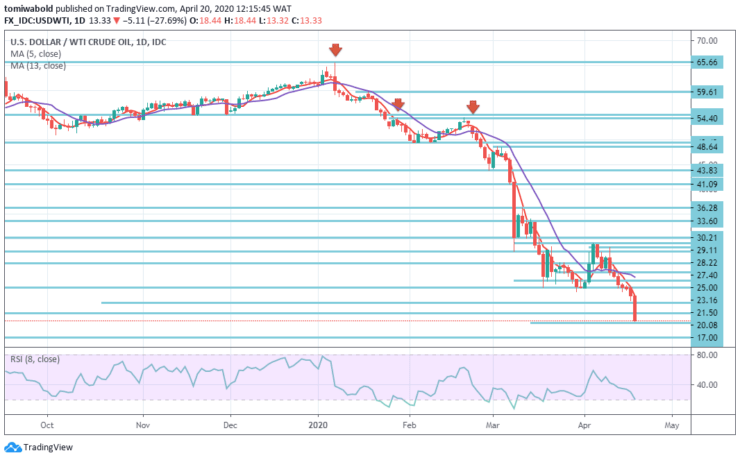

USDWTI Price Analysis – April 20

WTI Oil plummeted at the beginning of the week’s market falling underneath the $15/bbl as the globe was growing out of storage and crude stocks began to accumulate owing to coronavirus shutdowns in most of the global economy. Crude may have been the ultimate casualty of the decline of global demand with market situation increasingly compounded by Saudi Arabia’s price war with Russia.

Key Levels

Resistance Levels: $21.50, $20.08, $17.00

Support Levels: $13.00, $10.00 $8.00

USDWTI Long term Trend: Bearish

Here are some significant support and resistance levels in terms of technical price levels based on a medium to long-term (4 to 7 months) period. Unless the price falls under $13 to $10 (which is probable), the upside range will be between $21.50 and $23.16 levels.

Unless the price drops to $10 and below, a probable scenario, the price at the immediate threshold maybe $15 to $17 levels. The bottom line is that oil prices are undoubtedly well over-sold at the current level, however, given the constraints, the price may probably keep falling lower.

USDWTI Short term Trend: Bearish

Oil trades on the 4-hour chart beneath its 5 and 13 moving averages-a bearish sign. Initial support is seen on the low level at $13. Past this zone, it provides support after the round figure at $10 level. Resistance is seen at $17.00 (near high) before reaching $20.08 levels (5&13 MA crossings) and $21.50 (14 April) level.

WTI rates stay somewhat under stress. The constant rise in trading volume and quantity despite negative price swings paves the way for the moment to the reassertion of the downtrend, with the $10.00 mark per barrel evolving as the next key support.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.