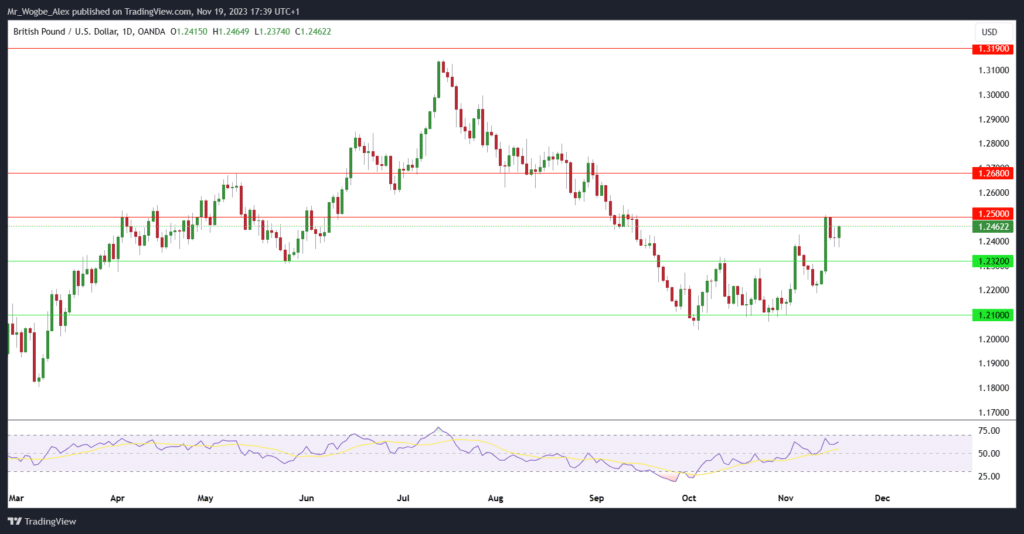

The recent surge seen with the pound against the US dollar may be short-lived as divergent economic challenges unfold.

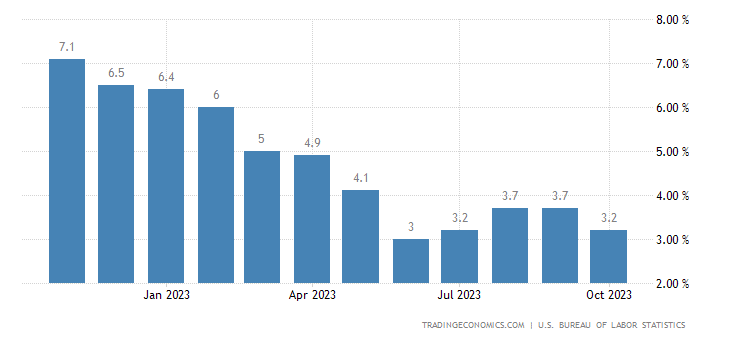

Over the past week, the pound experienced a sharp ascent against the US dollar, propelled by market optimism surrounding the belief that US interest rates may remain stagnant or even decrease in the first half of 2024. This sentiment gained traction following the release of the latest US inflation data, revealing a dip in the headline consumer price index to 3.2% in October, down from 3.7% in September.

Caution Trails the Pound

Yet, the jubilation surrounding the pound’s rally is tinged with caution, given the hurdles faced by the UK economy.

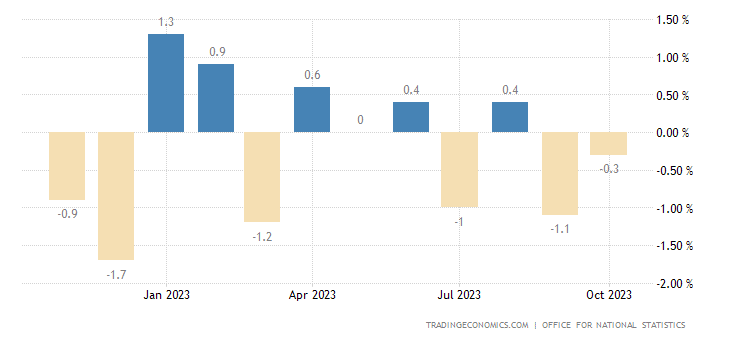

In response to persistent inflation exceeding the 2% target, the Bank of England has hiked interest rates multiple times in the past year. However, this proactive measure has cast a shadow on economic activity, notably impacting the retail sector, which witnessed sales volumes plummeting to their lowest level since February 2021.

This week presents a relatively quiet landscape for potential market-shifting events, with a notable exception being the release of the minutes from the US Federal Reserve’s recent policy meeting on Tuesday. Analysts anticipate these minutes could serve as a reminder that US inflation remains above target, influencing future interest rate decisions based on economic data. Such reminders may bolster the dollar against the pound and other currencies.

Consequently, the pound could encounter downward pressure this week as market expectations adjust to evolving US and UK monetary policies. Breaking above the 1.2500 resistance level might prove challenging for the pound-dollar pair, potentially testing the critical 1.2320 support level. That said, failure to hold the 1.2320 support (if it does, in fact, fall that low) would open the door to the 1.2100 floor in the near term.

The outlook for the pound appears bearish in the short term, navigating a path through the ebb and flow of global economic dynamics.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.