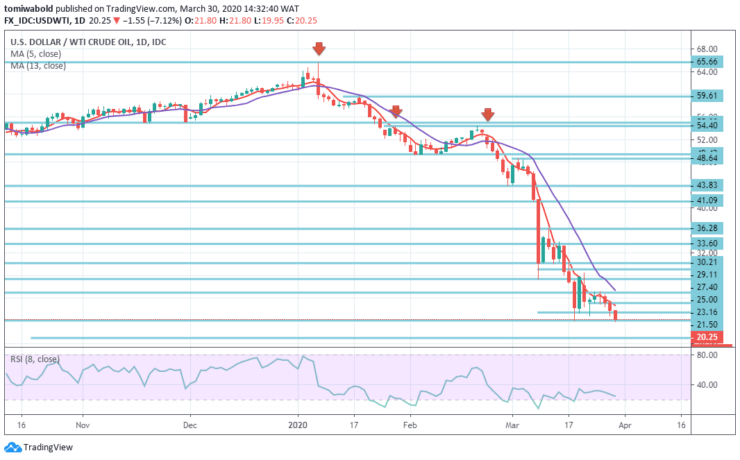

USDWTI Price Analysis – March 30

In the early Monday session, WTI slips to $19.95 price level. In doing so, the energy index stays nearly weak for so many years while posting declines for the fourth straight time since the weekend and is now looking to finish the month of March more than 50 percent weaker. Besides the dismal mood of the market, the lack of commitment on the part of major oil-producing countries to alter the production makes it impossible for oil to attempt a rebound.

Key Levels

Resistance Levels: $30.21, $25.00, $23.16

Support Levels: $17.00, $15.00, $10.00

USDWTI Long term Trend: Bearish

Oil prices steadily decreased to slide down just below $20.08 level in the support area. That indicates the pair’s latest attempt around this level. Prices are slowly picking up so far. Nonetheless, on the daily chart, the bearish price action indicates there is room for more downside.

But the double-bottom on the daily at the moment suggests the probability of a potential rebound. Currently, the price close to $27.40 level could be the obvious target. On the contrary, the $17.00 low level could be the next aim the moment the $20 support zone is unable to hold.

USDWTI Short term Trend: Bearish

In the short-term frame, the loss of $20.08 psychological level may trigger renewed selling and unmasking support at $17.00 (low) level with continuation to the next level, which is the psychological $10 level, which is not ruled out.

Conversely, an upward breach of the initial line of resistance, at a level of $23.16, may reach $27.40 and $30.21 levels during the subsequent advance. The bulls are less probable to be persuaded, even so, if they provide a consistent shoot-up far above top March 11 around $36.28 level.

Instrument: USDWTI

Order: Sell

Entry price: $20.84

Stop: $21.50

Target: $19.50

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.