Key Support Levels: $80, $60, $40

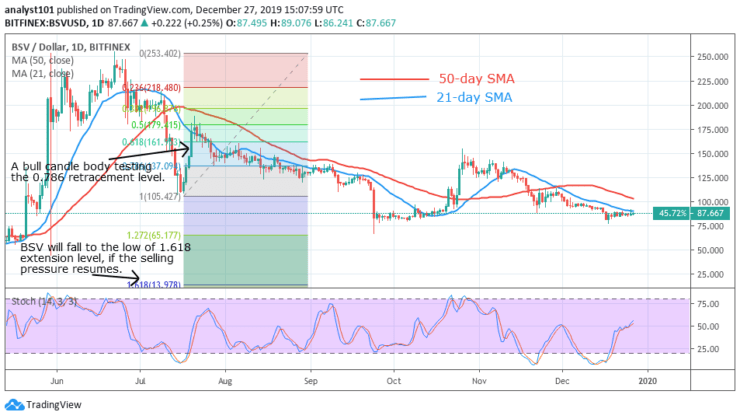

BSV/USD Long-term Trend: Bearish

Bitcoin SV has been relatively stable since September. The bulls have efficiently defended the $80 support level. The bears have not been able to break below the support in the last three months. In September, the bears tested critical support level and rebounded. The price made an upward correction but was resisted at a $150 resistance level.

The bears made a downward move to retest the critical support. On December 18, the coin fell to the low of $80 and commenced consolidation above it. On the upside, the coin will rise and reach the high of $150, if the $80 support holds. On the downside, BSV will fall to the low of $50 or $65, if the support cracks.

Daily Chart Indicators Reading:

Currently, the BSV is holding at the $80 support level. From the Fibonacci tool, there is likely to be a further selling pressure. A bull candlestick tested the 0.618 retracement level. This indicates that if the selling pressure resumes, BSV will fall to a low of 1.618 extension level. This is equivalent to a low of $25. Meanwhile, BSV is trading above the 50% range of the daily stochastic. It implies that the coin is in bullish momentum.

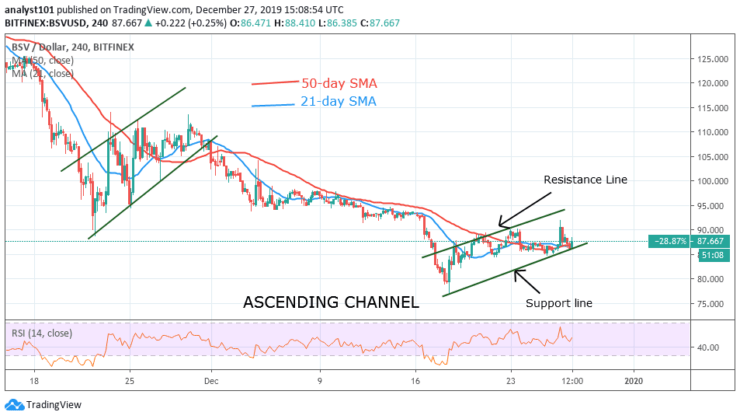

BSV/USD Medium-term bias: Bullish

On the 4- hour chart, BSV was in a bull market in November. The coin rose from a low of $90 and was resisted at $110. The bull market was short-lived as it fell to a low of $80. The coin made another bullish move to a high of $90. Presently, the coin is facing resistance at the price of $90.

4-hour Chart Indicators Reading

At the moment, the coin is facing resistance in the ascending channel. The coin may fall if the support line is broken and the price closed below it. That BSV may revisit the previous low at $80. However, if the support line holds the coin will rise and retest the $110 price level. The Relative Strength Index period 14 level 53 indicates that the price is above the centerline 50. It means that the coin is likely to rise.

General Outlook for Bitcoin SV (BSV)

Bitcoin SV is in a bullish momentum and that the coin is likely to rise. The Fibonacci tool indicated otherwise. It claims that selling pressure may resume and that the coin may fall to the low of $25 or $1.618 extension level. Meanwhile, the coin is trading in the bearish trend zone. At the support, the coin tends to slide into depreciation except we have a bullish breakout.

BSV Trade Signal

Instrument: BSVUSD

Order: Buy

Entry price: $88

Stop: $60

Target: $140

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.