The British pound (GBP) recorded a decent bounce against the US Dollar (USD) on Monday after the UK government backtracked on plans to slash its income tax by the highest percentage in its history. The dollar also lost ground against most of its counterparts during the first trading session in October.

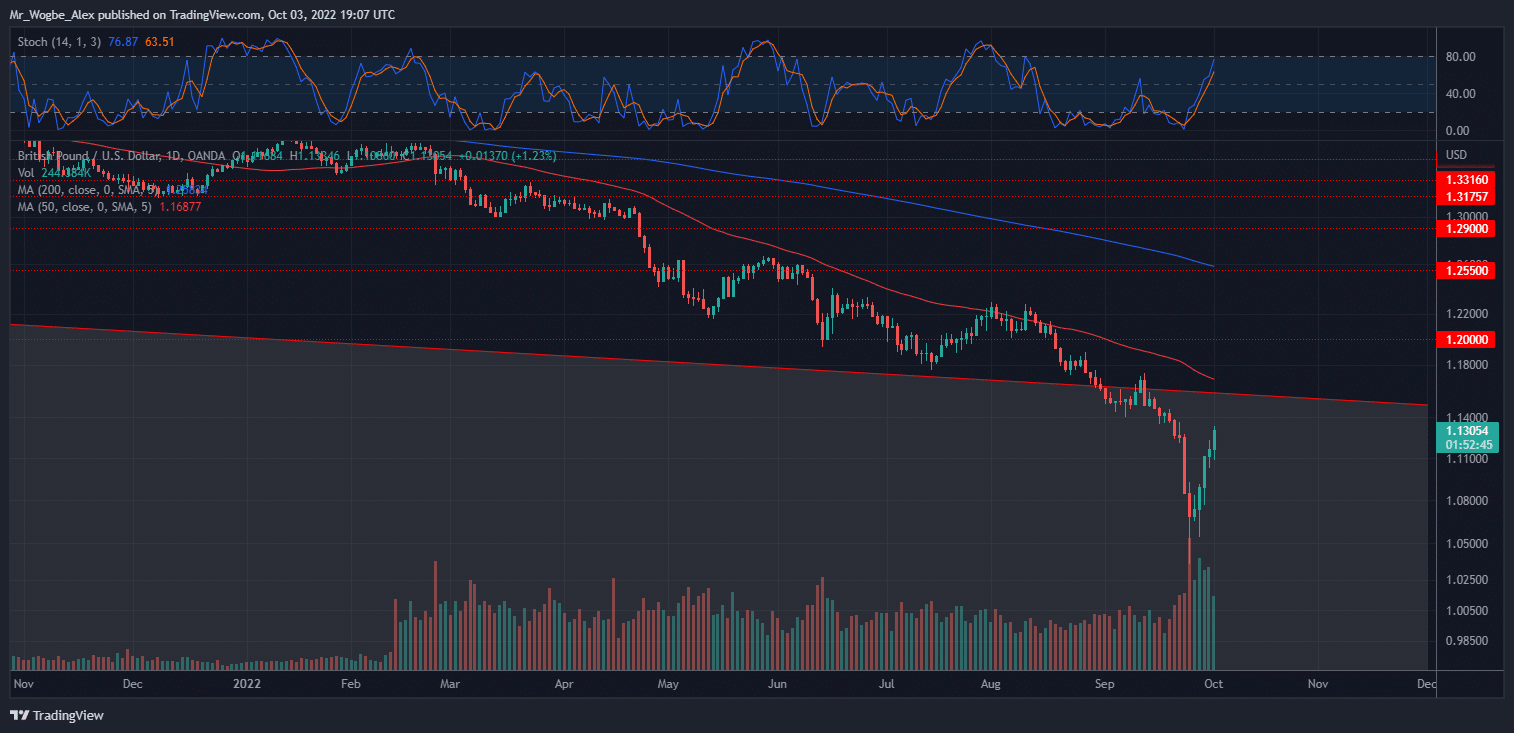

Sterling jumped to its highest point since September 22, the day before an unprecedented crash for the single currency after British Finance Minister Kwasi Kwarteng’s “growth plan” to cut taxes and regulation sent markets into a frenzy. At press time, the GBP/USD pair trades up by 1.4% at 1.1323.

British Pound Not Out of the Woods Yet

Commenting on the recent price action, Amo Sahota, the director at Klarity FX in San Francisco, noted: “Sterling is getting a boost as the UK tries to reverse some of its tax cuts.”

Meanwhile, the British finance minister noted that he would publish the details of how he plans to cut public debt as a share of economic output over the medium term.

As mentioned earlier, the dollar weakened against most of its major counterparts on Monday. However, Sahota cautioned that “the big macroeconomic themes have not changed, so take this for what it is, it’s a new quarter and an opportunity for a bounce in equities and a little unwinding of the US dollar.”

In other news, the Japanese yen dropped past the 145.00 mark against the dollar for the first time since September 22, when Japanese authorities stepped in to support the crashing currency.

The euro (EUR) also rallied against the dollar on October 3, tapping the 0.9844 top. However, recent data showed that manufacturing activities across the Eurozone declined in September, which could spell bad news for the continent’s currency.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.