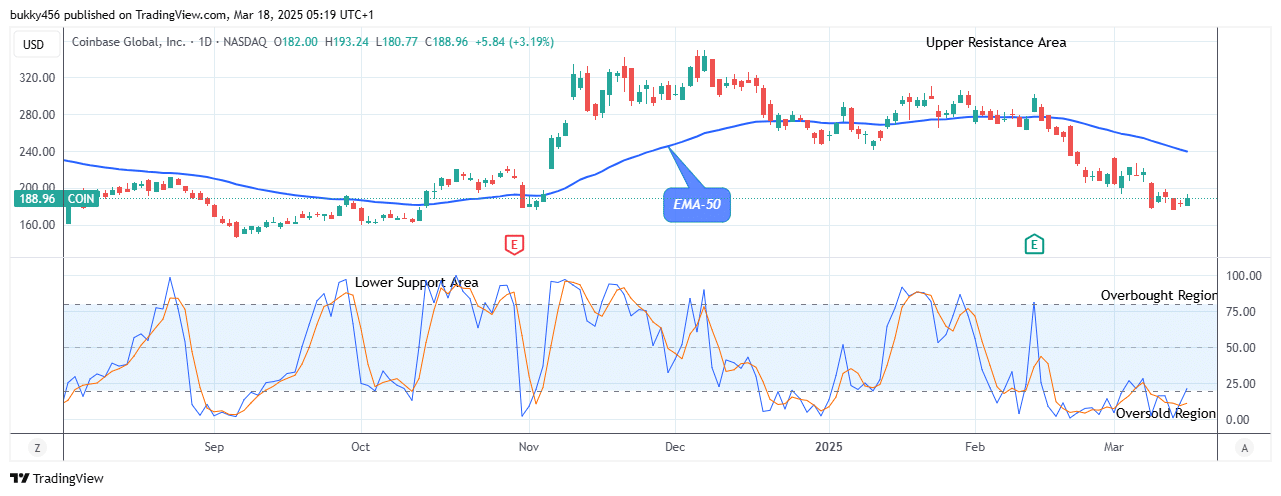

$COIN (NASDAQ: COIN) Forecast: March 19

The Coinbase Global (NASDAQ: COIN) price is sitting at a $193.24 high level, aiming to rally, and a swift increase might follow soon. The stock market is attempting the next big bounce as the selling pressure has been exhausted. Therefore, if the bulls can push higher, a bullish crossover above the $349.75 prior peak mark will encourage the buy investors for a prolonged correction, and this might reach a high at the $355.00 upper supply trend line, triggering a flurry of interest among the shareholders.

Key Levels:

Resistance Levels: $300.00, $301.00, $302.00

Support Levels: $162.00, $161.00, $160.00

COIN Long-term Trend: Bearish (Daily Chart)

The $COIN market price aims to rally and could see a big bounce as it begins the new correction to the resistance levels in the long-term perspective. The stock price is slightly below the moving average line, confirming its bearishness.

Today, a breakout and the beginning of an upward continuation have been observed. The NASDAQ stock price pulled back at the $182.00 value and increased to the $193.24 supply value below the EMA-50 as a correction phase with intraday gains.

Such lower price rejection indicates defending this level and attempting to accelerate the share price. Hence, a strong push above the $349.75 supply level will offer strong resistance to the stock market price.

In addition, the NASDAQ: COIN price may rally as it remains in an uptrend on the daily projector. As a result, the share price could see a significant bounce to a $355.00 upper resistance level in the days ahead in its long-term perspective.

COIN Medium-term Trend: Bearish (4H Chart)

On the medium-term chart, the NASDAQ stock market price at the $193.20 high mark is aiming to rally. The share price rebounded after its downside moved to the resistance level.

The sustained bearish pressure to a $179.18 support level in the last session has made the share price remain below the supply trend levels in its recent price.

The $COIN buyers made a touch at the $193.20 high mark below the EMA-50 as the 4-hourly chart resumes today, proving the impact of bullishness on the share market.

The stock market sitting at $193.20 is currently witnessing a post-rally pullback, aiming to surge higher. If the bullish correction breaks above the EMA-50, buyers could strengthen their grip on the stock price to hit the $349.75 supply level, as it aims to rally higher.

In addition, the momentum indicator shows that the price of $COIN will bounce up. In light of this, the price distribution might rally to the $355.00 supply level and beyond in the coming days in its medium-term-term outlook.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.