S&P 500 Price Analysis – January 31

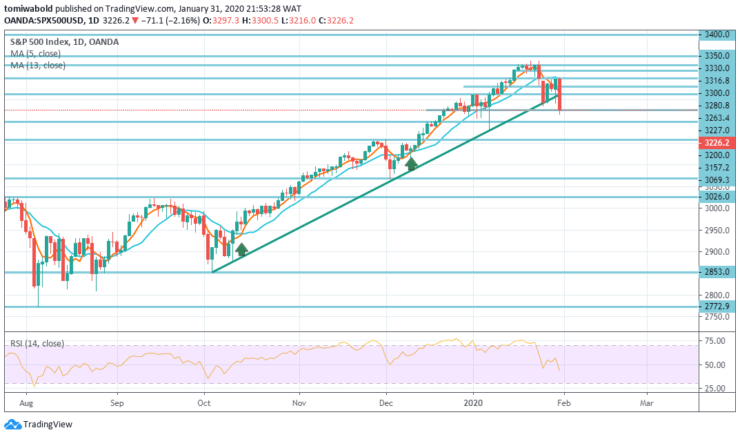

The number of S&P 500 stocks that traded above their 5 and 13 moving average on Friday fell to the lowest level since October. Markets collapse on Friday as the coronavirus spreads, for the moment, easing bullish sentiment and fuels uncertainty in a period of high valuations.

Key Levels

Resistance Levels: 3400, 3350, 3300

Support Levels: 3200, 3157, 3026

S&P 500 Long term Trend: Ranging

The SP 500 initially gapped lower to kick off the week, rallied to fill the gap, and then broke back down. Because of this, it looks as if the S&P 500 is finally ready to get a bit of a pullback.

A significant amount of support near the 3200 levels exists, where buyers can lean on the anticipated bulls. If that level breaks down, then it’s likely that we go down to the 3100 levels after that.

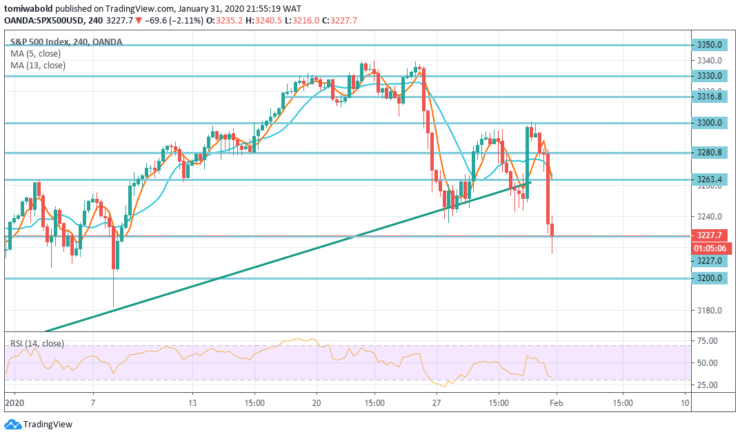

S&P 500 Short term Trend: Ranging

On the 4-hour time frame, bull positions exist past the level of 3263.00 with targets on the level at 3300.00 & 3316.00 in extension.

Meanwhile, trending beneath the level of 3263.00, more short positions exist for further downside with the level of 3227.00 & 3200.00 as targets.

Instrument: S&P 500

Order: Sell

Entry price: 3263

Stop: 3300

Target: 3200

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.