$COIN (NASDAQ: COIN) Forecast: January 17

Today, Coinbase Global (NASDAQ: COIN) sellers may lose momentum following the return of buyers into the market. The stock value may increase soon as selling pressure is already exhausted, and the price may be ready for an upward movement. If buy investors could change their orientation, prove stronger, and the price shows sustainability above the $361.41 resistance value, its upsides should extend further to reach the $392.16 upper resistance level, restoring bullish sentiment in the market.

Key Levels:

Resistance Levels: $356.00, $357.00, $358.00

Support Levels: $231.00, $230.00, $229.00

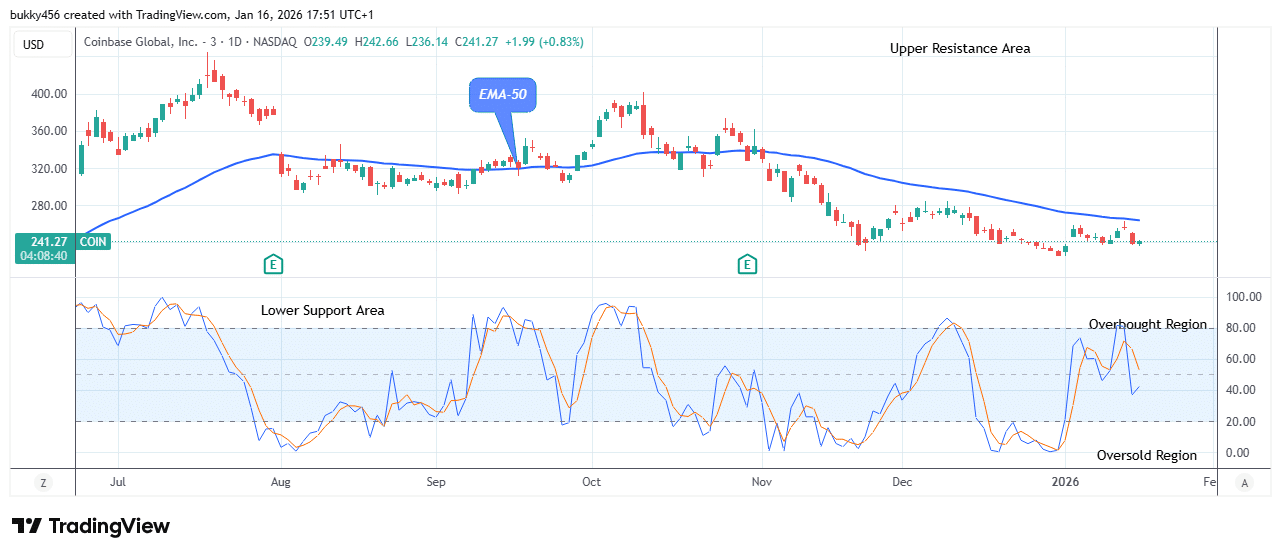

COIN Long-term Trend: Bearish (Daily Chart)

NASDAQ: The COIN market is undergoing a price reversal action and has a bearish posture in the long term perspective.

The sustained bearish pressure at a $237.47 low value in the last session has made the stock market remain below the supply levels lately.

Hence, the share market is correcting and will resume its full bull moon soon.

The $COIN price shows a power struggle as it rebounded to a high of $242.66 below the resistance, resisting the start of another bear cycle.

Thus, if the bulls change their orientation and the buying pressure persists, the share price may surge and breakout of the bearish pattern to retest the previous peak barrier of $320.76 supply, resulting in an intraday gain for buyers.

In a like manner, the momentum indicator which is pointing up also indicates that the NASDAQ stock price may continue in that direction and a $392.16 upper high level might be the target in the days ahead in its higher time forecast.

COIN Medium-term Trend: Bearish (4H Chart)

The $COIN also trades in a bearish trend in the medium-term outlook, due to the high impact of short-term traders on the price flow.

A rise or a price retracement to a $242.66 high level shortly after the 4-hourly chat opens today confirms the return of the long traders into the stock market, leaning towards a bullish trend.

The NASDAQ stock price is edging closer to the resistance; therefore, sustainability above the $370.26 prior supply level would render any intended bearish move invalid.

Furthermore, the $COIN price has fallen below the 20% zone of the daily stochastic, suggesting that the selling pressure is unlikely. Hence, the emergence of buyers in the oversold region of the market is imminent.

In light of this, the NASDAQ stock price may surge to reach an upper resistance level of $388.27 in the days ahead in its medium-term forecast.

On Coinbase Exchange and Coinbase Advanced, our LIGHTER-USD trading pair is in full trading mode. There are now stop, market, and limit orders available.

Our LIGHTER-USD trading pair is in full-trading mode on Coinbase Exchange and Coinbase Advanced. Limit, market and stop orders are all now available.

— Coinbase Markets 🛡️ (@CoinbaseMarkets) January 15, 2026

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.