$COIN (NASDAQ: COIN) Forecast: April 16

The Coinbase Global (NASDAQ: COIN) market price may proceed higher. The stock is about to make the noise again in the share market charts, with a 0.72% rise after long hours of low dips. The stock market just sent a signal that the selling pressure will subside soon. Amid the selling pressure, the share price gave a bullish breakout from the $178.62 4-hourly candle, indicating more jumps ahead. Therefore, if buyers can put more effort into their tension in the market, a shift in the trend to the $349.75 barrier level could be achieved, signaling the potential for significant gains.

Key Levels:

Resistance Levels: $278.00, $279.00, $280.00

Support Levels: $163.00, $162.00, $161.00

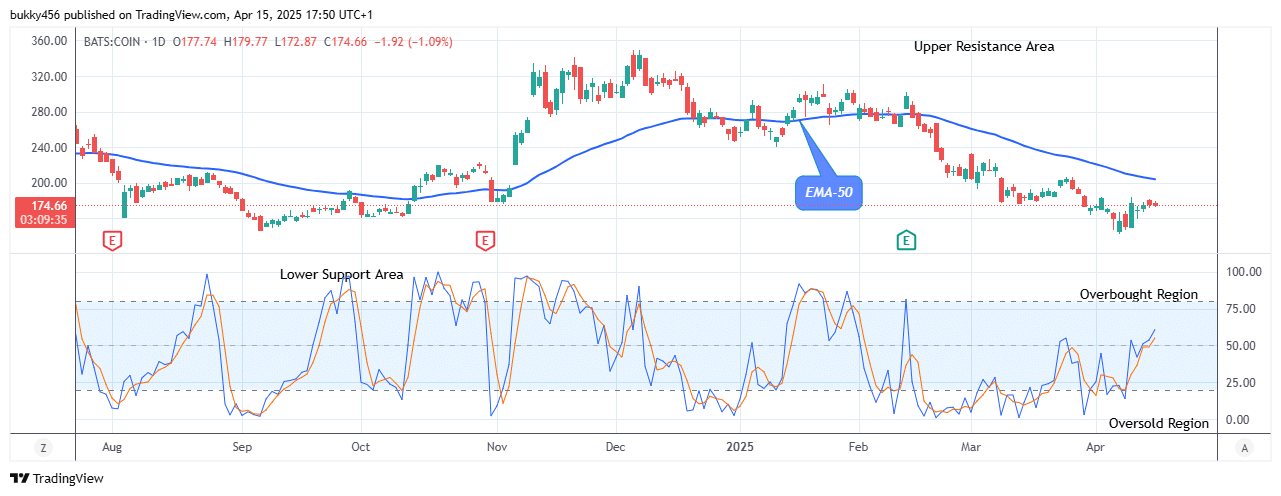

COIN Long-term Trend: Bearish (Daily Chart)

As the daily chart begins today, bearish actions dropped the NASDAQ stock price lower, reaching the $172.87 support level below the EMA-50. Nevertheless, traders might seize this opportunity to invest in the share at a lower rate for future gains.

Thus, if buyers eventually wrestle trend control from sellers and rebound from $172.87 support, a positive breakout above the current support is needed to confirm the potential Bull rally.

Hence, the share price may proceed higher to break up the $320.90 high value soon if the current support at $172.87 remains unmoved and the bulls should speed up their activities.

In addition, the price projector points upwards, indicating an uphill momentum.

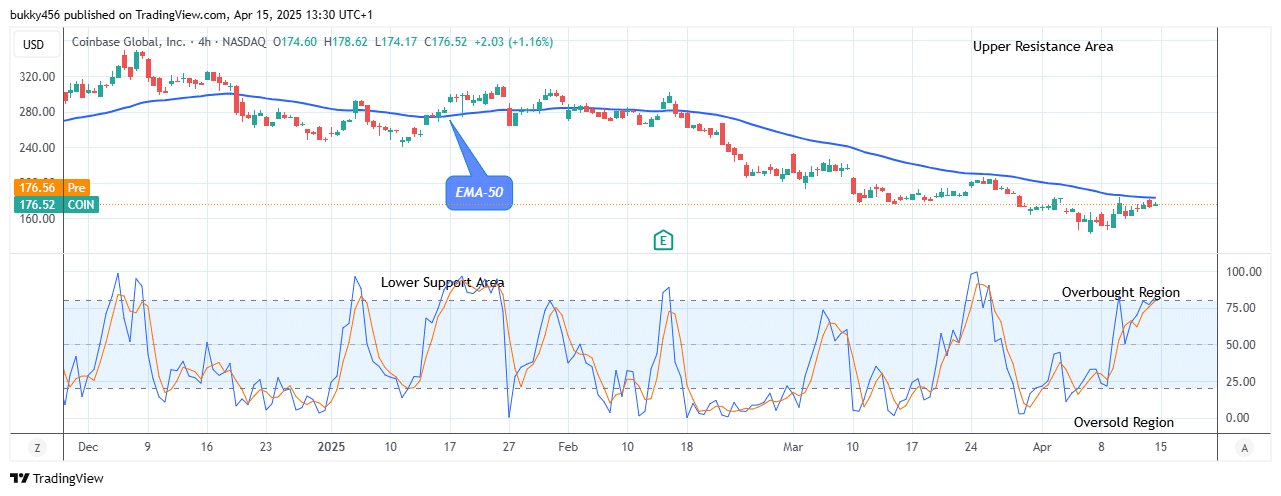

COIN Medium-term Trend: Bearish (4H Chart)

The NASDAQ: COIN market is bearish. Meanwhile, the share value may proceed higher as the share market reclaimed a crucial supply below the moving average, suggesting a bearish trend.

The interference of short-term traders at the $172.01 low level in the last session has made the share price remain beneath the supply in its recent correction.

Price movement to a $178.62 high level below the EMA-50 as the 4-hourly chart commences today is a pullback that will enable bulls’ recovery to foster a higher price resulting in an intraday gain for shareholders.

Such lower price rejection indicates that buyers are defending this level and attempting to push the stock price higher.

It’s worth noting that the upward trajectory could face another barrier near the next resistance level at $310.64. A breakout above this level could propel the $COIN price to proceed higher by 20% towards the upper resistance level.

Notably, more jumps are ahead as the NASDAQ stock price suggests an uptrend on the daily signal pointing upwards, indicating that the selling pressure is not likely to continue.

In light of this, the bulls may proceed higher to hit the $349.75 high value in the days ahead in its medium-term outlook.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.