.40

Support Levels: $20.08, $15.00, $10.00

USDWTI Long term Trend: Bearish

WT trades at $23.00 level at the time of writing, having reached a daily high of $24.00 in early Asia, + 13.68 percent. WTI’s barrel plummeted at Wednesday’s session to $20.54 level, the lowest rate seen in 17 years, losing almost 25 percent regularly.

There was a slight upside reversal after selling as low as level $20.54. Nonetheless, the market struggled to clear the $24.00 area and topped close to the same level, the market could check the $15.00 support level or $10.00 region if there is a downside break below the $20.54 range.

USDWTI Short term Trend: Bearish

Looking at WTIUSD’s 4-hour chart, the market opened at a low volume and traded beneath the $27.40 and $25.00 support level turned resistance level.

Besides, there could be a break higher than the price level of $25.00 where it may settle well past the moving average (5 and 13, 4-hours), and to start a strong recovery wave, the price must rise past the level of resistance of $30.00 and then advance past the level of $33.60.

Instrument: USDWTI

Order: Sell

Entry price: $24.00

Stop: $29.11

Target: $15.00

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.