The Canadian dollar encountered some headwinds against its U.S. counterpart on Friday, as early data indicated a contraction in the domestic economy during the month of June. This development has sparked concerns among market participants, who are closely monitoring the situation to assess the potential impact on borrowing costs and economic activity.

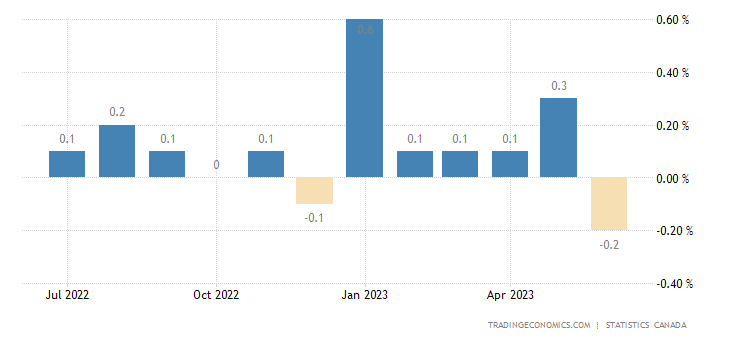

Previous data from May showed a commendable 0.3% growth in the Canadian economy. However, the latest figures from June indicated a 0.2% contraction, pointing towards a potential slowdown. As a result, market watchers are speculating about the Bank of Canada’s ongoing monetary tightening campaign and the possibility of interest rates reaching a 22-year high.

According to Reuters, Karl Schamotta, chief market strategist at Corpay, highlighted that the data implies underlying momentum may be weakening, primarily due to the impact of higher borrowing costs on various sectors. This observation has sparked debate among experts regarding the effectiveness of the current monetary policies and their implications for economic growth.

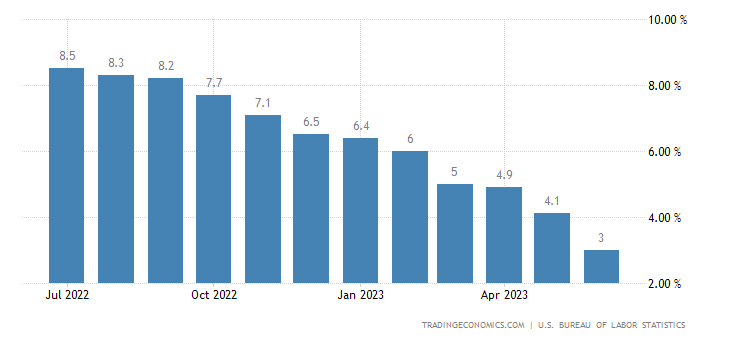

Interestingly, on the other side of the border, the U.S. economy appears to be experiencing a softer landing. Annual inflation in the United States rose at its slowest pace in more than two years in June, with underlying price pressures showing signs of receding. This trend may prompt the Federal Reserve to consider adjustments to its current interest rate hike cycle, which has been one of the fastest since the 1980s.

The favorable outlook for the U.S. economy had a ripple effect on Wall Street and also positively influenced the price of oil. As oil constitutes a significant portion of Canada’s major exports, the boost in oil prices may help alleviate some pressures on the Canadian economy.

In response to the economic data, Canadian government bond yields experienced a decline across the yield curve. The 10-year bond yield was down 8.1 basis points at 3.536%, while the yield spread between Canadian and U.S. equivalent bonds widened to 43.6 basis points, further suggesting investor sentiment and potential adjustments in monetary policies.

Canadian Dollar Loses Ground to the U.S. Dollar

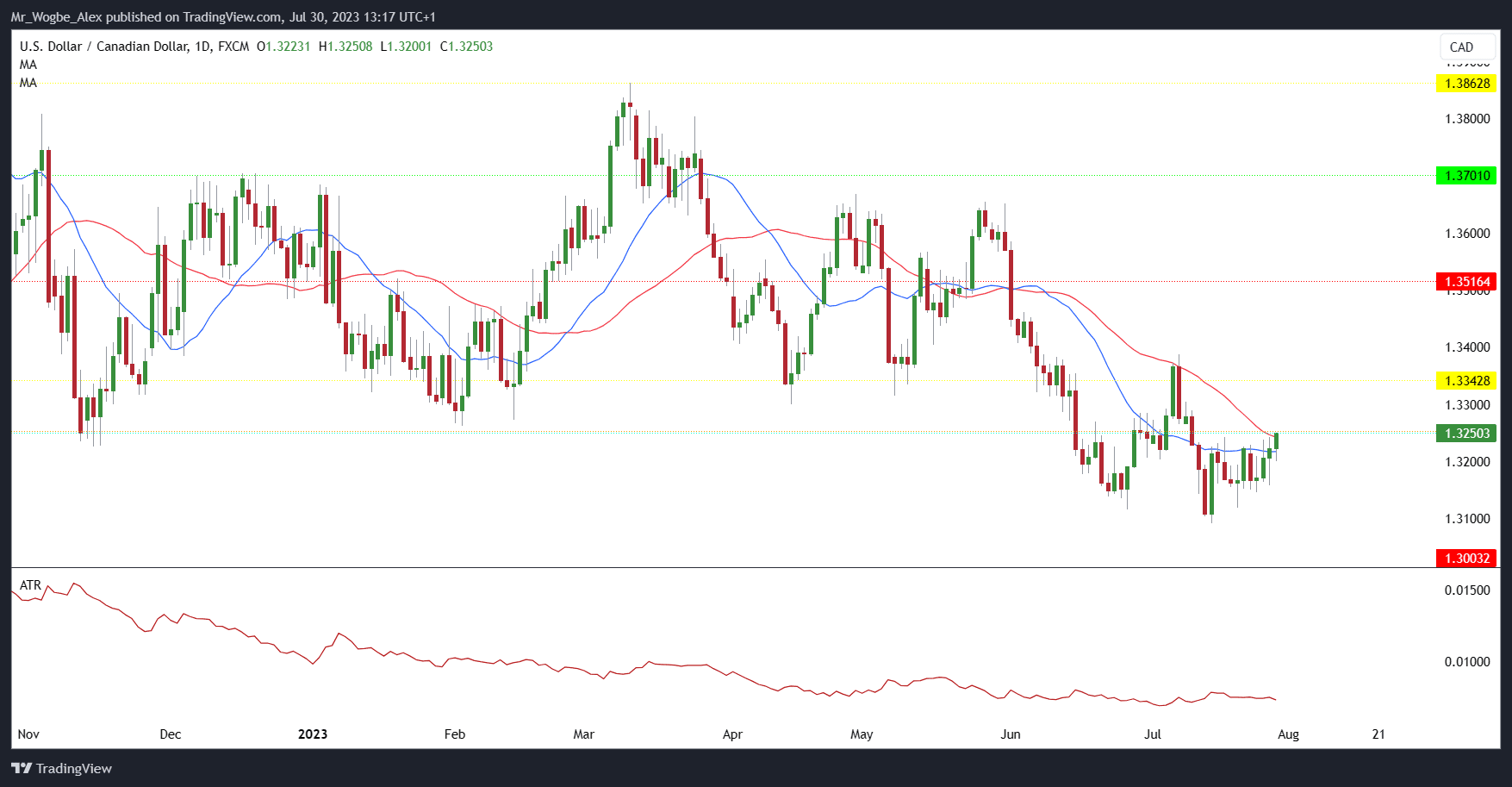

On Friday, the USD/CAD pair rose to its highest point since July 11 at 1.3250, thanks to the slipup recorded by the Canadian dollar. Regardless, the CAD remains close to its highest point this year against the USD and could resume its bullish ways as we enter a new month.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.