Coinbase reported mixed second-quarter results that failed to meet Wall Street expectations, with the crypto exchange generating $1.5 billion in revenue against analyst estimates of $1.6 billion.

While the company’s stock fell 6% in after-hours trading, Coinbase demonstrated resilience through diversified revenue streams and strategic positioning for future growth.

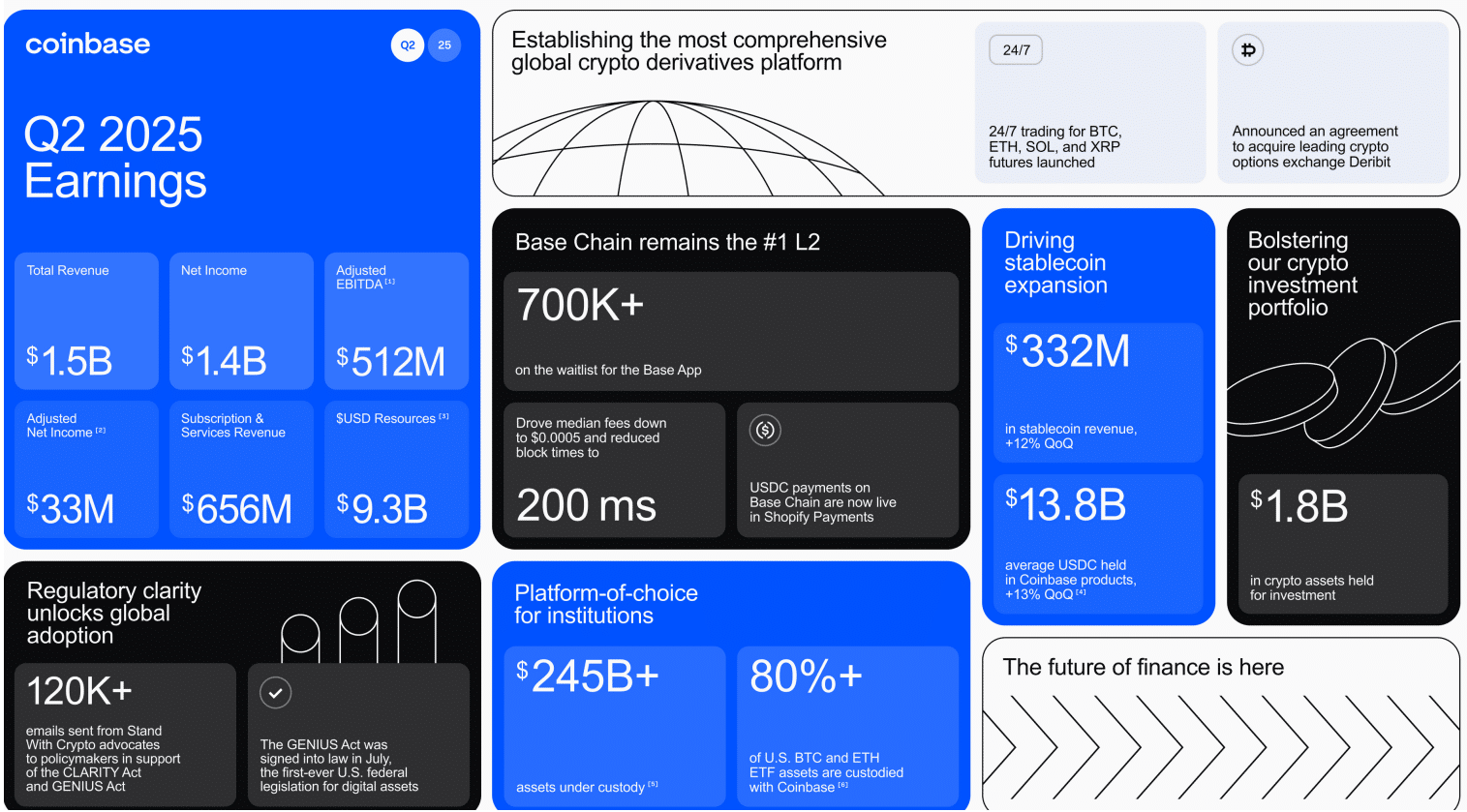

The exchange’s net income surged dramatically to $1.43 billion, or $5.14 per share, compared to just $36 million in the same period last year.

This exceptional profit growth stemmed largely from a $1.5 billion gain related to Circle investment holdings and $362 million from crypto portfolio appreciation. On an adjusted basis, earnings reached $1.96 per share, surpassing the $1.26 consensus estimate.

Trading Volume Challenges Impact Core Business

Transaction revenue disappointed at $764 million, missing StreetAccount projections of $787 million. Retail trading volumes, typically Coinbase’s most profitable segment, reached $43 billion but fell short of the expected $48.05 billion.

This decline reflects broader market conditions as speculative retail activity cooled following first-quarter enthusiasm around pro-crypto regulatory policies.

The company’s subscription and services division, encompassing stablecoins, staking, and custody operations, generated $655.8 million—below analyst expectations of $705.9 million.

However, stablecoin revenue performed solidly at $332.5 million, nearly matching estimates and representing a 38% year-over-year increase.

Coinbase Expands Beyond Traditional Crypto Trading

Looking ahead, Coinbase announced plans to broaden its platform beyond cryptocurrency trading. The exchange will introduce tokenized real-world assets, derivatives, prediction markets, and early-stage token sales within its main application.

This “everything exchange” strategy aims to capture additional revenue streams while competing against lower-cost platforms like Kraken and Robinhood.

The company also disclosed that its highly publicized data breach cost $307 million during the quarter.

Cybercriminals bribed offshore customer service representatives to access user data and account records, though Coinbase had previously estimated potential losses could reach $400 million.

Despite quarterly challenges, Coinbase shares remain up over 50% year-to-date, significantly outperforming the S&P 500.

The company’s strategic focus on diversification, regulatory compliance, and emerging financial products positions it well for long-term growth in the evolving digital asset ecosystem.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.