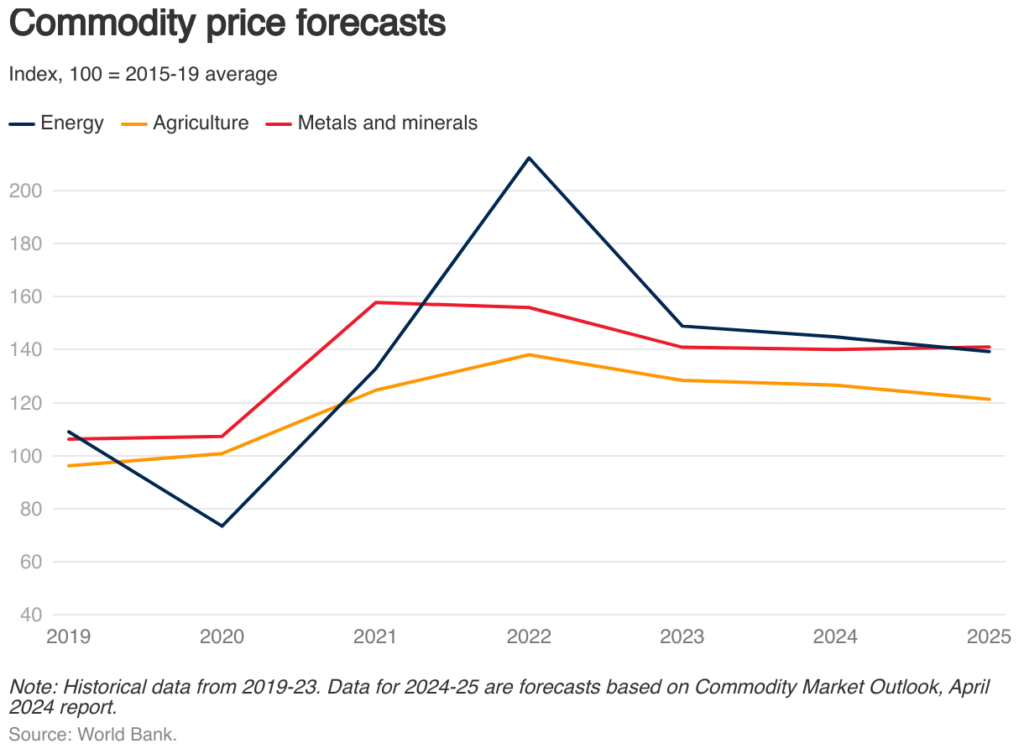

Commodity prices are anticipated to experience a modest decline in 2024 and 2025, yet they should stay above pre-pandemic levels. Energy prices are projected to decrease by 3% in 2024 due to lower natural gas and coal prices outweighing higher oil prices, with an additional 4% drop expected in 2025.

Agricultural prices are also set to decrease in 2024 and 2025 due to the supply conditions. Metal prices are predicted to remain stable in 2024 before slightly increasing in 2025.

While these price forecasts do not factor in further conflict escalation, there is an upward risk stemming from potential conflict in the Middle East and its possible effects on energy supplies.

In the first quarter of 2024, commodity prices dropped by 3%, primarily due to a decrease in energy prices while agricultural and metal prices remained relatively stable.

Energy prices fell by 3% compared to the previous quarter, mainly because of lower natural gas and coal prices.

Oil prices, however, were notably volatile due to rising tensions in the Middle East and an unexpectedly tight supply outlook.

Meanwhile, metal prices stayed largely consistent, with declines in iron ore prices offsetting gains in other metals.

Commodity price forecasts face a variety of risks, with the primary concern being potential further escalation of geopolitical conflicts. Rising tensions have already put upward pressure on certain key commodity prices. Gold prices, an indicator of demand for safe-haven assets, reached record highs in April.

The main upside risk is the potential widening of conflicts in the Middle East, which could disrupt energy supplies essential for the production and transport of other commodities.

Other upside risks include reduced U.S. energy supply and disruptions from adverse weather and climate conditions, particularly affecting agricultural commodities.

Conversely, downside risks to the forecast stem from the possibility of increased OPEC+ oil production and weaker-than-expected global economic growth, both of which could lead to lower commodity prices.

To have the best trading experience with us, open an account at Longhorn.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.