$COIN (NASDAQ: COIN) Forecast: December 22

Today, the Coinbase Global (NASDAQ: COIN) market is poised for its next big move and may continue rising. The share has just resumed its rising pattern, and from the look of it, a swift increase is expected to follow soon. Based on the outlook, if the new bullish correction persists, the stock price may break through the $392.16 supply mark and rise to an upper resistance level of $405.88 as it surges to reclaim another crucial supply, signaling an uptick in investors’ interest.

Key Levels:

Resistance Levels: $392.00, $393.00, $394.00

Support Levels: $292.00, $291.00, $290.00

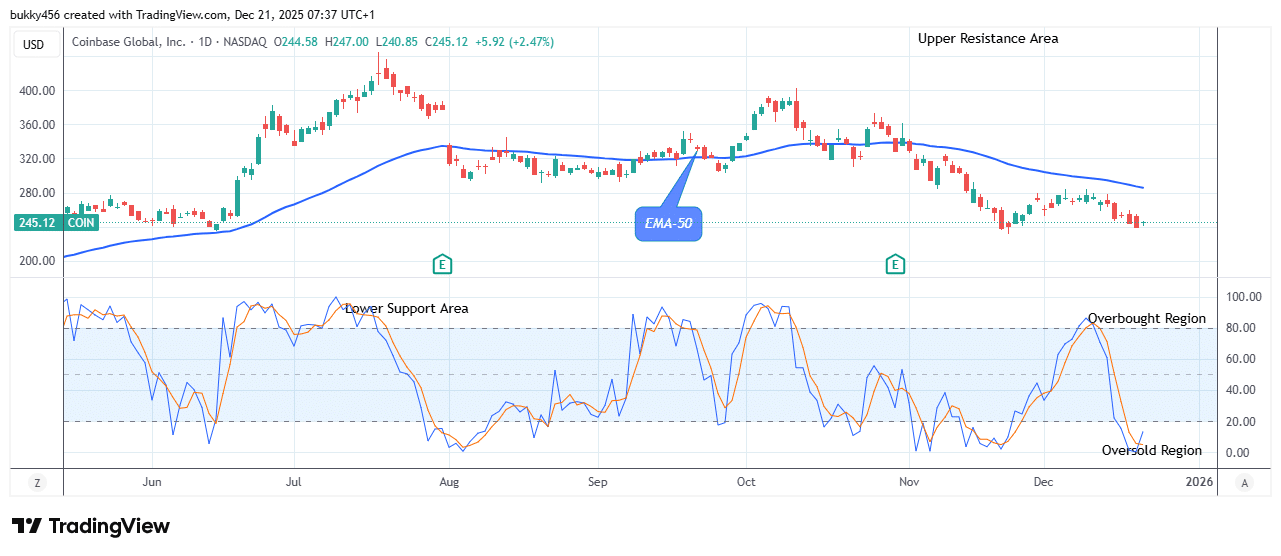

COIN Long-term Trend: Bearish (Daily Chart)

The $COIN market price is in green below the resistance level, claiming the returns of stock buyers on the higher time frame.

The share has been dealing with the sell traders in the previous action and has dropped the price below the supply trend levels in its recent high.

However, the bulls are ready to swing the share price as a new correction has occurred below the trend levels.

Currently, the price is struggling at a critical level, where any directional trend will bring wild swing moves.

The NASDAQ:COIN price displayed a gradual but steady recovery to the $247.00 supply level below the EMA-50, on the daily chart, as a result of the general uncertainty in the stock market.

The long-term traders can profit from this brief bullish ascent to the supply barrier, but the fate of the NASDAQ stock’s near future price depends on the range breakout.

The bullish outlook would therefore be strengthened, and its upward stability would be maintained by a significant breach over the $392.16 resistance mark.

Meanwhile, the $COIN price is pointing upward in the oversold region of the daily stochastic, compelling the bulls to continue the uphill ride.

Given this trend, the price may soon reach the $405.88 high mark in its long-term forecast.

COIN Medium-term Trend: Bearish (4H Chart)

The NASDAQ: COIN market is in a bearish trend zone in its medium-term outlook.

Pressure from bears at the $239.17 high value in the previous action has contributed to its recent drop in price.

Today’s 4-hourly chart, however, shows a more comprehensive price rebound. As the bulls took their position in the market, the share price surged to a $246.90 supply level below the EMA-50, getting closer to the resistance level.

Thus, there is a good chance that the stock price will rise to its most recent swing high at $389.56 if the price closes above $370.26.

Additionally, the daily stochastic indicates that the $COIN price is likely to maintain its current bullish trend.

Therefore, the price may be poised for a bullish pattern continuation to hit the resistance level of $405.88, which could then extend to the high value of $415.96 and beyond in the upcoming days.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.