$COIN (NASDAQ: COIN) Forecast: February 5

The Coinbase Global (NASDAQ: COIN) market price is increasing and may continue if the stock buyers exert more force into the price action in the market. The $349.75 peak barrier level might be retested and exposed to a $360.00 upper resistance level, registering a buoyant upward trajectory and a clear buy signal for stakeholders.

Key Levels:

Resistance Levels: $288.00, $289.00, $290.00

Support Levels: $164.00, $163.00, $162.00

COIN Long-term Trend: Bullish (Daily Chart)

The NASDAQ: COIN price is currently increasing and will continue trading in a bullish trend market in the long term. If market conditions remain favorable, the bulls might continue with the buying pressure.

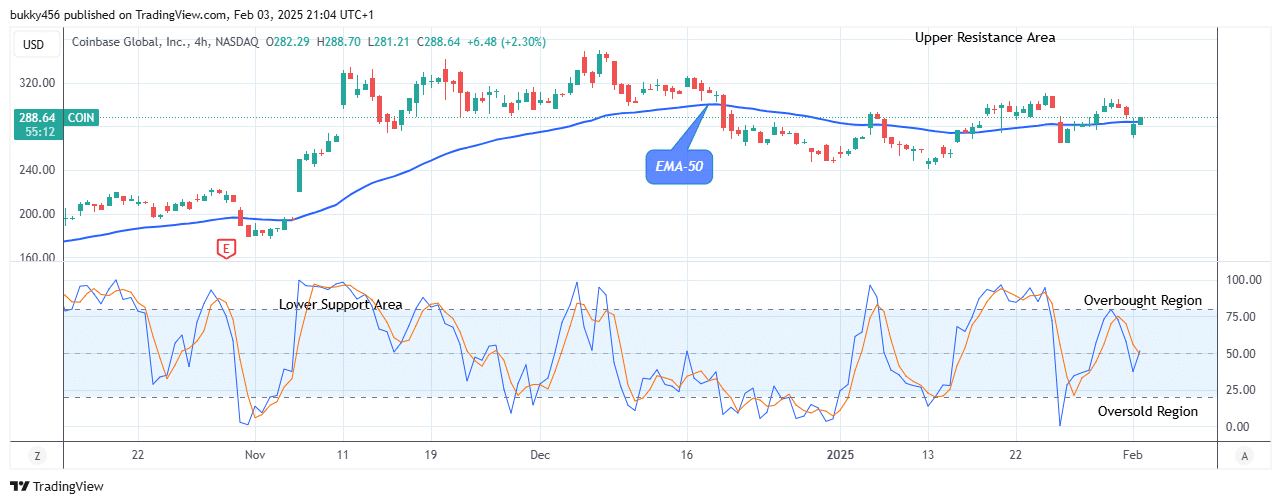

After completing the $287.22 lows of yesterday, the $COIN price pulled back to a $288.40 high level above the EMA-50 as the daily chart opens today, suggesting that stock traders are actively buying and the share price is increasing at this price level.

A further increase in the buying pressure will lead the NASDAQ stock price to the $349.75 previous high mark, suppressing any further bearish thesis.

Additionally, the share market is approaching the oversold region. If the bulls can prove strong and increase their buying pressure, the share market will continue to move higher and quicken the emergence of more buyers to move the stock price up to a significant level on the upside and this might hit the $370.00 supply trend mark as the $COIN market is increasing in its higher time frame.

COIN Medium-term Trend: Bullish (4H Chart)

The NASDAQ: COIN market price is also increasing and will continue to move higher in the medium-term outlook, due to the high impact from the long-term traders in the price flow.

The buy traders’ impulse move pushed the price of $COIN up to a $288.70 high level above the moving averages shortly after the 4-hour session opened today, allowing buyers to influence and increase the market price trend.

Notably, the NASDAQ stock market is pointing up, indicating an uptrend on the daily signal.

As a result, the share price is increasing and this may continue to surpass the $349.75 previous high level and expose the trend to hit the $370.00 upper resistance value in the days ahead days in its medium-term perspective.

$COIN claim is now live! Stake your claimed tokens below to earn rewards!

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.