Circle has officially launched its USD Coin (USDC) on the XRP Ledger this week, marking a significant expansion for the world’s second-largest stablecoin.

This development comes as the company’s recent IPO performance has pushed its market valuation to an impressive $18 billion, demonstrating strong investor confidence in regulated digital currencies.

The integration with XRP Ledger introduces an auto-bridging feature that allows users to transfer stablecoins between decentralized exchanges using XRP as an intermediary currency.

This technical advancement addresses one of the key challenges in cross-chain transactions, potentially reducing costs and settlement times for users moving funds across different blockchain networks.

Market Performance Reflects Growing Stablecoin Demand

The company’s stock debut on the New York Stock Exchange under the ticker CRCL has exceeded all expectations. Shares closed 140% above their first-day price and over 270% higher than the initial $31 IPO offering.

This performance outpaces other major cryptocurrency-related public listings, signaling institutional appetite for exposure to compliant digital asset infrastructure.

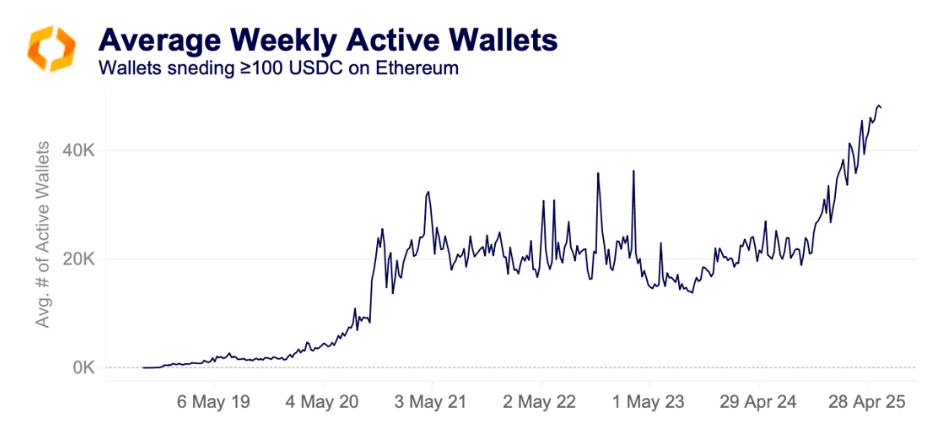

On-chain data reveals the fundamental drivers behind this valuation surge. USDC’s weekly active wallet count has doubled from 2024 levels, now averaging 40,000 wallets weekly that transact at least 100 USDC on Ethereum.

Trading volumes and total supply have both reached all-time highs in the second quarter of 2025, while USDC’s role as collateral in decentralized finance protocols continues expanding.

How Circle Is Strategically Positioning Itself in US Dollar Digitization

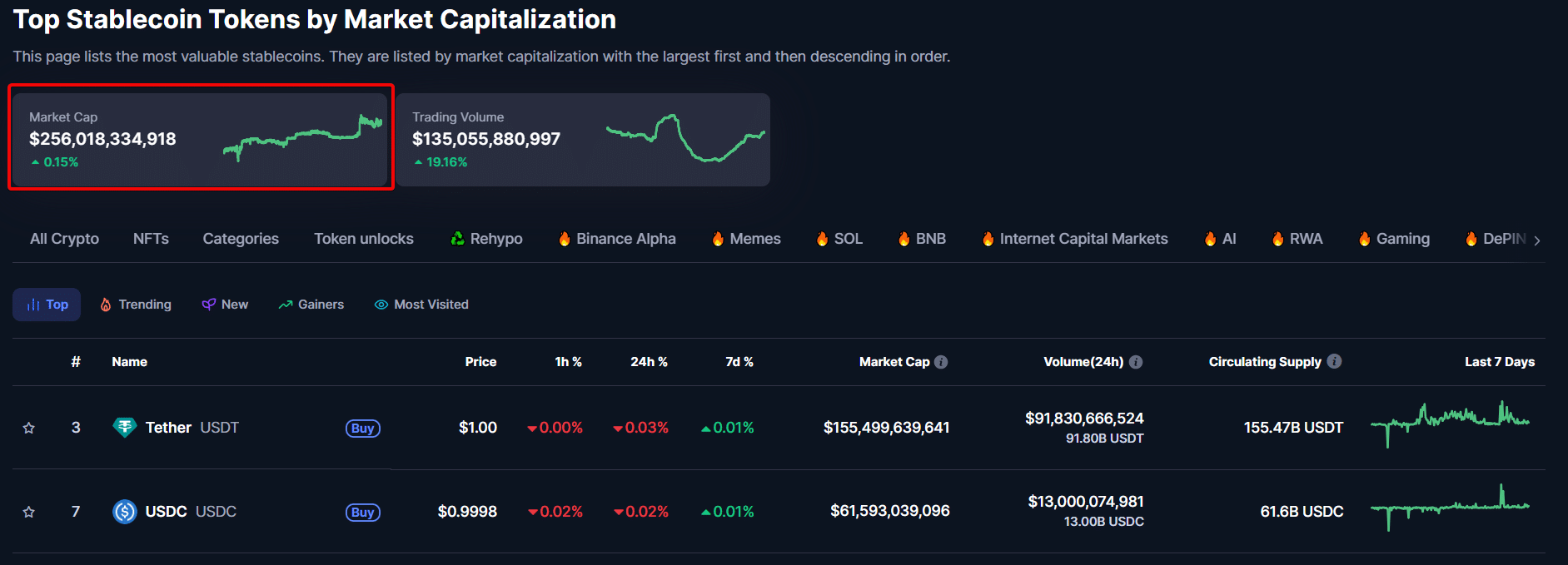

The timing of USDC’s expansion aligns with broader regulatory developments in the United States. The stablecoin market has grown to over $237 billion in total capitalization, with policymakers increasingly viewing compliant stablecoins as tools to maintain US dollar dominance globally.

During the White House Crypto Summit in March, Treasury Secretary Scott Bessent emphasized prioritizing stablecoin development to protect dollar hegemony.

The company’s business model benefits from this regulatory clarity. Circle generates revenue by investing the reserves backing USDC in short-term US Treasury bills, collecting yields while maintaining full collateralization.

With current 10-year Treasury yields exceeding 4.3%, this revenue stream has become increasingly attractive.

The XRP Ledger integration represents the firm’s broader strategy to increase USDC adoption across multiple blockchain ecosystems.

As foreign governments reduce holdings of US debt instruments due to concerns about creditworthiness, stablecoins offer an alternative mechanism for maintaining dollar-denominated transaction flows globally.

Market participants view the company’s expansion and strong financial performance as validation of the regulated stablecoin sector’s long-term viability, particularly as institutional adoption accelerates across traditional finance and decentralized applications.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.