Bitcoin continues its remarkable ascent, with the cryptocurrency recently trading around $116,800 while institutional demand reaches unprecedented levels.

The digital asset has captured global attention as corporate treasuries increasingly allocate significant portions of their balance sheets to cryptocurrency holdings.

Record-Breaking Corporate Investment Wave

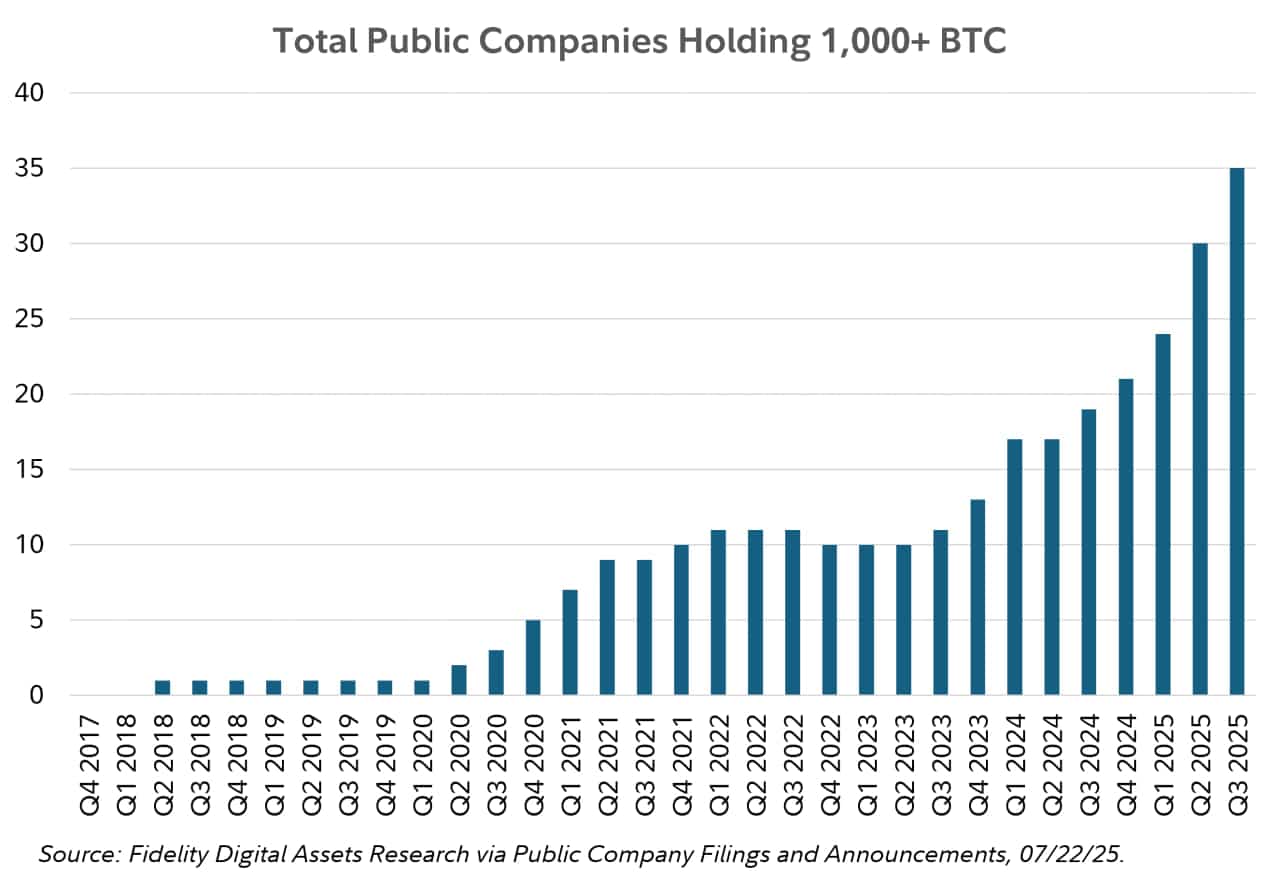

The institutional adoption landscape has experienced dramatic growth, with 35 publicly traded companies now holding at least 1,000 BTC each.

This represents a substantial increase from just 24 companies at the end of Q1 2025, according to research from Fidelity Digital Assets.

The collective value of these holdings exceeds $116 billion, demonstrating the growing confidence among corporate executives in cryptocurrency as a treasury asset.

This expansion reflects a fundamental shift in how businesses view digital assets. Companies are no longer treating Bitcoin as a speculative investment but rather as a legitimate store of value and hedge against traditional financial risks.

The distribution of buyers has also broadened significantly, with purchases becoming more widespread across various industries rather than concentrated among a few large entities.

Global Leadership in Crypto Holdings

The United States leads the world in corporate Bitcoin adoption, with 94 public entities holding the cryptocurrency. Canada follows with 40 entities, while the United Kingdom maintains 19 public companies with Bitcoin positions.

This geographic distribution highlights the regulatory clarity and institutional infrastructure that enables widespread adoption.

Quarter-over-quarter Bitcoin purchases increased by 35%, rising from 99,857 BTC in Q1 to 134,456 BTC in Q2 2025. This acceleration demonstrates sustained institutional appetite despite market fluctuations and regulatory uncertainties in various jurisdictions.

The convergence of corporate adoption, technical market conditions, and geographic expansion suggests Bitcoin’s continued evolution from experimental technology to mainstream financial instrument.

Bitcoin Market Dynamics Signal Potential Volatility

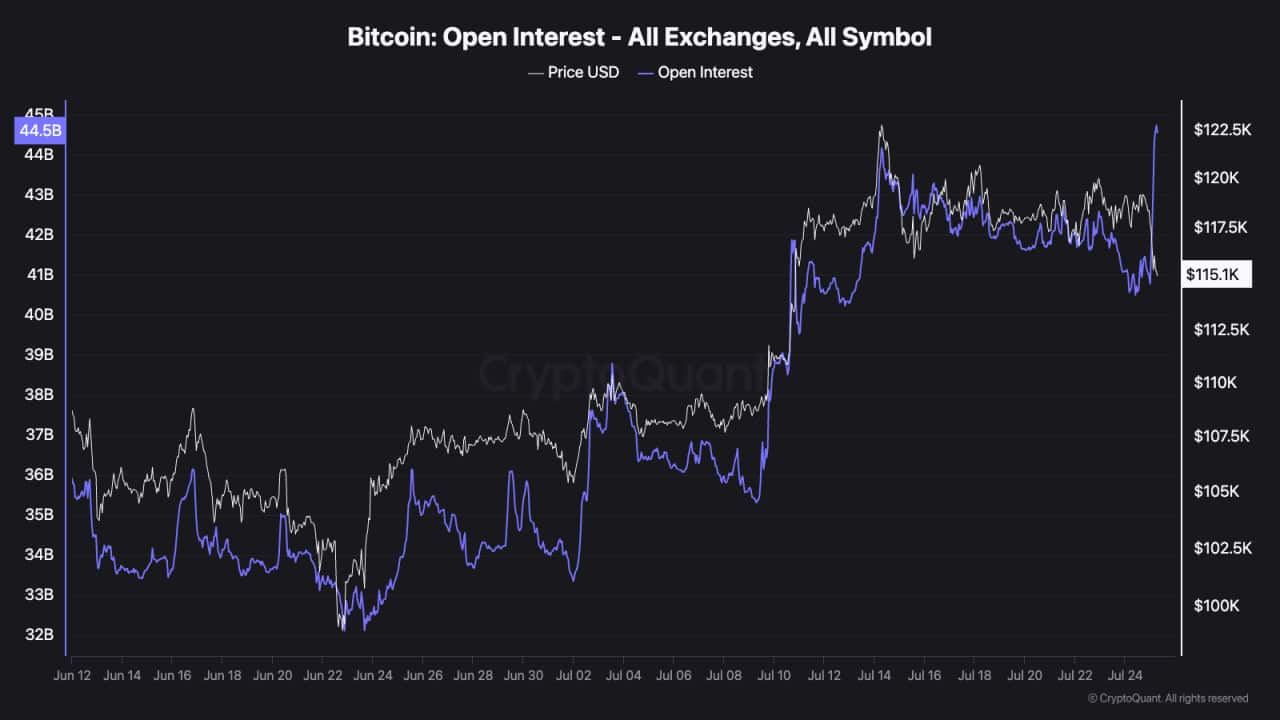

Despite the positive adoption trends, technical indicators suggest increased market volatility ahead. Bitcoin’s open interest has reached a new all-time high of approximately $44.5 billion, coinciding with recent price corrections.

This unusual pattern, where open interest climbs during price declines, typically indicates heightened speculation and potential for significant price movements.

The cryptocurrency recently experienced a temporary dip below $115,000 before recovering to current levels.

Analysts note that elevated open interest levels often precede periods of increased volatility, as the probability of mass liquidation events rises substantially.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.