$COIN (NASDAQ: COIN) Forecast: March 3

The Coinbase Global (NASDAQ: COIN) market price updating the lows as usual, begins its uphill trend with a positive performance touching a daily high of $216.44 earlier today. The pullback is due to the broader upward movement and a positive shift in the stock market conditions. Hence, if all support levels hold and resistance breaks out of the $302.40 level, a shift and further change in the share price to retest the $349.75 prior peak value high is possible, and might perhaps rise as high as the $360.00 upper resistance level, signaling increased buying activity.

Key Levels:

Resistance Levels: $298.00, $299.00, $300.00

Support Levels: $169.00, $168.00, $167.00

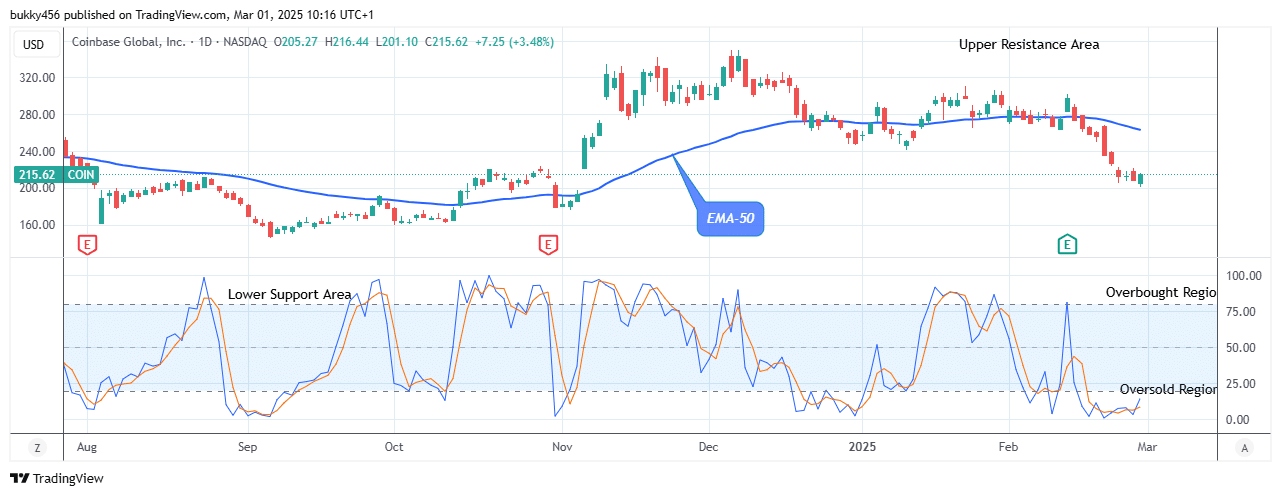

COIN Long-term Trend: Bearish (Daily Chart)

The $COIN market is currently in a negative area, as it begins its uphill trend with the stock price trading below the supply levels, confirming its bearishness, due to the inflow from sell traders.

The NASDAQ stock market began its uphill trend as the bulls pulled back to a $216.44 high mark below the EMA-50 as the daily chart opens today.

However, if a renewed surge in stock buyers occurs, the $COIN price might experience a notable surge to hit the $349.75 prior supply value, signaling the potential for significant gains as the up-north journey resumes.

Additionally, the daily stochastic indicates an uptrend by pointing upwards.

Hence, there is a tendency for the NASDAQ: COIN price to rise above the crucial supply if the support level at $207.79 holds.

In light of this, the shareholders might drive the stock price to a high of $360.00 upper resistance level in the coming days in its long-term perspective.

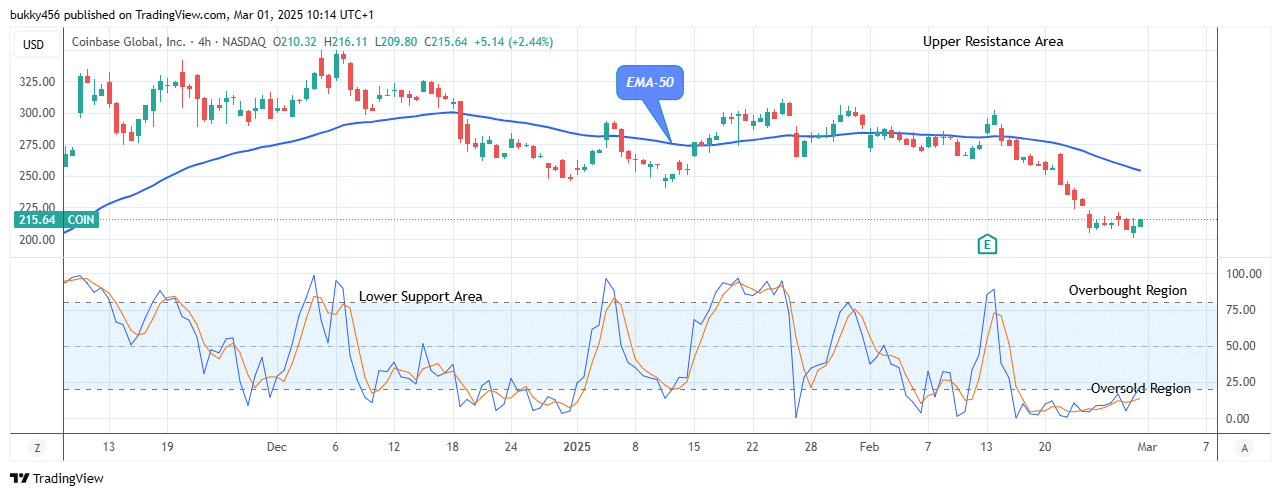

COIN Medium-term Trend: Bearish (4H Chart)

The stock market is below the moving averages, suggesting a bearish market sentiment in its medium-term view. Thus, the $COIN is correcting as it begins its uphill trend, aiming to rally higher.

A rise or a price retracement to a $216.11 high level by the bulls shortly after the 4-hour opens today affirms the returns of the long traders into the stock market, leaning towards a bullish trend.

Thus, the share price will advance if the bulls can redouble their efforts and push above the current supply level.

Hence, the stochastic oscillator pointing up suggests an uptrend. Thus, the NASDAQ: COIN price might surge to retest the $349.75 prior supply level and increase to a $360.00 upper supply level in the coming days in its medium-term forecast.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.