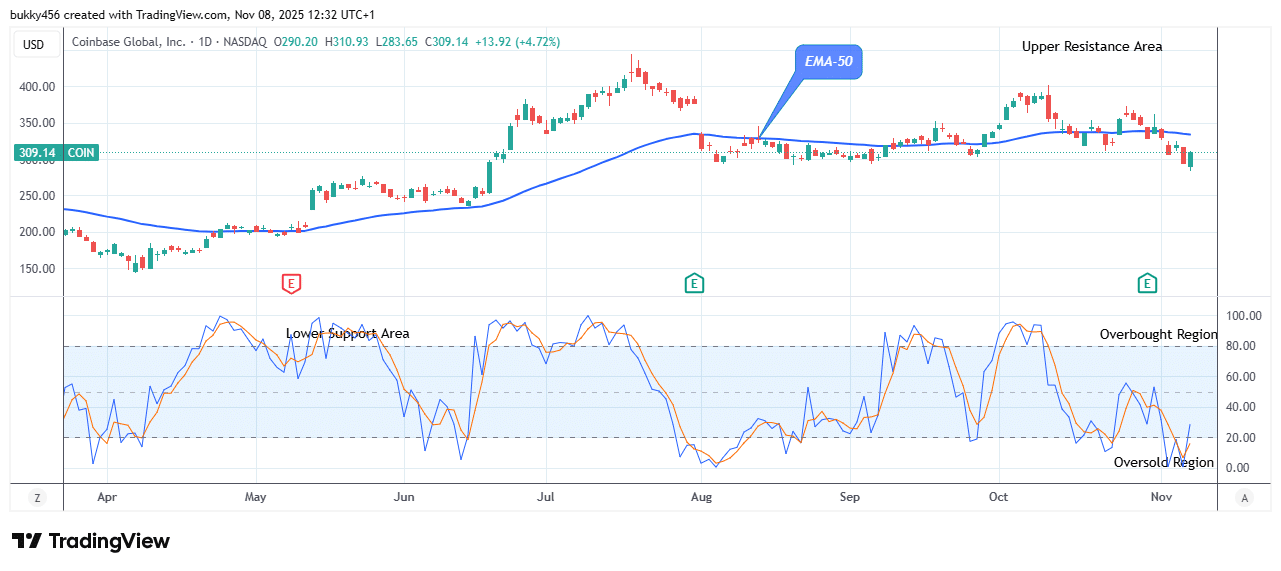

$COIN (NASDAQ: COIN) Forecast: November 10

Today, the Coinbase Global (NASDAQ: COIN) market is gathering momentum as it approaches the resistance region, while investors and analysts resume their keen interest in the stock market. Given the current positive correction, the market price may continue to rise. In the meantime, the share price is opposing the beginning of another bear cycle by engaging in a power battle near the crucial level at $310.93, suggesting buyers are making a recovery attempt. Thus, if the price can sustain above the prior resistance barrier of $398.50, the potential rally could surge higher to hit $405.00 and beyond, indicating high conviction from buyers.

Key Levels:

Resistance Levels: $398.00, $399.00, $400.00

Support Levels: $198.00, $197.00, $196.00

COIN Long-term Trend: Bearish (Daily Chart)

The NASDAQ: COIN market is gaining momentum, but the long-term trend remains bearish as the stock price stays below the EMA-50.

As the daily session begins, $COIN is bouncing at a resistance level of $310.93 near the moving average. This shows that buyers are attempting a recovery within an overall bearish trend.

However, if the bullish trend continues, the $398.50 resistance level could be reached, signaling the potential for significant gains as the bull trend resumes.

Such a breakthrough would enable stock buyers to regain control and drive the share price in the direction of the overhead trend level.

Similarly, the daily stochastic, pointing upward, suggests that the stock price may continue its northward voyage.

As a result, the NASDA stock value may continue to rise to the upper resistance level of $405.88 and above, indicating strong market activity and trends.

COIN Medium-term Trend: Bearish (4H Chart)

In the medium term, the $COIN market is bearish, anticipating a bullish opportunity in the near future. A negative trend is indicated by the stock price being below the resistance level.

The NASDAQ: COIN market value surges to a $310.90 high level below the EMA-50 as the 4-hourly session opens today, indicating the return of buyers and increased positive market sentiment.

The stock price may therefore rise beyond the $389.56 prior barrier, suggesting strong buyer conviction, if the bulls increase their purchasing momentum.

Furthermore, as indicated by the daily signal signaling an uptrend, a positive close above the prior high barrier will signal an upward momentum and trigger the NASDAQ stock price to an upper resistance level of $405.32, reflecting promising growth.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.