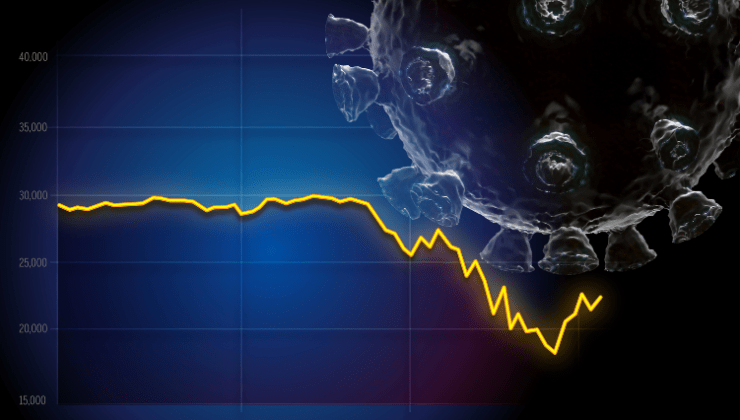

Coronavirus vaccine readiness news was the biggest market driver last week, reinforcing short-term risk sentiment. Subsequent price movements of the main world indices looked clearly corrective, creating the basis for further growth.

The stock market has finally received the news it has been waiting for since the summer. Pfizer’s highly positive COVID-19 vaccine kicked off an already strong stock market ahead of the opening. In the prior week by opening, S&P futures rose from 60 points to 120 points.

The Swiss franc and yen finished the day with the worst performance, followed by the Canadian dollar, which weakened on lower oil prices. The New Zealand dollar, the Australian dollar, and pound sterling were the strongest. The dollar and the euro ended in different directions.

Bullish performance in market technical research speaks in favor of higher prices in 2021, but a strong bullish sentiment and growing overbought conditions are not fueling price chases in the coming weeks.

While the yen crosses finally followed the stocks and rallied, the development was rather disappointing for the Yen bears. In particular, it looks like the Yen’s decline will not rise despite the persistent Nikkei rally. There is a chance to further decouple the Yen from stocks. One explanation is that the fiscal stimulus was key “during” the pandemic. But with the advent of vaccines, the torch could be returned to monetary policy to accelerate the coming recovery.

Data released this week will show the economy entered the fall on a strong basis. Reports on Monday and Tuesday are expected to confirm that the exceptionally fast and robust recovery in Canadian housing markets continues. Earlier reports noted that activity remained at record levels despite signs of weakening activity in some downtown condominium markets.

The data on housing commissioning on Tuesday may show very high rates on an annualized basis of 240 thousand in October, given the increase in the number of building permits in the previous month (271 thousand).

And while vaccine news suggests there is light at the end of the tunnel, renewed COVID cases and the possibility of tighter restrictions remain the biggest threat to economic recovery in the near term. The economic growth may virtually stall in Q4 this year, with growth in sectors less likely to be impacted by containment measures, such as retail and manufacturing, to be offset by a downturn in some of the already hard-hit service sectors. such as restaurants and hotels.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.