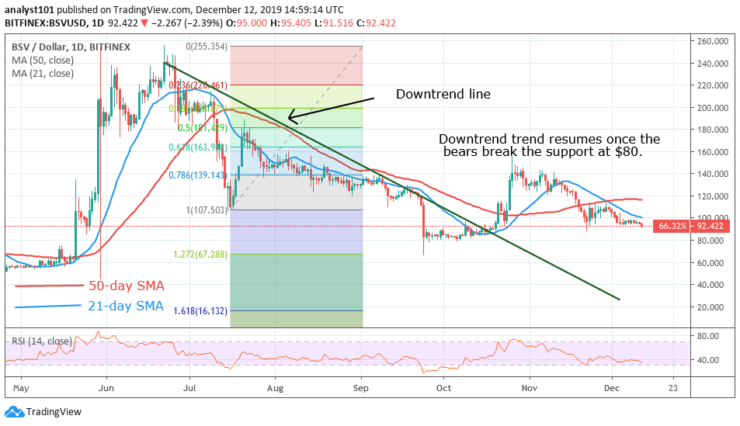

Key Support Levels: $80, $60,$40

BSV/USD Long-term Trend: Bearish

Early in December, the coin fell to the support at $92 and continued fluctuating above it. Trading at the bottom of the chart is precarious because of the tendency of the price to slide into depreciation. In retrospect, BSV was in a bear market and it fell to the low of $80 in September.

The bulls reacted and made a price correction up to the high of $140. The bulls could not penetrate the resistance at $140. However, the coin fell again after retesting the resistance on three occasions before nose-diving to the low of $92. The downtrend may continue if the coin trades below the $80 price level. Nevertheless, if it rebounds, it will move up and face the resistance at $140.

Daily Chart Indicators Reading:

Early in October, the bearish trend was terminated as the bulls break the downtrend line and closed above it. However, the selling pressure resumed as the coin was resisted at $140. The EMAs have made bearish crossover as the blue line crosses over the red line indicating a sell signal. The RSI period 14 levels 35 is still below the centerline 50 which implies that the price will fall.

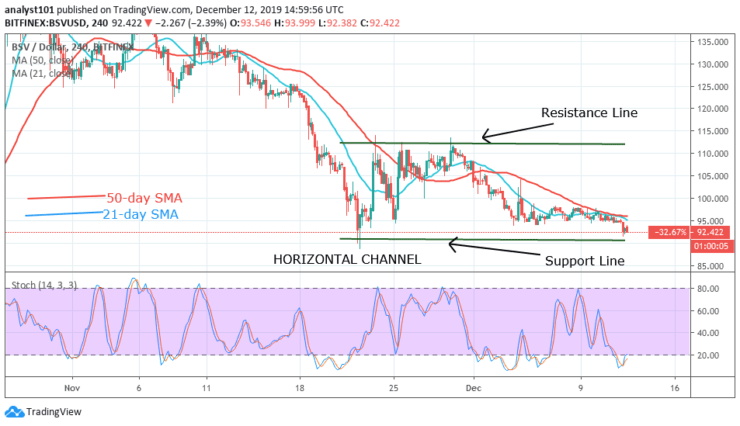

BSV/USD Medium-term bias: Bullish

On the 4- hour chart, the coin is trading between the price range of $90 and $112. In November, the bulls made attempts to move up but were faced with resistance at $112. The bulls made over three attempts at the resistance before falling to the low of $92. Presently, the market is fluctuating at the bottom of the chart for a possible bullish move.

4-hour Chart Indicators Reading

Bitcoin SV is trading in the oversold region but above 20% range of the daily stochastic. BSV has commenced making an upward move. The coin is now in a bullish momentum. The 21-day SMA and the 50-day SMA are sloping horizontally indicating that the market is fluctuating.

General Outlook for Bitcoin SV (BSV)

Bitcoin SV is in a sideways move above the $90 price level. The coin is expected to trade below the support at $80 before assuming that the downtrend has resumed. However, if the coin rebound at the current price level, BSV will move up to retest the $140 price level.

BSV Trade Signal

Instrument: BSVUSD

Order: Buy Limit

Entry price: $80

Stop: $60

Target: $140

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.