$COIN (NASDAQ: COIN) Forecast: October 22

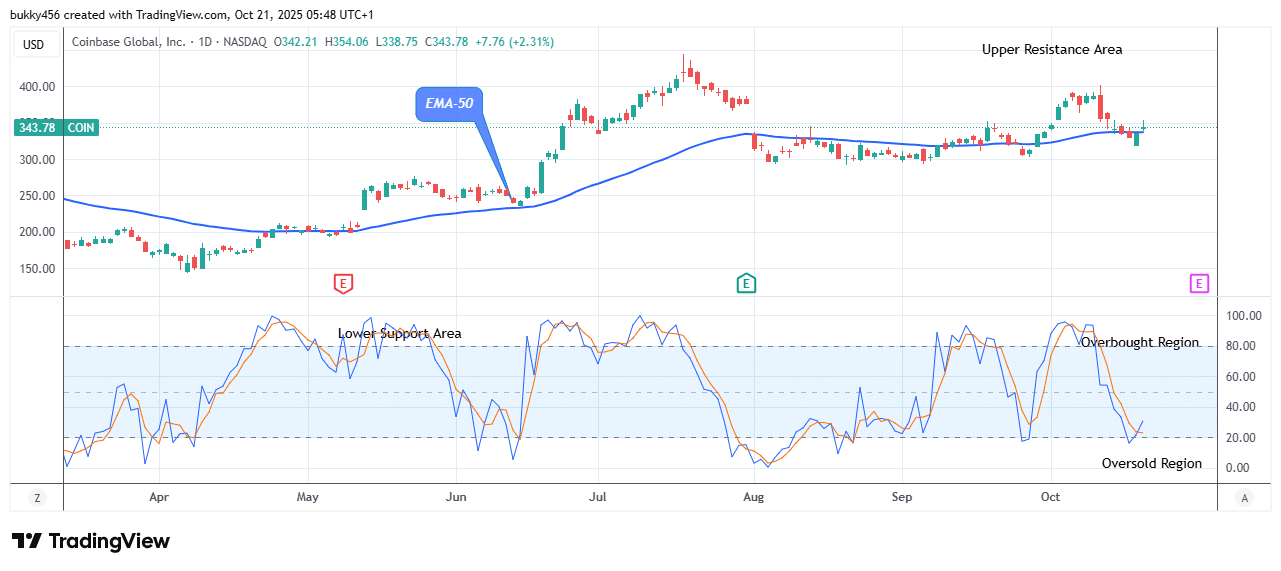

The Coinbase Global (NASDAQ: COIN) market price anticipates a potential retreat as selling pressure may soon come to an end, and the share price could see an upward movement. The price could see a significant bounce if a renewed surge in buyers’ interest occurs. The daily candle reached a high of $354.06, suggesting that buyers are optimistic about regaining control of the entire market. However, if the buy investors could prove stronger and exchange hands with the sell traders at the $343.62 current support, its upsides should extend further to reach the $405.88 prior resistance, driving the broader market recovery to the upper range.

Key Levels:

Resistance Levels: $351.00, $352.00, $353.00

Support Levels: $175.00, $174.00, $173.00

COIN Long-term Trend: Bullish (Daily Chart)

NASDAQ: The COIN market value increases significantly over time, and the share price exhibits an upward trend above the supply levels, confirming a bullish trend.

Shortly after the daily session began today, the price of $COIN hit an all-time high of $354.06. It traded above the moving average, indicating an increase in purchasing activity at the time of writing.

The stock price will therefore soar to its target of $392.16 if the bulls are able to create market tension, demonstrating increased trust in the share among various investor types.

Notably, with buyers clustering around the market as indicated by the daily price signal, the NASDAQ stock price is expected to hit the $405.88 upper resistance mark soon as it remains in an uptrend in its higher time frame.

COIN Medium-term Trend: Bearish (4H Chart)

On the medium-term chart, the $COIN price is in a downward trend and is still on the verge of a potential reversal. This is evident as the stock price remains below the supply levels.

Meanwhile, the current correction may end, and the NASDAQ: COIN price might see an uphill trend to the $405.32 previous peak level if the bulls wrestle trend control from the sell traders and rebound from the mentioned support level.

Furthermore, the NASDAQ stock market is approaching the oversold region, indicating that the selling pressure will soon subside.

As a result, the next potential retreat by the bulls could reach the $436.30 upper resistance level in the upcoming days.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.