Bitcoin changed little during the weekend and after the last aggressive sell-off. It’s traded at 49,740 being located under broken downside obstacles.

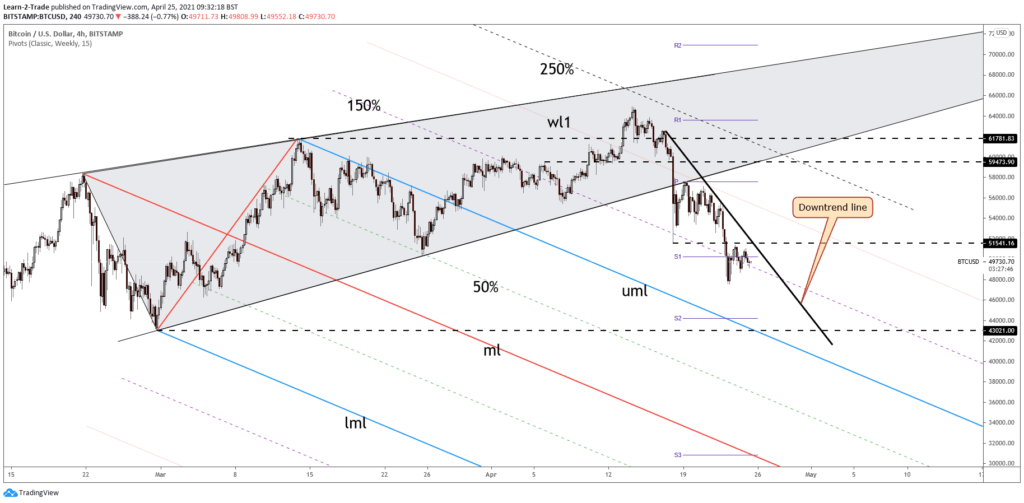

The bias is bearish in the short term after escaping from a major Rising Wedge reversal pattern. Still, the current corrective phase could end soon after the rate reaches strong support levels.

The retreat could help the buyers to catch a new upside momentum.

The current decline is natural after Bitcoin’s breakdown from the Rising Wedge pattern. The rate has retested the broken uptrend line and the weekly pivot 57,568 confirming the correction.

Now is traded right below the weekly S1 (50,229.84) which represented strong support. BTC/USD could resume its decline as long as it stays under S1 and below the immediate downtrend line.

51,541 level represents strong resistance. Breaking and stabilizing below this obstacle indicates that BTC/USD could move down towards 43,021 static support.

A strong reversal pattern around the support levels could bring a buying opportunity. The outlook remains bullish in the long term, so we should look for long signals when the correction ends.

Join our VIP telegram group HERE if you want to receive new buying opportunities, signals, on Bitcoin!

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.