COIN (NASDQ: COIN) Forecast: October 4

Today, the $COIN sellers are holding back as the stock market suggests a bullish outlook, indicating strong confidence from the major market players. The stock price is showing positive signs above the $368.00 supply value and could see significant gains if investors and analysts continue to show keen interest in the share. However, if buyers put additional pressure on the market’s price movement, the share price will move higher above the current resistance at $372.50 and surge to retest the $405.88 barrier level, extending to the $415.96 upper resistance level, suggesting a good entry point for shareholders.

Key Levels:

Resistance Levels: $374.00, $375.00, $376.00

Support Levels: $148.00, $147.00, $146.00

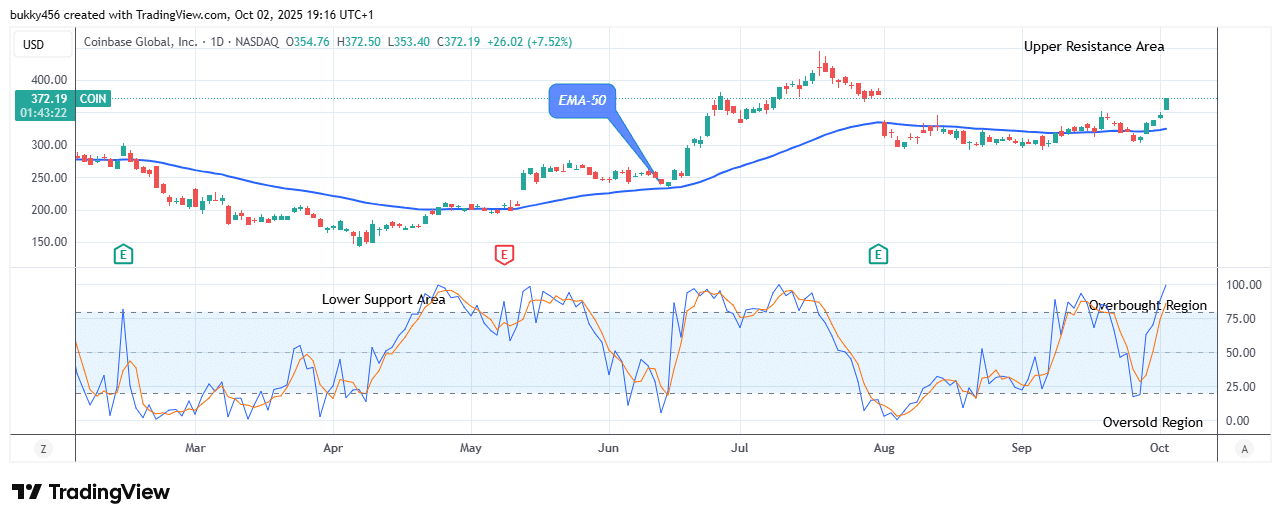

COIN Long-term Trend: Bullish (Daily Chart)

Amid the current fluctuations in the stock market, NASDAQ: COIN sellers have decided to hold back, providing buyers with an opportunity to enter the market and in its long-term outlook. The bulls are trying not to fall this time around.

The currency pair was able to maintain its upward trend at its most recent high due to the bulls’ previous rise to a barrier level of $349.87.

As the daily chart opens today, a surge in the $COIN price to a high level of $372.50 over the EMA-50 and nearing the overhead resistance at the time of writing suggests that traders are actively buying at this level.

Meanwhile, if there are fresh spikes in buyer interest, the share value might surpass the $405.88 resistance value, signaling resurgence in bullish activity and potentially leading the price action towards the overhead region.

Additionally, the NASDAQ stock market is pointing up on the daily stochastic, indicating further growth.

Therefore, if the overall market bullish trend persists, $410.00 might be attained and extend further to a $415.00 upper resistance level, signaling the potential for significant gains as the bull trend continues.

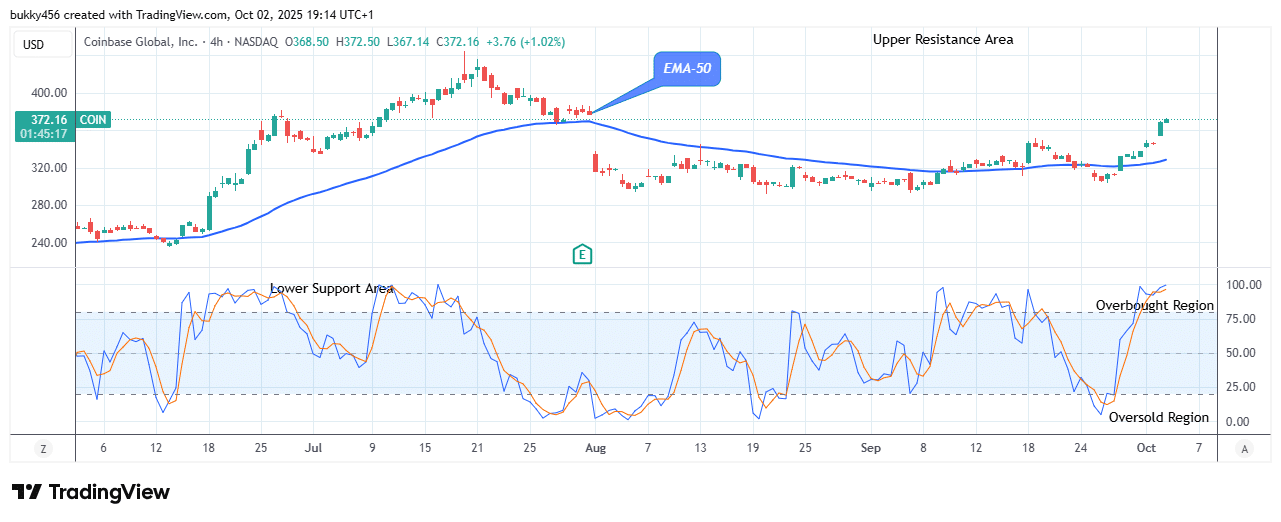

COIN Medium-term Trend: Bullish (4H Chart)

The $COIN also trades in a bullish trend market in the medium-term outlook due to the highly significant influence of the bulls.

As the 4-hourly chart opens today, the NASDAQ: COIN price rose to a high value of $372.50 above the EMA-50, indicating that bearish momentum is waning.

Therefore, to push the market past the previous high at the $436.30 trend line, buyers must increase the ferocity of their actions.

Furthermore, an increasing trend is shown by the daily stochastic. Hence, the subsequent rally has the potential to surpass the $370.02 value and reach the psychological $415.00 level in the upcoming days if the bulls can drive the stock price above the previous high of $436.30 barrier.

This would provide a stronger indication of a sustainable recovery in its medium-term forecast.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.