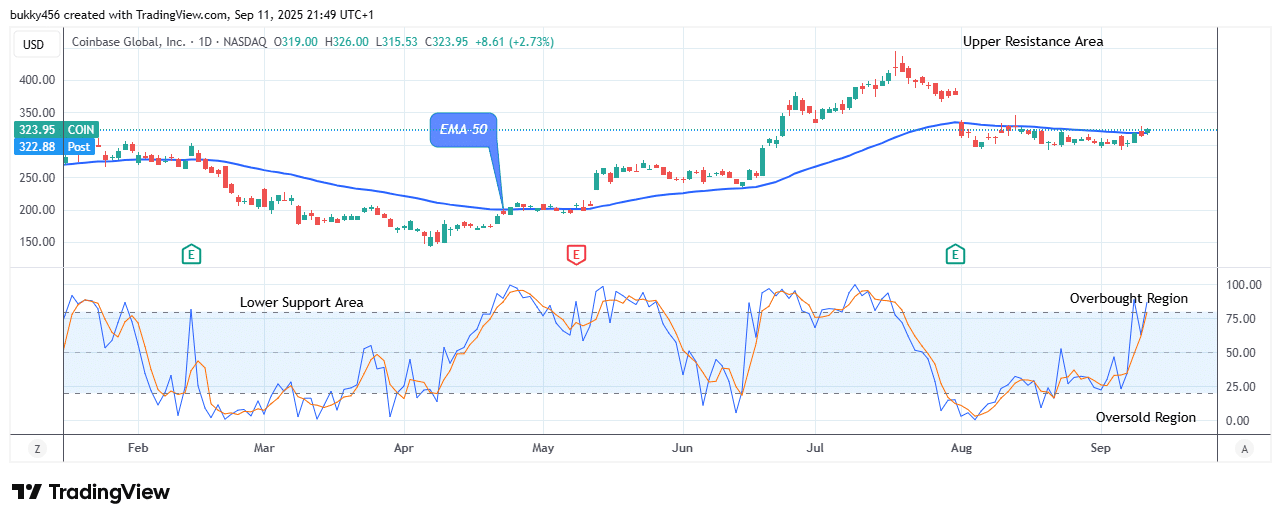

$COIN (NASDAQ: COIN) Forecast: September 13

The Coinbase Global (NASDAQ: COIN) market price is flashing a bullish signal as it rises and retarding negativities; this could be the start of something bigger. The share price signal has surpassed the $319.39 supply trend line, driven by bullish momentum to kick start a parabolic rally that could push the price to a higher level. If the bulls can strengthen their possible purchases and the share price holds above the $405.88 high, the stock will likely rise even further. Hence, the potential rally could surge above the mentioned high to hit the $415.96 upper resistance value and beyond, confirming a bullish breakout and bull flag pattern.

Key Levels:

Resistance Levels: $398.00, $399.00, $400.00

Support Levels: $172.00, $171.00, $170.00

COIN Long-term Trend: Bullish (Daily Chart)

The NASDAQ: COIN price is rising and staying in an upward trend, holding off negativity for now. If the market remains positive, buyers may continue pushing the price higher.

As the daily chart opens today, the $COIN price breaks through at a $326.00 high mark above the EMA-50, indicating that the price is increasing and delaying the negative effects, which leads to intraday gains.

According to the forecast, a bullish breakthrough confirmation will indicate better market sentiment if the bulls can quicken their buying and close above the $405.88 high.

Notably, the NASDAQ stock market is up on the daily signal, showcasing a continuous uptrend.

As a result, the bulls may drive the stock price to a reliable $415.96 upper high level, fueling renewed market enthusiasm.

COIN Medium-term Trend: Bullish (4H Chart)

The $COIN price is above the moving averages on the medium-term time frame and has broken the previous high of $319.40, confirming a bullish trend.

When writing today, the NASDAQ: COIN price increases dramatically above the resistance trend lines at the $324.00 level as the 4-hourly chart begins, due to a bullish impact on the market price.

As it moves further north, the rebound rally is moving in the direction of the upper channel, suggesting a potential bullish breakout and continuation to retest the previous barrier of $436.30.

Additionally, the NASDAQ stock price may continue to make a buy trade set-up as suggested by the daily stochastic pointing in an upward direction.

In light of this, the share price may reach the $415.96 upper resistance trend mark soon in its long-term outlook.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.