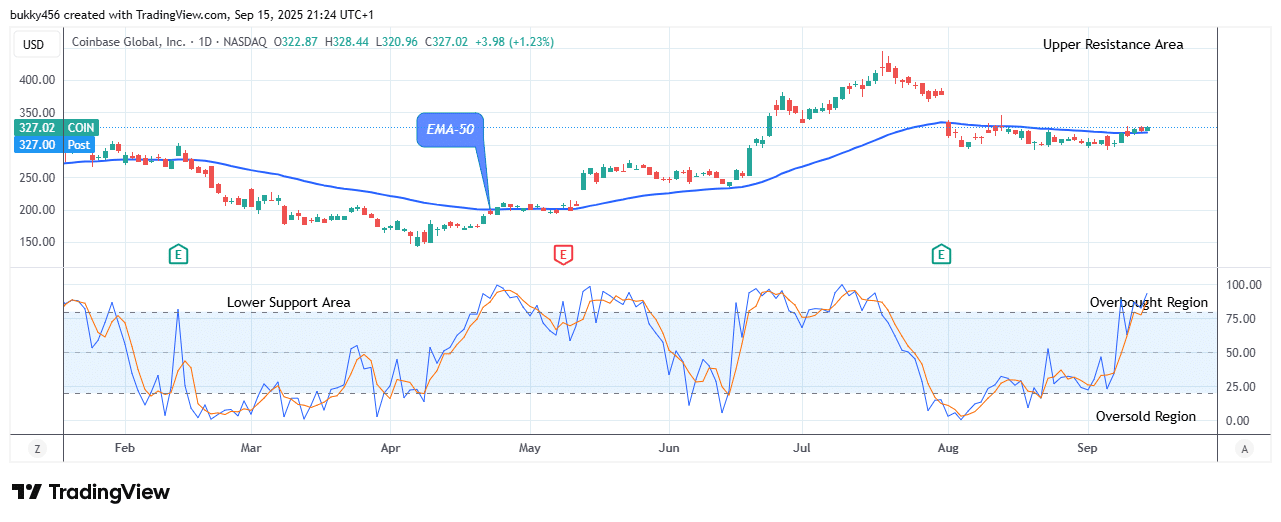

$COIN (NASDAQ: COIN) Forecast: September 17

The Coinbase Global (NASDAQ: COIN) market a buy trade set-up at the $328.44 price level, witnessing a substantial increase in its value over the past few hours, marking a stable bullish trend. Investor attitude around the share is showing signs of resurgence. Thus, strong buying pressure and a positive outlook on the market may push the stock price higher, retesting the $405.88 prior barrier and recording a robust upward trajectory, leading the market value to reach a $415.00 upper resistance level, amid the increasing bullish move.

Key Levels:

Resistance Levels: $359.00, $360.00, $361.00

Support Levels: $149.00, $148.00, $147.00

COIN Long-term Trend: Bullish (Daily Chart)

The NASDAQ: COIN price today creates a buy trade setup as it moves slightly above the resistance level, suggesting bullish momentum in the long-term perspective.

A buy trade setup in the $COIN market today at the $328.44 resistance level above the moving average line validates the bulls’ control of the market and encourages more buy investors to enter it, extending the upward correction.

Therefore, a daily candle close and an upward breakout over the $405.88 barrier will provide buyers with a strong foundation to drive the stock price higher, offering shareholders an excellent entry opportunity.

Furthermore, the daily stochastic moving upward suggests that the NASDAQ stock price may continue to rise and remain in a buy trade setup. Given this, the share price may soon reach the upper resistance trend point of $415.00 in the long run.

COIN Medium-term Trend: Bullish (4H Chart)

The $COIN market stays in a bullish market zone on the 4-hour chart. This indicates a buy trade setup, moving toward the upper resistance level.

Its buy trade setup at its most recent high was aided by the strong bullish influence on the share at the $323.24 high level in previous action.

The Bull Run pushed the NASDAQ: COIN price higher at the time of writing, setting up a buy trade that sent the stock price above the moving averages at $328.44. The price will be able to rise or break out to positive territory as long as it continues on its current path.

As a result, a potential breakthrough from the $405.32 neckline would strengthen the buying pressure on the share to higher resistance levels by accelerating the purchasing momentum and prices to a substantial level at the overhead area.

Furthermore, the NASDAQ stock price moving upward on the daily stochastic indicates that the buy trade setup may persist and shift the price action to the upper resistance level of $415.00, as the share price suggests a buy trade setup from a medium-term standpoint.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.