ADA Price Analysis – May 18

Increase in the bulls’ momentum will increase the price to the resistance level of $2.30, the bullish momentum may extend to the resistance level of $2.51 and $2.72 level. Should the sellers interrupt the bulls’ pressure and gain enough momentum, ADA/USD may decline to $2.08, $1.87 and $1.64.

ADA/USD Market

Key Levels:

Resistance levels: $2.30, $2.51, $2.72

Support levels: $2.08, $1.87, $1.64

ADA/USD Long-term Trend: Bullish

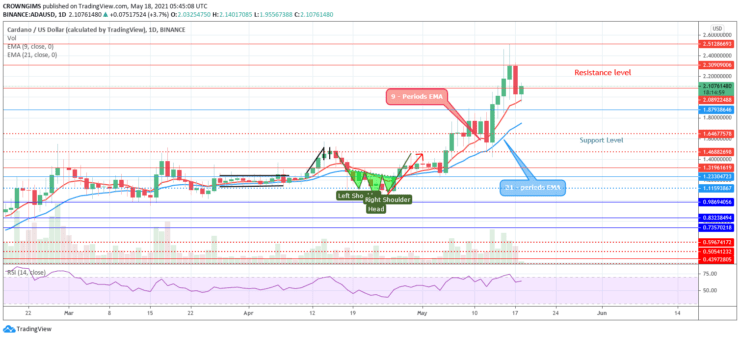

On daily chart, Cardano is bullish. The bulls dominates Cardano market after the formation of the bullish pattern (Head and Shoulder). The price soared to the resistance level at $1.87 after it breaks up the former resistance levels of $1.46 and $1.64. On May 10, the coin pulls back and consolidates for three days at the resistance level of $1.87. The bulls gained more momentum and break up the resistance level of $1.87 with the formation of strong bullish candle. The price increase further to test the resistance level of $2.30.

Cardano pulls back yesterday to test the dynamic support level and it is trading above the 9 periods EMA and 21 periods EMA at close range to the EMAs. Increase in the bulls’ momentum will increase the price to the resistance level of $2.30, the bullish momentum may extend to the resistance level of $2.51 and $2.72 level. Should the sellers interrupt the bulls’ pressure and gain enough momentum, ADA/USD may decline to $2.08, $1.87 and $1.64. The technical indicator Relative Strength Index period 14 is at 60 levels with the signal line pointing upside which indicates a bullish signal.

ADA/USD Medium-term Trend: Bearish

Cardano is on the bearish movement on 4-hour chart. Cardano increases to test the high level of $2.51 on May 16. The breakup of the level is prevented by the pressure of the bears. The price pulled back to retest the support level of $1.46. The bears increases their momentum and the price is falling towards the support level at $1.87.

The price is trading below the 9 periods EMA and 21 periods EMA while the two EMAs are close to each other. The relative strength index period 14 is above 40 levels and the signal line pointing up to indicate buy signal which may be a pullback.

You can purchase crypto coins here: Buy coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.