$COIN (NASDQ: COIN) Forecast: October 6

Today, the $COIN price shows a massive breakout while all support levels holds in place, recording a massive growth of 10.09% increase in value as investors and analysts continue to show keen interest in the stock market. The breakout rally at $383.50 is approaching the overhead resistance. Over the last 24 hours, the share’s increasing network activity and expanding user confidence have stayed steady. Looking promising at the mentioned supply, if stock buyers strengthen their pressure and the price holds above the previous high of $405.88, the stock price may continue to rise to the $415.96 upper barrier level and beyond, leading to a strong buying opportunity for traders.

Key Levels:

Resistance Levels: $382.00, $383.00, $384.00

Support Levels: $193.00, $192.00, $191.00

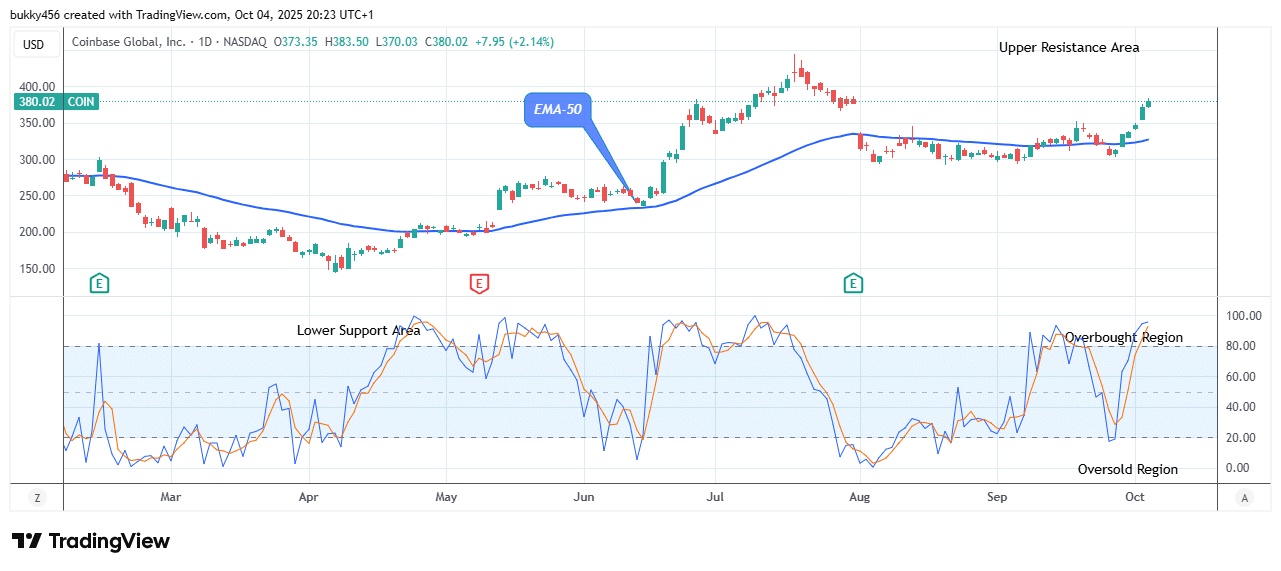

$COIN Long-term Trend: Bullish (Daily Chart)

As it forms a strong base and exhibits encouraging signs of recovery over the critical level, the $COIN market records tremendous growth, suggesting a large upward trend in its higher time period.

The price of NASDAQ: COIN has increased dramatically over the past few days, reaching a current trading value of $383.50 above the supply trend levels, indicating high conviction from buyers.

However, the share price might test the $405.88 supply strength and lay the stage for further increase with persistent buying.

Notably, the daily stochastic pointing upward indicates an uptrend. Therefore, in its longer time frame, the post-retest rally may spike higher and soon reach the upper high of $415.96.

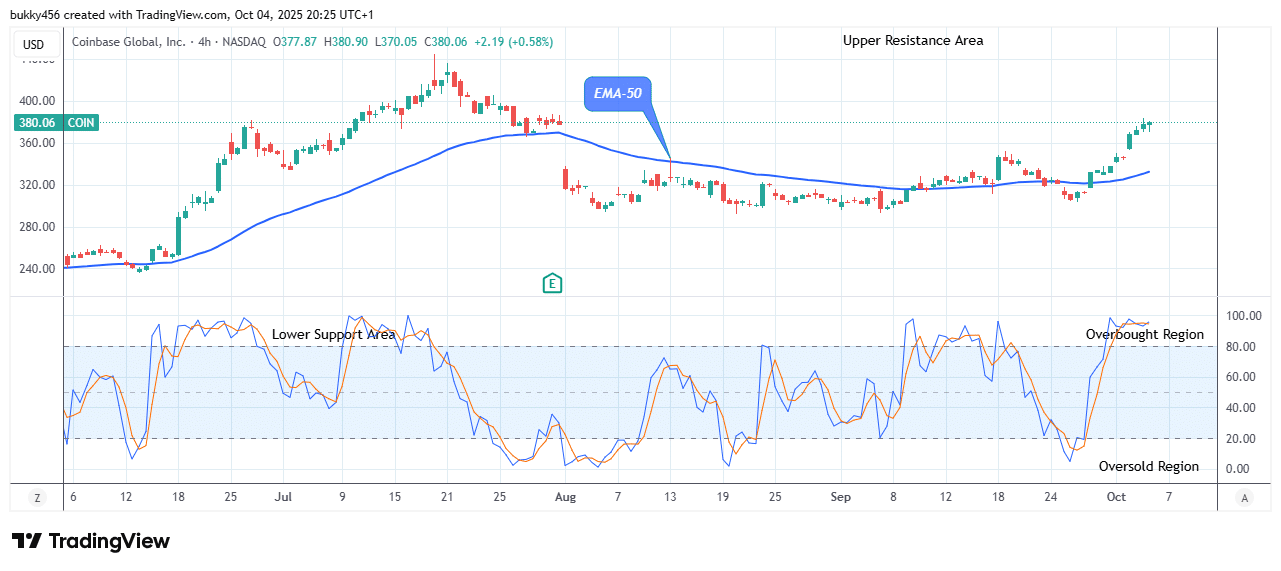

$COIN Medium-term Trend: Bullish (4H Chart)

The NASDAQ: COIN medium-term market value is trending upward. This is evident from the fact that prices are trading close to the market’s upper resistance zone, denoting a robust bullish rally.

A recovery rally to the $380.90 supply value above the moving averages, as the 4-hourly chart resumes today, will encourage buyers to invest in $COIN, as possible future gains are assured.

To indicate a potential buy entry for interested buyers, a potential breakthrough from the previous high of $420.09 neckline will quicken the purchasing momentum and drive prices higher.

Furthermore, the price indicator pointing up suggests that the NASDAQ stock market will rise, and that the bullish trend may continue.

In light of this, if the bulls can push harder and sustain the share price above the previous peak resistance value, the resulting rally may further bounce up to the $436.30 upper resistance level in the days ahead.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.