Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Unlike most cryptocurrencies, the Cartesi coin has been experiencing a notable upsurge in its price. Even today, as most prominent coins continue to dip, this token has managed to move against the trend. As a result, at the time of writing, the coin has recorded a price increase of 2.71%.

Cartesi Market Statistics

Current Price: $0.1081

Market Capitalization: $86.77M

Circulating Supply: 877.66M

Total Supply: 1B

CoinMarketCap Rank: 400

Key Price Levels

Resistance: $0.1250, $0.1500, $0.2000

Support: $0.1000, $0.0850, $0.0650

CTSI Upside Stays on an Upward Course

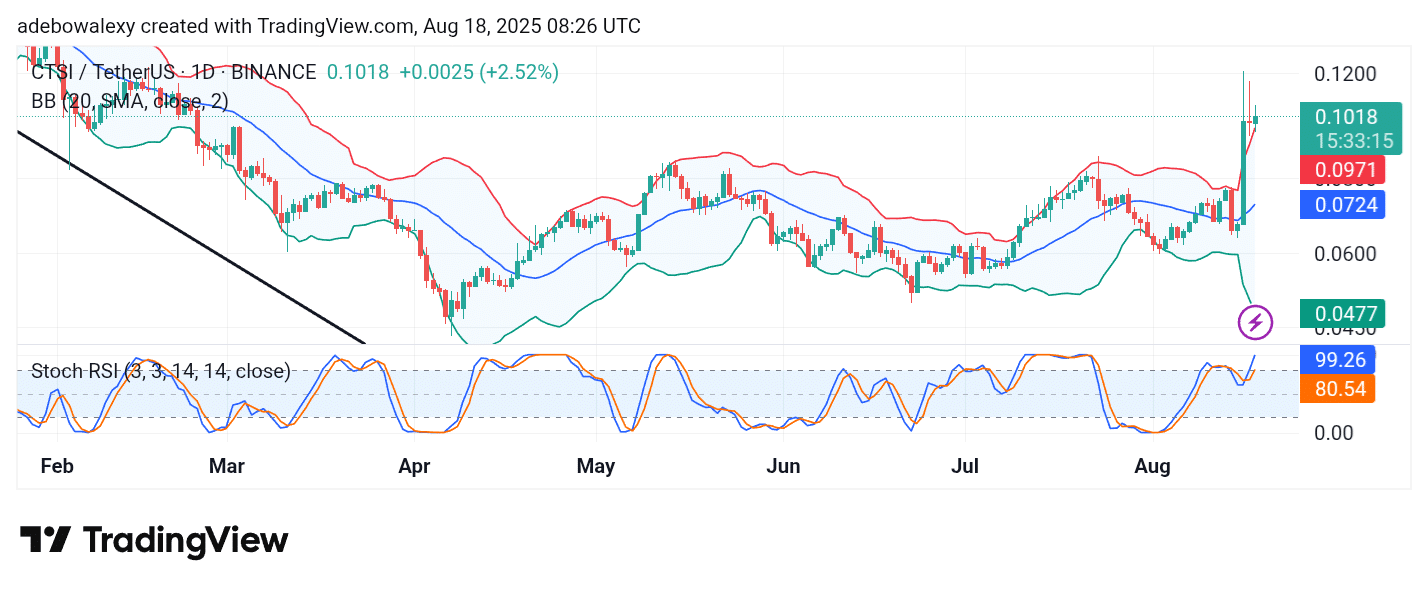

Price activity in the Cartesi daily market has risen past some key levels, which could potentially trigger headwinds in the market. However, the current session’s price candle has appeared green and stands directly above the uppermost band of the Bollinger Bands (BB). Although the gains are modest, the fact that the candle is green here suggests continued bullish persistence.

Additionally, the Stochastic Relative Strength Index (SRSI) lines remain in the overbought region but continue to trend upward. Consequently, while the market may experience a short-lived retracement, traders can still anticipate bullish momentum before a possible pullback.

Cartesi Bulls Maintain Modest Control

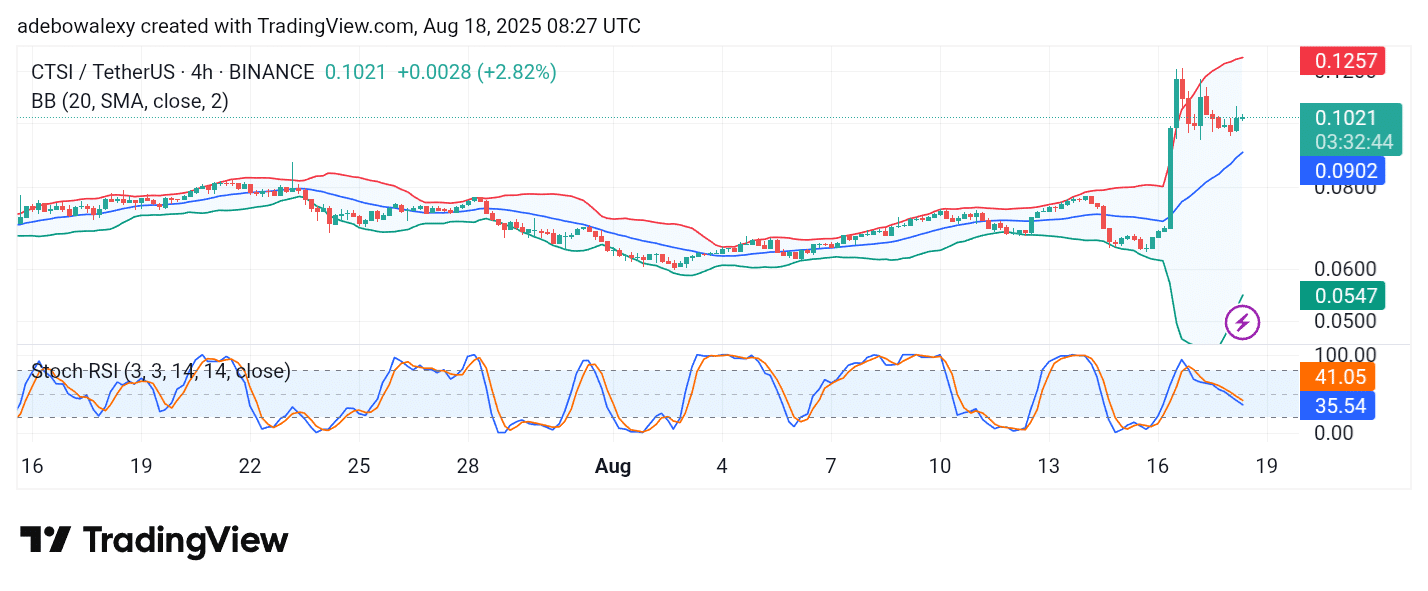

The 4-hour CTSI market has shown that price action rebounded in the previous session. Although the ongoing session has continued in the same direction, downward forces have been visible. Nevertheless, trading activity remains above the middle band of the BB indicator, which itself maintains an upward trajectory.

Meanwhile, the SRSI indicator lines are descending toward the oversold region. This suggests that bullish traders may continue to hold their ground, at least until price action breaks the support level at $0.1000. A fall below that region could signal a steeper dive toward the $0.0900 mark.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.