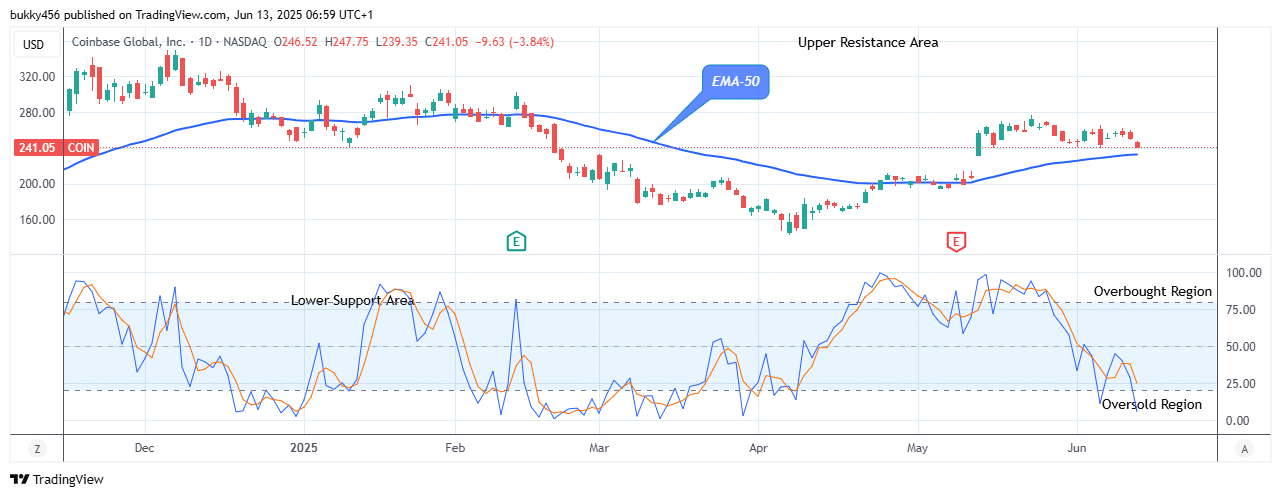

$COIN (NASDAQ: COIN) Forecast: June 14

The Coinbase Global (NASDAQ: COIN) market price could see a new bullish pattern soon, as it is about time to end the selling pressure. The stock market may experience an upside reversal of the current support at $239.35 and turn up to the resistance level at $306.00 as selling pressure is about to subside. This reversal pattern could enable coin buyers to reach the $306.00 neckline barrier and remain stable at the upside. Therefore, should the bulls add more pressure to the buying momentum, the share price may reverse to a bullish pattern, and its upside could extend to a $349.75 upper resistance level, indicating a high potential for shareholders.

Key Levels:

Resistance Levels: $300.00, $301.00, $302.00

Support Levels: $165.00, $164.00, $163.00

COIN Long-term Trend: Bullish (Daily Chart)

Despite the bears’ interference, the $COIN market price remains bullish. However, the stock price could see a new bullish pattern as the selling pressure is about to end. The price is in red above the EMA, indicating an upward momentum and a high impact on buyers.

Nevertheless, it seems the bulls will take over the price of NASDAQ stock and commence the new bullish phase as the selling pressure will soon be exhausted.

As the daily chart begins today, bearish actions sent the stock price lower to a $239.35 support level above the EMA-50, indicating an uptrend.

It is worth noting that it has no serious effect on the market as the share price remains in an uptrend. However, this allows for a more optimistic touch on the market value. Furthermore, investors may seize the opportunity now and buy the share at a lower price, for more gains ahead.

Thus, if buyers eventually wrestle trend control from sellers and rebound from $239.35 support, a positive breakout above the $277.01 supply mark is needed to confirm the new bullish pattern.

In addition, the market price of NASDAQ: STOCK is at the oversold region of the daily stochastic, indicating that the selling momentum will end soon as the bulls prepare for a new bullish pattern and this may surge above the $306.00 level and increase further to reach the $379.75 upper resistance level in its long-term outlook.

COIN Medium-term Trend: Bearish (4H Chart)

On the medium-term chart, $COIN is showing a downward movement and is still on the verge of an upside reversal. This is clear as the stock price continues to make lower highs and lower lows.

The market price of NASDAQ: STOCK drops further to a $239.38 low mark below the moving averages as the 4-hourly session opens today due to low bullish momentum. Meanwhile, traders who buy the stock during a bearish market will also make gains in the future.

Thus, if the bulls change their orientation and accelerate their buying actions, the stock price may give a bullish breakout, reaching a prior high at $277.00 before a range breakdown.

Additionally, the NASDAQ stock price has dropped below the daily stochastic 10% zone, indicating that an upside reversal is imminent. It shows that the share is now trading in the oversold area of the market, suggesting that the selling pressure is likely to run to an end.

Hence, the emergence of buyers in the oversold region of the market is imminent.

In light of this, the stock price may reverse and pump or spike higher to reach the $349.75 upper resistance level in the days ahead in its medium-term forecast.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.