Currency analysts are painting a promising picture for the Canadian dollar (CAD) as central banks worldwide, including the influential Federal Reserve, edge closer to the conclusion of their interest rate hike campaigns.

This optimism has been revealed in a recent Reuters poll, where nearly 40 experts have expressed their bullish forecasts, projecting the loonie to strengthen approximately 2.0% to 1.31 per U.S. dollar, translating to around 76.34 U.S. cents within the next six months. This projection marks an encouraging improvement from the 1.32 rate that was forecasted in the previous month.

Canadian Dollar to Rally in the Coming Months as Fed Shifts Policy Stance

Over the course of the coming year, the Canadian dollar is expected to rally even further, gaining an impressive 3.6% and reaching a rate of 1.29 against the U.S. dollar. Shaun Osborne, Chief Currency Strategist at Scotiabank, commented on the forecast, highlighting the potential for a broad softening of the USD over the next 12 months, driven by the Federal Reserve’s expected reversal of its tightening cycle.

This optimism surrounding the loonie stems from a strategic bet made by investors, who anticipate the Federal Reserve to be on the cusp of completing its tightening campaign and possibly transitioning to rate cuts in the first half of 2024.

Such a shift in monetary policy is likely to be supportive of the global economy, and this bodes well for Canada, a major exporter of commodities, particularly oil.

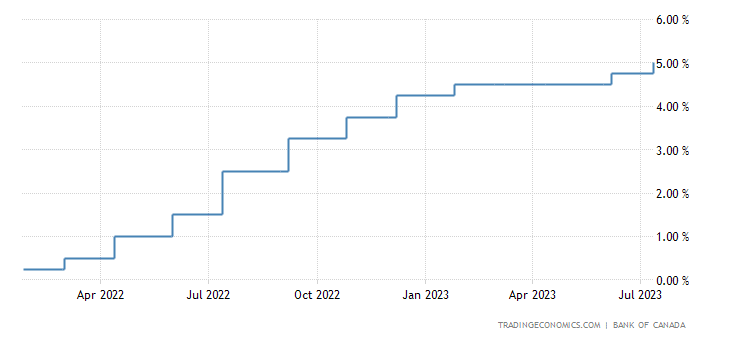

Bank of Canada Raises Rates to Record High

Meanwhile, in a significant development, the Canadian central bank recently raised its benchmark interest rate to 5%, hitting a 22-year high. The bank also cautioned about the possibility of further tightening if inflation surpasses its 2% target.

As such, market participants will be keenly observing Canada’s employment data for July, scheduled for release tomorrow, as it will likely guide expectations for any additional interest rate hikes.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.