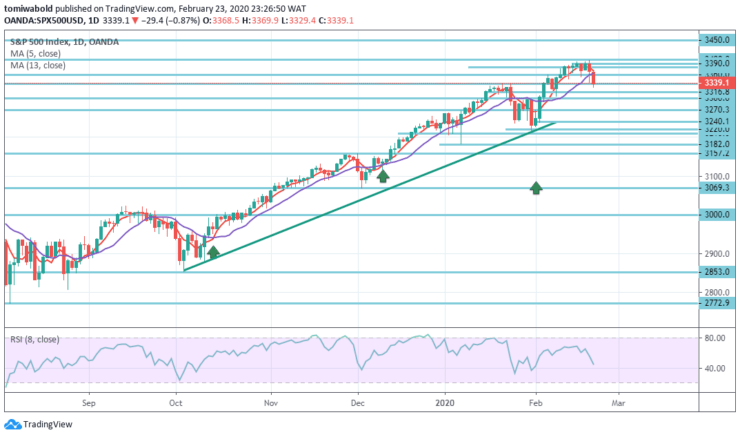

S&P 500 Price Analysis – February 23

The S & P 500 initially tried to advance over the previous week, but then returned gains by touching the 3340 handles. The United States will continue to be considered a bit of a security trade, and the S & P 500 is one of the most common ways to play this trade.

Key Levels

Resistance Levels: 3450, 3400, 3360

Support Levels: 3316.8, 3300, 3270.3

S&P 500 Long term Trend: Bullish

In the long run, the trend remains untouched, and buyers may require to restore the levels of 3400 to potentially expand the bullish advance to the levels of 3450 and 3500.

On the other hand, a break beneath the 3338.5 support level may lead to a deeper pullback to 3300 and 3270 levels.

S&P 500 Short term Trend: Bullish

An intraday bias indicates that a likely scenario for bears is short positions beneath the level of 3338.5 with targets towards the levels of 3270.00 and 3241.1 in the continuation.

While for the bullish scenario, after the level of 3360.00, the bulls can try to continue to advance with the levels of 3400.00 and 3450.00 as targets.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.