Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

BTC/USD (Bitcoin) Slumps as Bears Extend Control

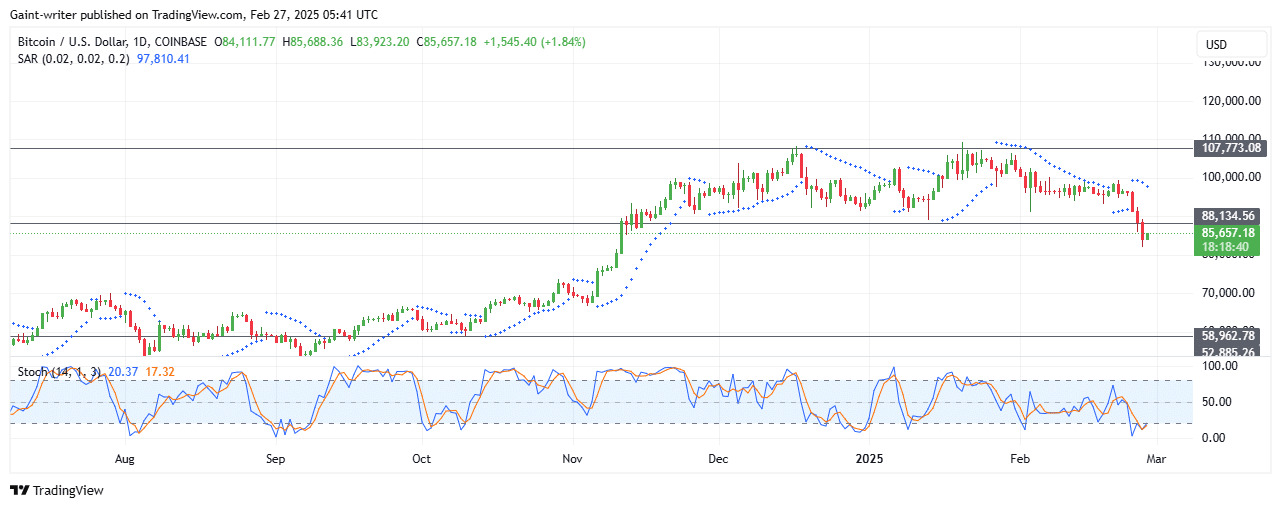

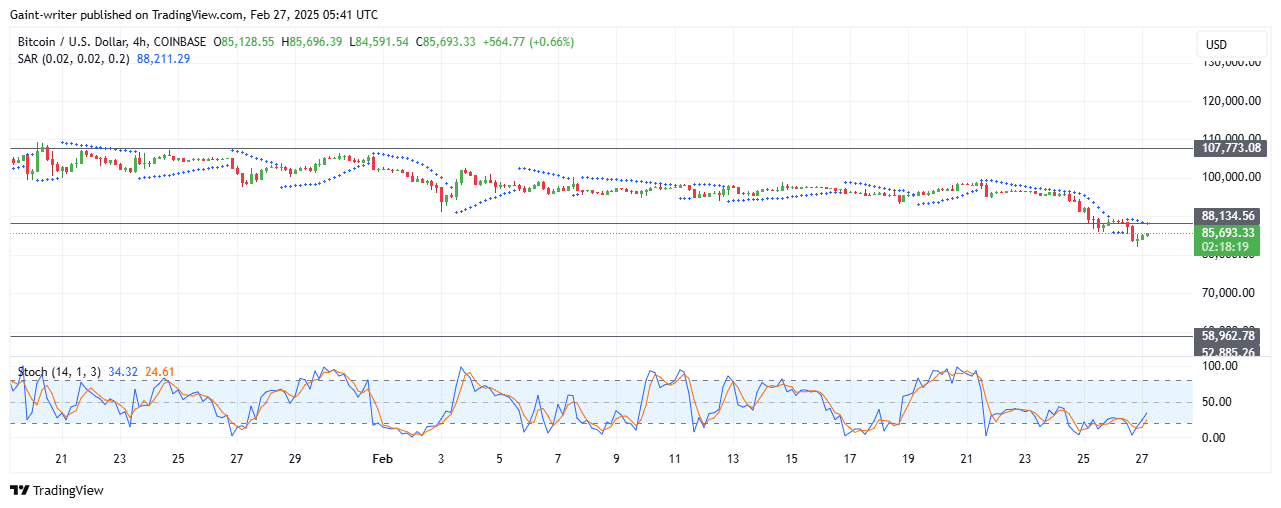

BTC/USD is slipping as sellers take charge, with Bitcoin experiencing a downturn as bears strengthen their grip on the market. The recent price movement saw Bitcoin falling below the crucial $90,000 level, triggering a sell-off that has left buyers struggling to regain momentum.

BTC/USD Key Levels

Support Levels: $84,260, $80,000

Resistance Levels: $90,000, $92,500

The Parabolic SAR (Stop and Reverse) indicator confirms that sellers remain firmly in control, maintaining their downward momentum. This bearish strength continues to dominate the market, raising concerns for buyers hoping to regain control.

Despite the prevailing bearish pressure, the Stochastic Oscillator offers some insight into buyer activity, indicating that buyers are attempting to regain strength. However, the oscillator’s signal line continues to move lower, aligning with the ongoing bearish trend in BTC/USD.

Market Expectation

In the short term, bears seem poised for further attacks, and selling pressure is expected to persist as the market searches for a bottom. While the immediate outlook remains bearish, a potential reversal could emerge if buyers manage to consolidate.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.