As the highly anticipated Bitcoin halving draws near, the latest monthly outlook report by Coinbase delves into the potential catalysts that could shape the cryptocurrency market in the coming months. While the halving has historically been credited with initiating bullish trends, the immediate effects on Bitcoin’s price remain uncertain.

According to the report, Coinbase analysts suggest that the increased access to Bitcoin via spot ETFs, coupled with new supply-side dynamics, could be constructive for the asset class in the long term. However, they caution that realizing these benefits may take months, based on patterns observed in previous Bitcoin halving cycles.

The report highlights the growth of distinct crypto verticals, fueled by improvements in blockchain infrastructure and tooling. This diversity could lead to more pronounced rotations of capital between sectors, with AI projects, memecoins, and restaking garnering attention in recent months.

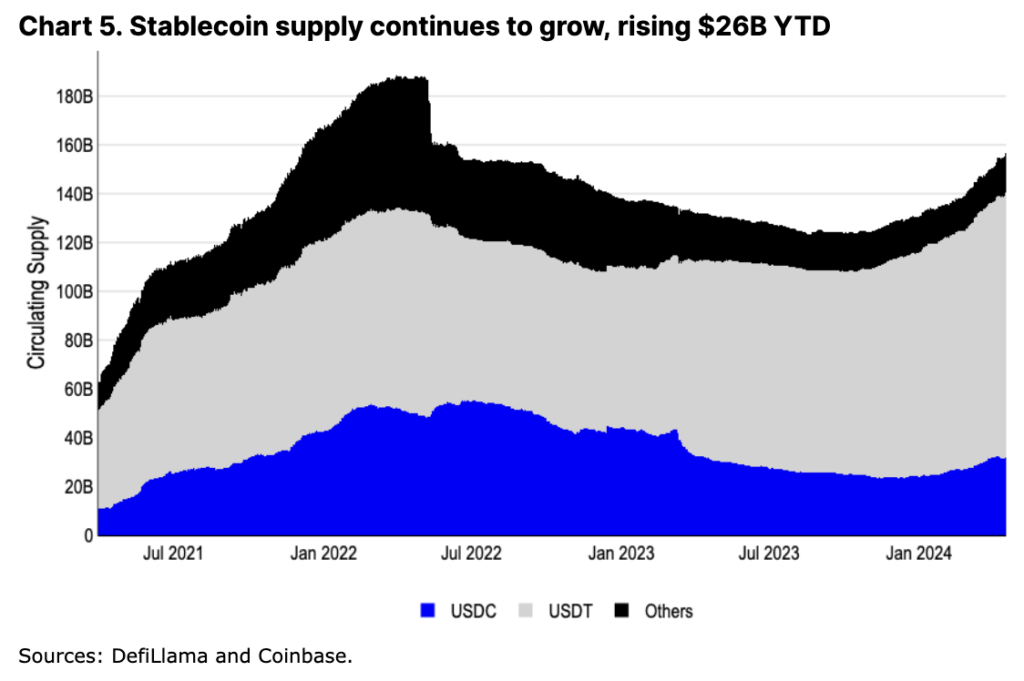

Liquidity in the altcoin market is primarily driven by the growth of stablecoins, which are involved in a majority of decentralized exchange trading activity. The combined issuance of USDC and USDT has already breached all-time highs, signaling continued strength in onchain activity.

Coinbase Sees Macro Factors Playing a Major Role in Crypto Market Sentiment

While crypto-specific catalysts remain relevant, Coinbase analysts believe that the macro environment will play a more significant role in the near term. Geopolitical uncertainties, rising national debt, and concerns over inflation are expected to shape the market backdrop for this cycle.

Bitcoin’s increasing correlation to gold and its resilience during recent economic uncertainties suggest its growing reputation as a store of value and a geopolitical hedge. However, the report cautions that compressed price appreciation could distort this signal, introducing an element of speculation.

Crypto Market Liquidations Surge on Halving Eve

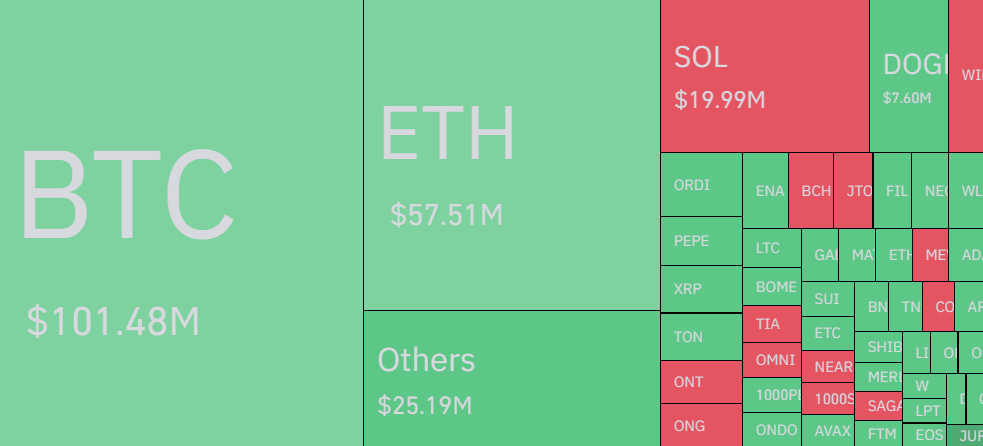

In related news, the cryptocurrency market has experienced over $274.5 million in liquidations in the past 24 hours, with Bitcoin liquidations surging to over $101 million as the asset briefly dipped below $60,000. The liquidations were nearly evenly split between long and short positions.

As the Bitcoin halving approaches, the cryptocurrency market faces a complex interplay of crypto-specific catalysts and broader macroeconomic factors. While the long-term effects of the halving remain to be seen, Coinbase’s report provides valuable insights into the potential drivers of market activity in the months ahead.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.