$COIN (NASDAQ: COIN) Forecast: November 17

The Coinbase Global (NASDAQ: COIN) price could see a significant increase as it anticipates a potential retreat to break through the prior resistance level. Therefore, if a renewed surge in buyers’ interest occurs and the stock is exchanged hands with the bears at the current support level of $282.50, the stock price could turn positive and hit the $405.88 peak barrier, extending to the $415.96 upper resistance level, reflecting high demand in the share market.

Key Levels:

Resistance Levels: $365.00, $366.00, $367.00

Support Levels: $193.00, $192.00, $191.00

COIN Long-term Trend: Bearish (Daily Chart)

The $COIN market price is in green below the moving averages, suggesting a bearish trend in its higher time frame.

Meanwhile, the story is about to change as the share price anticipates a potential retreat due to the brief returns of the buy traders.

The NASDAQ: COIN market at the $292.76 high level, below the EMA-50 as the daily session opens today, is due to investors’ high optimism, and a break of the crucial resistance level is imminent.

Thus, a daily candle closing and significant push by long traders above the previous high point of $405.88 could indicate a change in the market.

Such a breakthrough would give buyers a chance to regain control and push the stock price closer to the upper range.

Additionally, the NASDAQ stock price remains in the oversold region, suggesting that selling pressure is unlikely.

As a result, the share price may surge and experience a significant increase to the $415.96 upper resistance level in the long-term perspective.

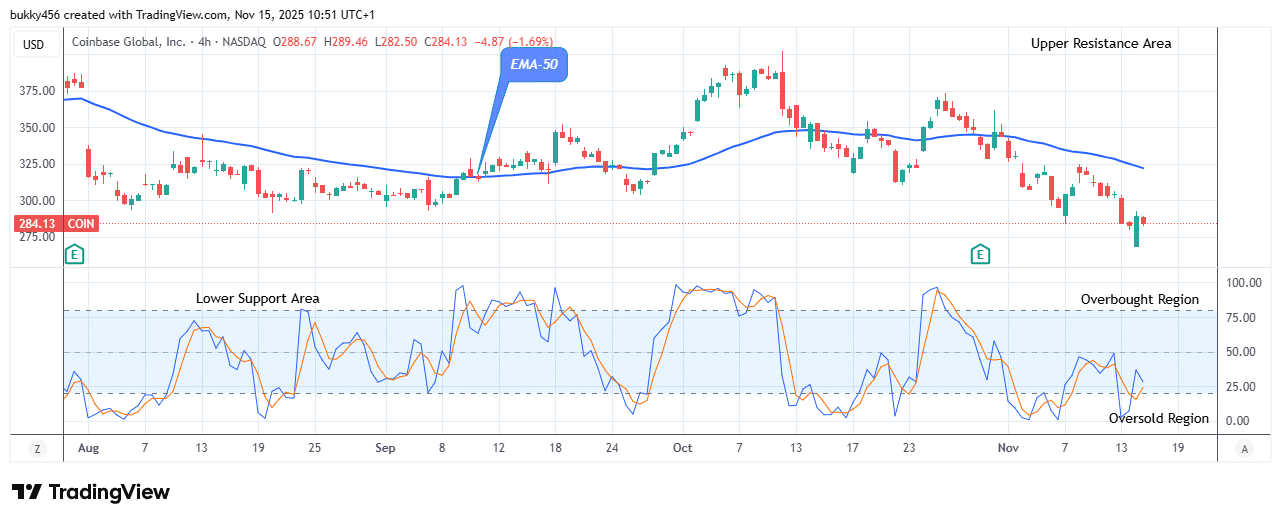

COIN Medium-term Trend: Bearish (4H Chart)

The NASDAQ: COIN market is in a bearish trend in the medium-term outlook due to the impact of short-term traders on the price flow.

Earlier today, the bulls increased the share price to a high of $292.69 ;after which the momentum was lost, the sell traders returned and dropped the price to a low of $282.50 below the EMA-50 as the 4-hourly chart resumed. This is due to low bullish momentum.

Meanwhile, if the bulls can prove harder and increase their inflows, the NASDAQ stock price may rebound from the mentioned support to retest the $388.27 supply level, proving a good entry point for stock buyers.

Notably, the $COIN market is approaching the oversold region, implying that selling pressure is about to subside and the share price could see a significant increase soon.

As a result, the emergence of bulls is imminent, and the stock price may reverse to reach the $389.56 upper resistance level in the days ahead in its medium-term time frame.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.