$COIN (NASDAQ: COIN) Forecast: February 15

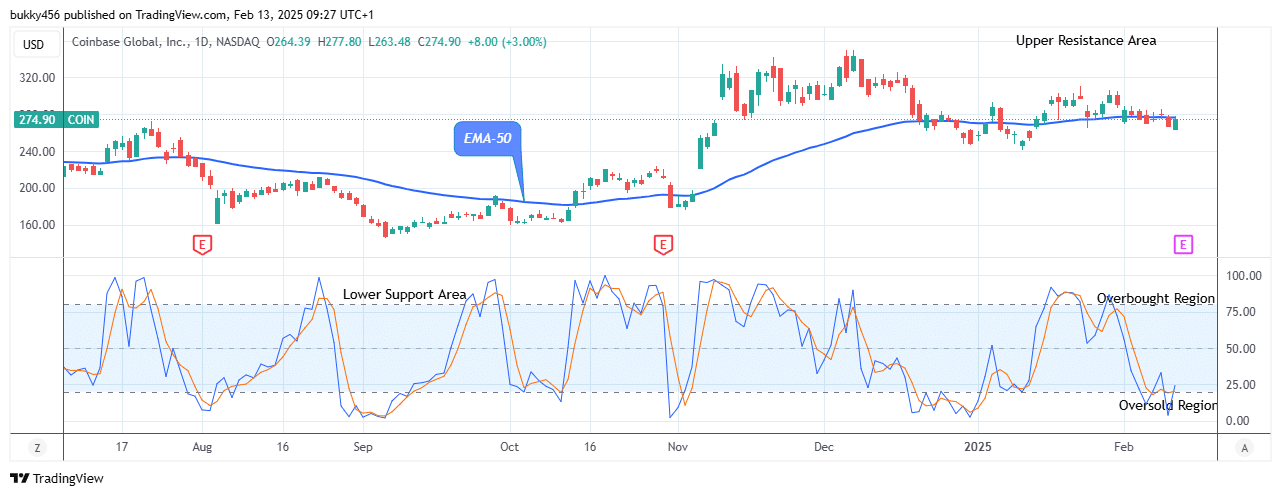

The Coinbase Global (NASDAQ: COIN) market may reclaim another crucial supply level soon as it is about to resume its bullish race, and a swift increase might follow. Having completed the downward correction, the stock price might resume the upside trend if the current support at $265.83 holds and the price on the daily chart closes above the $349.75 prior supply barrier. Then, there is a high probability of the share price reaching its anticipated target of $360.00 upper resistance value, resulting in an intraday gain for shareholders.

Key Levels:

Resistance Levels: $278.00, $279.00, $280.00

Support Levels: $163.00, $162.00, $161.00

COIN Long-term Trend: Bearish (Daily Chart)

In the long term, the $COIN is displaying a negative trend. However, the share market is set for an upswing as a new correction has just begun below the resistance level.

The stock price has been below the supply trend levels since its most recent low due to the persistent bearish pressure over the last few days.

Today, NASDAQ: COIN price rebounded from the $265.83 support value and pushed higher to the $277.80 high mark below the EMA-50 as the daily chart opens, indicating a genuine reversal which may attempt the $349.75 crucial supply breakout.

In light of this, a bullish impact by the buy investors toward the higher side is likely, as indicated by the daily stochastic pointing in an upward direction.

The bulls could aim at the psychological level of $360.00 resistance value in the day ahead as the NASDAQ stock price reclaims new supply levels in its long-term perspective.

COIN Medium-term Trend: Bearish (4H Chart)

The NASDAQ: COIN market is bearish. Meanwhile, the share value has just reclaimed a crucial supply below the moving average, suggesting a bearish trend.

The interference of short-term traders to the $265.87 low level in the previous action has contributed to its bearish momentum in its recent correction.

The market price of $COIN at a $277.80 high level below the moving averages as the 4-hourly session opens today suggests the return of the bulls to the market and improved bullish market sentiment, indicating that buyers are defending this level and attempting to push the share price higher.

Hence, a strong push above the $349.75 prior barrier level will offer strong resistance to the stock price, providing the foundation for an upward trajectory.

In addition, the momentum indicator shows that the NASDAQ stock market will bounce up. So, we expect the price distribution to reach the $360.00 supply level and beyond in the coming days as the stock buyers reclaim crucial supply in its medium-term outlook.

Make money without lifting your fingers: Start trading smarter today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.